Earlier this month, the Texas Senate unveiled its interim charges, which are topics of study assigned to Senate committees during the interim period between legislative sessions.

These charges, issued by Texas Lieutenant Governor Dan Patrick, guide committees in their research and analysis.

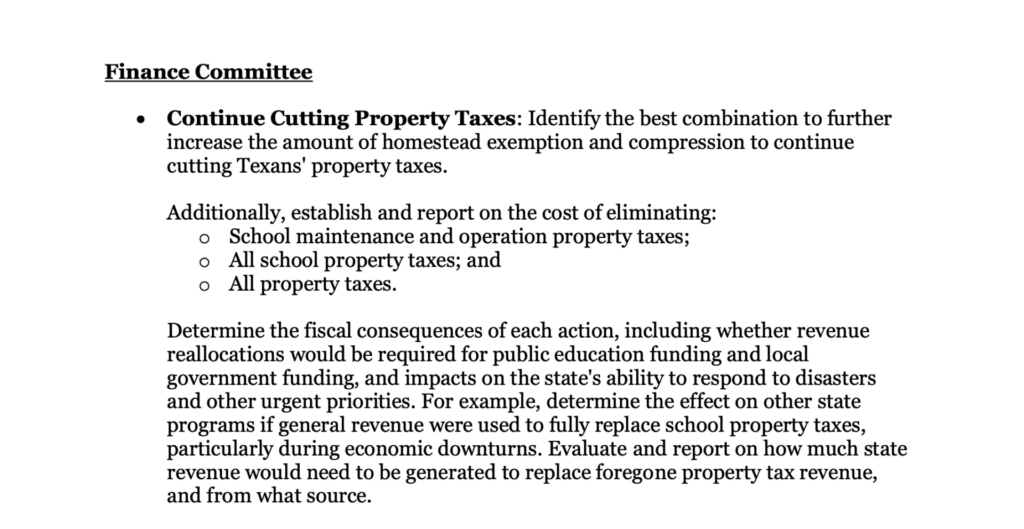

One significant charge for the Finance Committee is to examine property taxes. Lieutenant Governor Patrick has tasked Senators with assessing the cost of eliminating various property taxes, including school maintenance and operation property taxes, all school property taxes, and all property taxes. This directive highlights the ongoing concern over the burden of property taxes on Texans and aims to explore avenues for relief.

Despite several lawmakers claiming that the last legislative session gave Texans the ”Largest Property tax relief in Texas History,” this claim, unfortunately, turned out not to be the case. In fact, overall property taxes increased by roughly $165 million in 2023, despite the property tax relief that was passed by the Texas Legislature.

Patrick is taking a step in the right direction to deliver Texans the results they deserve by tasking Senators with investigating the elimination of property.

Texans for Fiscal Responsibility (TFR) has long advocated for the complete elimination of property taxes, so that Texans can truly own their homes and property, without having to pay perpetual rent to the government. TFR has a plan to accomplish this important task here, and compiled some essential research here.

The examination of property taxes underscores the broader concern by many that fiscal issues, such as the crushing weight of modern taxation, must return to the forefront of our efforts. Taxpayers should contact their Senators and Representatives in Austin before the 89th Regular Legislative session, slated to start in January, 2025, and voice their desire for a Texas to be put on a path to eliminating property taxes once and for all.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!