Depending on your perspective, Texas has either held the line by declining to legalize recreational marijuana or lagged behind the nation as more and more states have enacted laws regulating and taxing the sale of the plant and its derivatives.

As of November 2020, 15 states have legalized recreational marijuana. The most recent was Arizona, whose voters approved Proposition 207 with 60 percent of the vote on their November ballot.

Supporters of the initiative pointed to the revenues brought in by Arizona’s neighboring states of Colorado, Nevada, and California—all of which regulate and tax the sale of recreational marijuana. In 2019 those states brought in $302.4 million, $99.2 million, and $629.3 million respectively.

Is Arizona on track to a big budget windfall? Should Texas follow its lead to greener pastures?

In every state that has green-lit recreational marijuana, proponents of its legalization sold lawmakers and voters on the idea by promising large tax revenues that could shore up current government spending on education, public safety, and other sectors that ostensibly pay the “price” for public marijuana usage.

Turns out both the revenues and the expenses surrounding government regulation and taxation are a little…hazy.

Estimating Potential Revenues

With different populations, tax regimes, and markets, each state that has legalized recreational marijuana has seen a somewhat different reaction. While there are some “successes” where tax revenues met or exceeded expectations, in most instances collected revenue has fallen short, regulations have been difficult to implement, and advocates of the drug are already clamoring for lower taxes.

The state most comparable to Texas is California which, after allowing medical marijuana for a number of years, legalized recreational marijuana in 2018. In March of 2020, California surpassed $1 billion in total marijuana tax revenues.

That number may sound impressive, but it’s actually substantially smaller than expectations. As the Orange County Register reported over the figures:

“While industry insiders and advocates are celebrating those numbers, they’re also raising a flag about stagnating revenues and ongoing layoffs. Those hurdles, many say, can be fixed if regulators make key changes, including a seemingly counter intuitive push to lower the state’s cannabis tax rate.

In 2018, when California voters approved the legalization of recreational cannabis, officials projected that once the industry was mature it would generate $1 billion a year in taxes.

Though growth has been slower than expected, and legal operators continue to be hurt by the persistence of the illicit cannabis market, cannabis tax revenues have been rising, from $72.6 million in the first three months of legalized sales in 2018 to $172.7 million in the last three months of 2019. If that growth rate holds steady in this third year, the industry will hit $1 billion in annual tax revenue in 2020.

But growth slowed significantly in the fourth quarter of 2019, according to figures released March 6 by the California Department of Tax and Fee Administration. The $2.6 million increase, or 1.5%, was the smallest quarter-to-quarter gain in tax revenue since the market kicked off. In previous quarters, increases averaged 15.5%.

‘It’s an industry that was supposed to be huge, going gangbusters with the green rush,’ said Zachary Pitts, chief executive of the delivery service Ganja Goddess and president of the California Cannabis Delivery Alliance.

‘It has been growing, but it’s not nearly where I think people were expecting it to be.’”

But industry growth (and corresponding tax revenue increases) haven’t just been short of people’s expectations, they’ve fallen far short of California’s own budget predictions.

After initially predicting marijuana tax revenues of $479 million this year and $590 million in the fiscal year starting July 1, Newsom’s revised budget now forecasts just $443 million this year and a decline to $435 million next year.

“While similar products like alcohol and tobacco tend to be recession-resistant, the forecast assumes that cannabis businesses will be more negatively impacted by the COVID-19 pandemic,” the budget says. “Cannabis businesses have less access to banking services that could provide liquidity, have a younger consumer base likely to be disproportionately affected by the COVID-19 recession, and still must contend with competition from the black market.”

Newsom also signed four bills into law to help marijuana retailers, including a tax freeze that prevents scheduled tax increases (that would have led to more revenue) from going into effect.

California’s trouble meeting revenue expectations on marijuana tax receipts is not unique to the Golden State. Indeed, a majority of the states that have chosen to legalize, tax, and regulate have encountered similar difficulties.

That said, there have been some instances where revenues have met or exceeded expectations. In Colorado, collected revenues were very much in line with estimates and in Nevada revenues actually eclipsed their projections significantly.

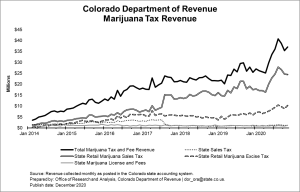

Thus far this year, Colorado marijuana tax reports show revenue of nearly $360 million for 2020—an increase of about $53 million over 2019. The following chart shows revenue by year and source.

Colorado’s data and taxing regime is the one most cited by Texas marijuana legalization activists, who argue a similar scenario in Texas would lead to $1.1 billion in revenues per biennium. That argument is best summed in a recent report by pro-legalization Vicente Sederberg LLP.

As they describe themselves: “Vicente Sederberg LLP is a top-ranked national cannabis law and policy firm with offices in Austin, Boston, Denver, Jacksonville, Los Angeles, and New York. It has been at the leading edge of cannabis policy since its founding in 2010, helping public and private sector clients evaluate, shape, implement, and navigate cannabis laws and regulations across the U.S. and around the world.”

According their October publication The Economic Benefits of Regulating and Taxing Cannabis in Texas:

“Based on our estimate of $2.7 billion in annual sales, Texas would generate approximately $555 million per year in new tax revenue, or $1.1 billion per biennium, if it adopted the same effective tax rate as Colorado (20.6%).”

