With redistricting out of the way, the Texas Legislature has turned to addressing Gov. Greg Abbott’s call for “[l]egislation reducing the property tax burden on Texans.” Sadly, the bill being considered—Senate Bill 10—will do nothing to accomplish what Gov. Abbott asked them to address.

SB 10 is a slight improvement over the status quo but falls far short of putting meaningful limits on property tax revenue growth. Its primary provision is:

- For cities and counties with a population of 75,000 or more, SB 9 lowers the revenue growth above the no-new-revenue rate that triggers a voter approval election for municipalities and counties from 3.5% to 2.5%.

That’s it. It applies only to cities and counties over 75,000. It does not apply to smaller cities and counties. It does not apply school districts. And it does not apply to special districts, leaving the voter-approval rate for them at 8%. Meaning that it applies to less than 35% of property tax levy across the state.

Another thing that SB 10 does not do is, despite the language in the bill, require these cities and counties to ask voters to approve revenue increases above 2.5%. The reason for this is that current law exempts large amounts of revenue from inclusion in the calculations of the voter-approval rate.

Local Politicians and Bureaucrats Won’t Stop Taxing US and Spending Our Money

Before we get to the details on SB 10, we’ll examine what happened on Friday in the legislative hearing on the bill. County judges, fire chiefs, city councilmen, and other representatives of local governments spent hours telling the House Ways and Means Committee how much harm SB 10 would do. The fire chief of the city of Carrolton said SB 10 would make it harder to keep his city safe. The Mayor Pro Tem of Georgetown said his voters just want him to address the city’s public safety; they don’t want to be asked about taxes. The city manager of Kerrville pulled out the “devastating flood card” when testifying against SB 10—even though it would not apply to his city, which is well under the 75,000-population floor. The Ector County judge said SB 10 was unneeded and would keep him from building “vital” roads in his county. He also attacked members of the legislature for not providing more transportation funding while saying SB 10 was being passed so it could be a sentence on campaign mailers, presumably those being created by the legislators.

What these and almost all the other local politicians and bureaucrats who testified had in common was that they were totally opposed to the concept of asking voters to approve property tax increases. Many struggled to acknowledge that the alleged harms they listed would never come to pass if they simply asked for and received voter approval for the increased revenue. In fact, they were so unified in their opposition to seeking voter approval that even the modest decrease from 3.5% to 2.5% was seen as a harm in itself. And more often than not they seemed to consider themselves—not the taxpayers—as the victims of this pernicious legislation. “Two and a half percent is too low; we’ll wind up having elections every year or two,” said a councilman from Flower Mound.

The No-New-Revenue Rate

Looking at SB 10, we’ll start with the no-new-revenue rate because it is the baseline for calculating the voter-approval rate. According to the Texas Comptroller, the no-new-revenue rate for property taxes is the “tax rate that would produce the same amount of taxes if applied to the same properties taxed in both years.” What that means is that the no-new-revenue rate does not actually mean no new revenue; it provides a lot more revenue to a taxing entity that it had in the previous year because of the numerous exemptions used in calculating the rate:

- Revenue from New Development. Increased revenue from new development on properties in the last year that increased their appraised value is not counted in the no-new-revenue rate calculations.

- State Criminal Justice Costs. Counties are allowed to increase their no-new revenue rates by the amount needed to produce additional revenue to pay for spending that covers the cost of keeping inmates in county-paid facilities that have already been sentenced to state jail or prison facilities.

- Indigent Health Care Costs. Taxing entities are allowed to increase their no-new revenue rates by the amount needed to produce additional revenue to pay for certain spending on indigent health care.

- Indigent Defense Expenditures. Counties are allowed to increase their no-new revenue rates by the amount needed to produce additional revenue to pay for spending on a public defender’s office and providing appointed counsel for indigent individuals in criminal or civil proceedings.

- County Hospital Expenditures. Counties and cities are allowed to increase their no-new revenue rates by the amount needed to produce additional revenue to pay for the costs of operating a hospital owned or leased by a county or a county and city.

The no-new-revenue rate is the first step used by local governments to mislead Texas taxpayers and voters about how much new revenue they will receiving under their proposed tax rates. The second one is:

The Voter-Approval Rate

The voter-approval tax rate is the tax rate at which local governments must call an election asking voters must approve the rate. Currently, for special districts the rate is 8% above the no-new-revenue rate. For cities and counties, 3.5% above the no-new-revenue rate. Schools do have voter approval elections, but under a different provision of law. The rate that triggers those elections is approximately 2.5% above the school district version of the no-new-revenue rate (which again, is not being changed in SB 10).

