As we have begun to report on cities adopting new tax rates and many failing to adopt the no-new-revenue rate, a number of folks have reached out to us at Texans for Fiscal Responsibility about the deceptive practices reducing transparency in these cities.

The deception typically takes place when cities use their tax notices to promote that they are “lowering rates,” giving taxpayers the impression that their bills will be going down with the new budgets. But nothing could be further from the truth; if your city adopts a tax rate higher than the no-new-revenue rate, your rate will be going up.

Enter Erika Browning, a previous mayoral candidate who fell short in the May 2022 election but continues to engage the city. I had the honor of speaking with Erika and hearing her story on this very issue. Erika told me she has attended many council meetings, sharing her opinions in the time allotted for citizen comments.

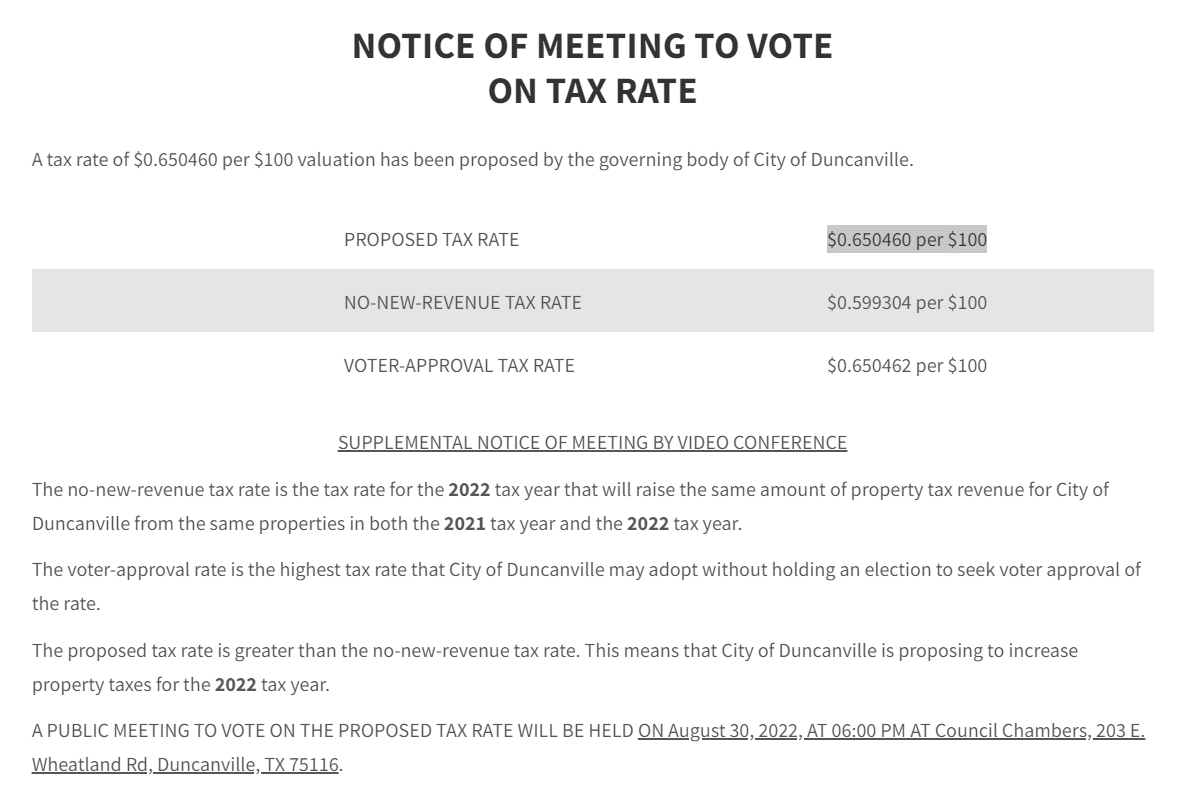

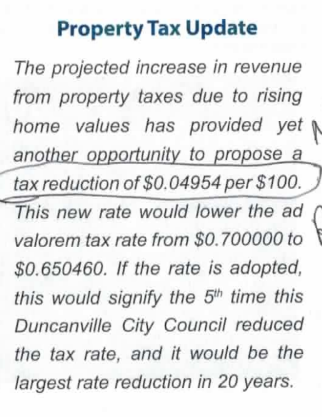

On Tuesday night, Duncanville voted and passed its proposed tax rate of $0.650460 per $100. According to Erika, the notices that were sent out to taxpayers promoted the lower rate as something they should celebrate. TFR has seen these same tactics used by bigger cities promoting the proposed tax rate as “lowered.” They typically don’t explain any further, allowing citizens to incorrectly assume they will see their tax bills go down as a result.

(In Duncanville’s case, the city is proposing a rate so high it is only .000002 away from triggering an election to approve it.)

Unless a local government announces it is adopting the no-new-revenue rate, tax bills will increase. This is mainly due to rising property values resulting in a massive amount of revenue for cities, counties, and ISDs.

Instead of providing taxpayers with transparency and disclosing that bills will actually go up, they promote a lower rate and hope the average voter is not smart enough to do research and call them out. This is precisely what Erika did, according to our conversation. Below is a document Erika shared with us, in which the City of Duncanville promotes its tax rate “reduction”!

On August 16, 2022, Erika offered comments speaking against the deception, but she was muted. It is unsure whether this was a technical difficulty or not. Erika has provided her comments here.

On August 25, 2022, she offered further comments and called out the deceptive practices of the council in heroic fashion. (Her comments begin at 2:27:00.) Councilman Patrick Harvey responded to the criticism by not dealing with the issue of deception at all, but rather saying the city needs extra money for a project and stating he “thinks the document is a good document.” (His response can be seen at 2:46:36.)

After the meeting, Erika says she approached Councilman Harvey and said, “You completely mischaracterized my comments, and I don’t appreciate it.”

According to Erika, Harvey responded, “Ask me if I care.”

This kind of attitude is all too common from politicians and lawmakers everywhere, and I certainly have seen my fair share of this in my time. TFR will take Erika at her word, and we encourage all taxpayers to do the same. Thank you, Erika, for standing up to corrupt local governments. If more citizens engaged local governments, we would not be in the mess we are in.

Cities like Duncanville are not the exception, but rather the norm. The bigger a city is, the less likely they will do the fiscally responsible thing; this is why we need taxpayers to engage and call out these practices and encourage our neighbors to do the same. It is worth noting that quite a few cities have adopted or proposed to adopt the no-new-revenue rate, including Colleyville, Keller, and Southlake.

How can you help? Go read the Texas Prosperity Plan for yourself and voice your support for REAL property tax relief by signing up to support the TPP. You can also sign up for The Fiscal Note to stay updated on all fiscal issues that affect Texans, especially our broken property tax system. We CAN get real tax relief if we amplify our voices loudly enough.