The City of Austin is in a financial crisis, and they’re asking voters to approve a permanent tax increase to fill in their budget deficit.1 This tax rate election, with “Proposition Q,” aims to raise the city’s property tax rate to 57.4 cents per $100 of valuation, a 20% jump from the current 47.76 cents, adding roughly $110 million annually to city coffers.

If passed, this measure would establish the higher rate as the new baseline for all future budgets.

The proposal arrives at a time of rapid city budget growth, and a growing deficit. Austin’s budget has grown from $3.5 billion in 2015 to $6.3 billion in 2025,2 an 80% increase, while population growth lagged at around 10%. Per-resident spending has climbed from $3,800 to $6,3003 annually, equating to an extra $2,500 per person, without noticeable improvements in services like roads or public safety.

And in light of a $33 million budget deficit,4 many Austinites, and Texans around the State are beginning to question the city’s fiscal priorities.

The Push for More Money

Advocates, including most Austin City Council members and the Love Austin Campaign, frame Prop Q as essential for maintaining core services. They argue the increase would fund public safety, parks, libraries, homelessness initiatives, and other programs5 facing potential cuts due to a projected $33 million shortfall, emphasizing the need to avoid service reductions. The campaign highlights that without approval, the tax rate defaults to a lower cap, forcing tough budget choices.

Highlighting Financial Burdens and Inefficiencies

Opponents of Prop Q point to a range of negatives, arguing the hike is unnecessary and symptomatic of deeper mismanagement. For homeowners, the increase could add $302 annually on a $492,000 homestead.6 Renters aren’t spared, as landlords often pass on property tax costs through higher rents, compounding affordability issues in a city already grappling with high living expenses. Small businesses face full exposure to the rate change, potentially raising operating costs and threatening their ability to stay open.

Fundamentally, the city’s budget growth far outpaces needs. Debt service has nearly doubled from $149 million to $283 million yearly.7 Homelessness funding is greater than $69 million,8 yet services are spread out across departments and they’re lacking unified metrics or accountability. Their street-level outcomes are poor.

Austin Energy’s budget rose 67%9 while electricity delivery increased only 30%, indicating inefficiencies in utility management.

Project Connect’s costs went from $5.1 billion to over $7 billion in just one year, with $200 million in operating expenses currently unfunded.10

“Internal Services & Transfers”, which are the people working in the offices of the various city departments – primarily bureaucrats, exceeds $500M annually.11 That is more than Parks, Libraries, and Public Health combined.

Local Pushback

Pushback has intensified, with diverse groups and residents voicing opposition. Save Austin Now12 calls it the “largest tax increase in history,” a “quicksand tax” that sinks families, backed by over 7,000 donors, 131,000 followers, 180,000 pledged votes, 90,000 petition signatures, and 1,000 volunteers. Business organizations, including the Greater Austin Chamber of Commerce board, have come out against it, citing impacts on affordability and operations.

On social platforms, residents are expressing their frustration. One analysis highlighted $6,000 per citizen in spending13 without proportional benefits, urging high turnout to reject the measure. Others label it a “slush fund” for bureaucracy and non-profits, pointing to over $500 million spent on homelessness since 2020 with little progress, attracting more issues rather than solving them. Bipartisan coalitions are forming, with disparate groups uniting against the hike.

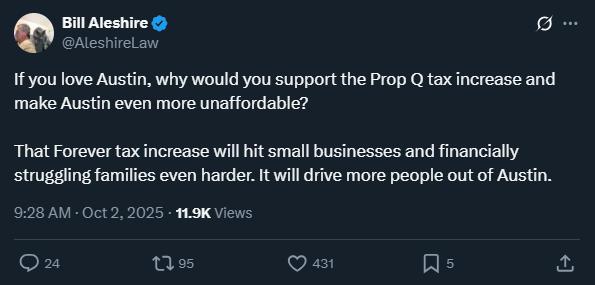

At least one prominent local Democrat, Bill Aleshire, has come out against the proposition. Aleshire served as Travis County Judge for 12 years, and his X feed14 is full of Anti-Prop Q content.

Even the Austin-American Statesman,15 the city’s largest local newspaper, has come out against Prop Q.

The paper’s editorial board came out swinging, saying in part, “we cannot support Prop Q — a $110 million cash infusion to City Hall after years of rising tax bills, diminishing returns and, at times, careless use of taxpayer dollars, in small but symbolic spending on logos and lunches that undercuts the public’s willingness to open their wallets further.”

Ethics controversies and Backlash

The Love Austin Campaign filed, then withdrew, complaints16 against anti-Prop Q sites like austintaxrateelection.com, created by resident Nate McGuire for $12, amid free speech concerns and legal threats. McGuire’s budget deep-dive and site aim to educate, countering what he sees as silencing tactics. Residents like Jen Robichaux distribute flyers warning of the 20% forever increase, while others decry council endorsements as prioritizing pet projects over responsible budgeting.

Calls for better audits before hikes are resonating, with groups like More Affordable Austin noting cumulative impacts and inefficiencies. Opposition to Prop Q spans different ideologies and political leanings, with some linking it to past failures like Project Connect and urging accountability rather than endless revenue demands.

The fate of Prop Q remains to be seen, as voters head to the polls for Early voting on October 20th, 2025. Election Day is Tuesday, November 4th.

- https://www.austintexas.gov/page/ballot-propositions

- https://www.austintexas.gov/news/austin-city-council-approves-63-billion-fiscal-year-2025-2026-budget

- https://austintaxrateelection.com/

- https://www.austintexas.gov/news/austin-city-manager-proposes-63-billion-budget-strengthening-community-and-critical-services

- https://www.austintexas.gov/page/ballot-propositions

- https://www.austintexas.gov/sites/default/files/files/BOE/Budget/FY26TaxpayerImpactStatement.pdf

- https://www.austintexas.gov/sites/default/files/files/BOE/Budget/FY2025-2026_Approved_Budget.pdf

- https://www.austintexas.gov/sites/default/files/files/BOE/Budget/FY2025-2026_Approved_Budget.pdf#page=383

- https://austintaxrateelection.com/

- https://austintaxrateelection.com/

- https://austintaxrateelection.com/

- https://www.saveaustinnow.com/

- https://austintaxrateelection.com/

- https://x.com/AleshireLaw

- https://www.statesman.com/opinion/editorials/article/prop-q-austin-statesman-endorsement-2025-election-21096293.php

- https://www.yahoo.com/news/videos/love-austin-campaign-withdraws-ethics-023500413.html

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!