Just like the no-new-revenue rate, the Legislature has put numerous exemptions into law that allows the revenue increases for taxing entities to greatly exceed the limits in the previous paragraph before they have to ask voters for approval. The exemptions are:

- Disaster Relief. Current law allows a taxing unit to increase its tax revenue up to 8% in a single year if any part of the taxing unit is located in an area declared a disaster area without seeking approval through a public vote. Legislation passed this year changes this to allow a taxing unit to exceed the voter approval limit by the revenue needed to pay for the estimated costs “essential assistance” and removal of debris or wreckage in the taxing unit.

- Pollution Control Expenditures. Political subdivisions of this state are allowed to increase their voter-approval tax rates by the amount needed to produce additional revenue to pay for pollution control equipment that is necessary to meet the requirements of a permit issued by the Texas Commission on Environmental Quality

- “Unused” Increment Revenue from Previous Years. Taxing entities are allowed to exceed their voter-approval tax rates to “recapture” revenue anytime during the previous three years where an entity’s tax rate was less than the maximum allowed under the voter approval tax rate.

Runaway Property Tax Increases

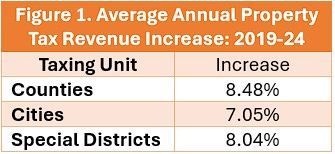

The meaninglessness of the voter-approval-rate is seen in Figure 1. Average annual revenue increases for cities and counties are more than double the voter-approval-rate limits above.

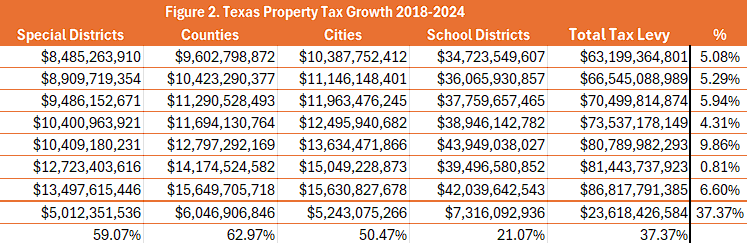

Overall, during that period Figure 2 shows that the property tax levy has increased $23.6 billion, even while the Legislature has used $51 billion of state tax dollars to slow the growth of school taxes. County taxes have grown 63% and cities by 50%.

The Solution

If the Texas Legislature is going to stop the runaway growth of property taxes, two major reforms are required. They are:

Transparency – Make the No-New-Revenue Rate Result in No New Revenue

As we’ve noted, the current limits on property tax increases are meaningless. There is no discernable relationship between the limits and the amount of property tax increases Texans experience every year. To fix this, transparency is needed. This entails first eliminating all of the exemptions to the no-new-revenue rate. This would result in the no-new-revenue rate actually being the rate that produces no new revenue for taxing entities. Thus, the limits that trigger voter approval would actually reflect the increases in revenue for the taxing entity. A 3.5% limit for cities and counties would reflect a 3.5% increase in property tax revenue instead of the current average of around 8%.

Accountability – Reset the Voter-Approval Rate to the No-New-Revenue Rate (0%)

Most Americans think that government is too big and should be smaller and provide less services; this includes 79% of Trump supporters. Yet the current limits on property tax revenue growth allow Texas local governments to grow on average by almost 8% per year. There may be reasons to allow certain governments to grow by certain amounts at different times. But there is no reason that the growth should not be subject to the approval of Texas voters. This means both the current exemptions and growth limits in current law should be eliminated. This would make the voter-approval rate identical with the no-new-revenue rate. If school districts and local governments want to increase spending, let them ask the voters. After all, it is the voters’ money that is being spent. If voters do approve the increase, the maximum increase in any year would be the lesser of the average of population growth plus inflation for the three years prior to the property tax year in question or 7.84%, the average annual property tax revenue increase for special districts, cities, and counties since growth limits have been in place (from 2018 through 2025).

Conclusion

The Legislature has spent billions of dollars of state taxpayer money on school districts in the name of property tax relief. Yet, Texas taxpayers have still experienced increasing property tax bills because of the rapid growth of spending at the local level. Rather than spending more taxpayer money on fruitless relief efforts, the Texas Legislature should slow or stop the spending growth by putting strong limits on property tax revenue increases.

Once this is done, the Legislature can return to using budget surpluses to permanently reduce property taxes.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!