Texas continues to outperform most of the nation in job creation and output, but signs of cooling are appearing beneath the surface. The latest data from the Texas Workforce Commission, Bureau of Labor Statistics, and Bureau of Economic Analysis show that while Texas’ economy remains strong, inflation and excessive spending threaten its momentum.

Employment and Unemployment

Texas added 17,600 jobs in August 2025, marking continued but slower growth after several months of cooling. The state’s unemployment rate increased to 4.1%, remaining below the national average of 4.3%.

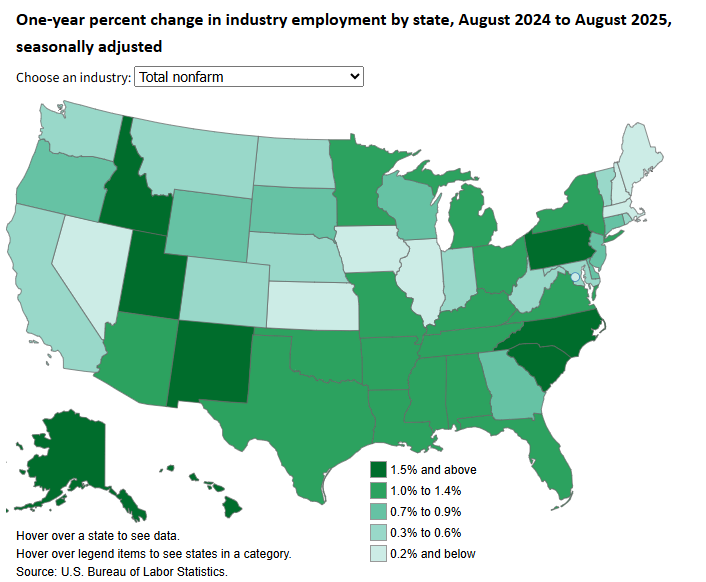

Over the past year, Texas employers have added 195,600 jobs, bringing total nonfarm employment to 14.35 million—a 1.4% annual growth rate, compared with just 0.9% nationwide. The labor force grew by 169,500 people to 15.86 million during the same period, reflecting ongoing population inflows as families and businesses continue to relocate to the Lone Star State.

Texas continues to outperform other large states, with nonfarm job growth stronger than California’s at 0.4%, New York’s at 1.3%, and Florida’s at 1.0%. Private-sector job creation in Texas is slowing, with a 1.3% increase, while government employment has seen a 1.7% increase—a concerning trend for a state built on entrepreneurship and free markets.

GDP and Output

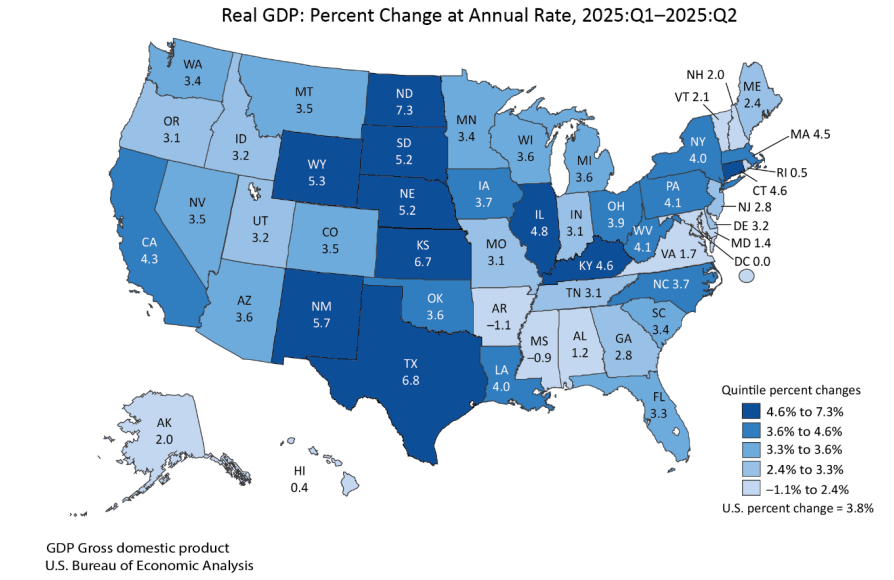

According to the latest BEA report, Texas’ real GDP grew 6.8% at an annualized rate in the second quarter of 2025, above the national average of 3.8%. The state continues to outperform peers thanks to strength in construction, professional services, and energy, offsetting slower performance in manufacturing and trade.

Among other large and nearby states, Florida (3.3%), Oklahoma (3.6%), and Louisiana (4.0%) trail just behind, underscoring that Texas remains a leader but cannot take that position for granted.

What Texas Gets Right

Texas’ strengths are well known:

- No personal income tax, allowing workers to keep more of what they earn.

- A diverse, resilient economy driven by energy, logistics, technology, and construction.

- A growing population and labor force, fueling demand and investment.

- A business-friendly environment that continues to attract employers fleeing high-tax states.

These fundamentals have made Texas an economic powerhouse—but they must be defended.

Where Texas Falls Short

Texas also has weaknesses that can’t be ignored:

- The state budget has increased by about 40% over the last two cycles, roughly twice the rate of population growth and inflation.

- Property taxes remain among the highest in the nation because local spending continues to expand at an unsustainable rate.

- Regulatory burdens and slow permitting processes increasingly frustrate small businesses.

- Government employment has grown faster than employment in the private sector, with taxpayer-funded jobs now accounting for about one in five new positions.

These trends represent a creeping expansion of government—precisely the opposite of what drives lasting prosperity.

The Path Forward

- Adopt a strong state and local spending limit of less than state population growth plus chained CPI inflation, ensuring government doesn’t grow faster than taxpayers’ ability to pay for it.

- Use state budget surpluses to buy down and eliminate school district M&O property taxes, and local budget surpluses to buy down and eliminate their local property taxes, creating a clear path to property tax freedom.

- Streamline regulations and permitting to unleash private-sector productivity.

- Stop corporate subsidies and new debt, which distort markets and fuel overspending.

Conclusion

Texas remains one of America’s economic engines, but growth is slowing and inflation is eroding families’ paychecks. The solution isn’t more government—it’s fiscal restraint, lower property taxes, and a renewed commitment to letting people prosper.

Texas has every advantage in the world. To keep it, lawmakers must remember what made this state thrive in the first place: limited government, competitive markets, and freedom for workers, entrepreneurs, and families.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!