The group also estimates the legalization of marijuana would lead to significant savings of up to $311 million per year for state and local governments by eliminating the costs of misdemeanor marijuana-related arrests and offenses.

But even if the “top-ranked national cannabis law and policy firm” is to be believed on the merited tax revenues it’s important to view those numbers in the context of the total budget. In 2019, Texas lawmakers approved a $250.7 billion budget. Had marijuana taxes been included in that figure they would have amounted to 0.4 percent.

Estimating Potential Costs

While the data regarding the tax receipts of legalized and regulated marijuana is official record, the costs are a lot more widely distributed and harder to calculate.

However, a study by Colorado Christian University’s Centennial Institute estimates they are both significant and substantial and outpace tax receipts by a significant margin. Centennial Institute Director Jeff Hunt characterizes his organization’s study on the costs of legal marijuana in Colorado thusly:

“While much has been written about the tax revenue and total sales generated from commercial marijuana, there has been little research to understand how Coloradans are paying to mitigate the consequences of commercial marijuana.

No matter where you stand in the marijuana legalization debate, having more information is critical to making the best decisions for the future of Colorado and our nation. This report is an important first step in giving researchers and policymakers a sense of the breadth of costs associated with commercial marijuana. Furthermore, it’s clear from the report that much more information is needed to fully understand the social costs associated with commercial marijuana.

The bad news is that the costs associated with commercial marijuana are only going to go up as the long-term health consequences have not been fully determined. Like tobacco, commercial marijuana is likely to have health consequences that we won’t be able to determine for decades. Those costs are not configured in this report.”

According to the Centennial Institute, marijuana legalization in Colorado is a liability for the state financially with every $1 in tax collected coming with an estimated $4.50 in associated costs stemming mainly from increased health care costs and an increased high school dropout rate.

The organization also asserts that while personal use of marijuana rarely results in death from the drug alone, the increased access to the drug has led to more DUI arrests and accidents in Colorado, with many of them being fatal.

“The researchers felt strongly that Colorado needs to have an important conversation about the presence of THC in fatal car crashes and suicide and they included these numbers in the report without attaching a monitory value to the loss of life,” said Hunt. “They pointed out that these are preventable deaths and if we’re serious about stopping THC-related car crashes and suicides, we need to explore these issues further.”

While the Centennial Institute’s study is backwards looking, Smart Approaches to Marijuana, a group who describes itself as “an alliance of organizations and individuals dedicated to a health-first approach to marijuana policy” has commissioned forward-looking studies in New York, Rhode Island, Connecticut, and Illinois all of which show tax revenues would be eclipsed by increased costs should those states decide to legalize and regulate marijuana.

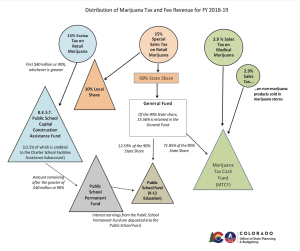

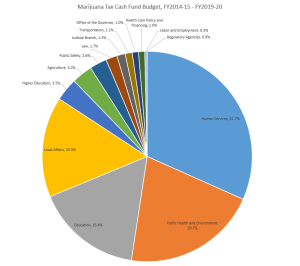

The states that have legalized marijuana appear to recognize at least some of these costs. In Colorado, marijuana revenues are distributed according to the following charts, courtesy of the Colorado Department of Revenue.

The marijuana tax cash fund, which receives the largest share of cannabis-related revenue, must be used for health care, health education, substance abuse prevention and treatment programs, and law enforcement.

In Maine, all marijuana tax revenue collected is split between public health and safety programs and law enforcement training programs associated with marijuana legalization.

In California, 60% of revenue is spent on creating and supporting youth drug prevention and treatment programs, 20% of revenue is allocated to environmental protection and restoring environmental damage caused by illegal marijuana growth, and 20% of revenue is given to state and local law enforcement to reduce public health and safety concerns, as well as to combat impaired drivers.

In virtually every state that has legalized marijuana, the tax revenues that are collected are distributed to departments and agencies that can expect increased costs. In no state are the revenues collected used to buy down tax rates.

Our View on the Issue

At Texans for Fiscal Responsibility, we are committed to our sole mission of illuminating the actions of government, educating and equipping citizens to effectively advocate for pro-taxpayer reforms, and holding lawmakers accountable for their actions.

In fulfilling that mission we’ve analyzed the purported gains that taxpayers could make as well as the potential costs they could incur should the Texas Legislature decide to legalize, tax, and regulate marijuana in the Lone Star State.

Following our analysis, we take no position on the issue of legalization of marijuana as a solitary item. We view the issue as a question of policy much like the age of criminal responsibility, the death penalty, or other issues that should be decided based off our values rather than dollars and cents.

Like those aforementioned issues, the question of whether or not Texas should legalize marijuana is one with Texas citizens of good faith on both sides of the debate. It is not in keeping with our mission to wade into it.

However, we do take a position in opposition to the taxation and regulation regime proposed by many legal marijuana advocates and against their argument such actions would lead to a windfall for Texas taxpayers.

What is clear in every state that has legalized marijuana is that government has gotten bigger as a result. That outcome does not serve taxpayers’ interest and does not serve their pocket books.

In order to navigate our state’s budget crisis and provide a firmer foundation for the days ahead, the Texas Legislature must prioritize real and lasting tax relief and reforms that shrink the size of government. That means cutting taxes and repealing regulations, not creating new ones and imposing them on Texans.