For almost 20 years, there have been serious discussions in Texas about eliminating property taxes. And during that period, few Texas politicians have made serious attempts to do anything about this.

In fact, as a body, the Texas Legislature (including state-wide elected legislative leaders) has done nothing serious to even slow the growth of property taxes.

Background

Since 1997, Texas governors, lieutenant governors, house speakers, state senators, and state representatives have told us they were going to provide property tax relief for Texans seven times—1997, 2006, 2015, 2019, 2021, 2023, and 2025. And seven times they have failed. Property tax increases may have slowed—or for homeowners dipped slightly—for one year, but then the inexorable rise resumed.

Why has this happened? Primarily, because eliminating—or even reducing—property taxes requires a willingness to spend less money on other things. And most politicians like to spend more money—especially on constituencies that are more important to them than the average taxpayer.

That is why back in 2012 my former employer, the Texas Public Policy Foundation, published a paper suggesting we could eliminate property taxes by increasing the state sales tax and “swapping” out the increased sales tax revenue for the revenue generated by the sales tax. I never liked the idea for reasons we’ll discuss below.

I was very excited, then, a few years later when the Foundation decided to take a different path to eliminating the property tax: fiscal discipline. The concept was simple. Every year, Texas state tax revenue increases on average by about 5.5%. Applying the average to 2025, that would produce a surplus of about $4.6 billion. Instead of spending most of that money on constituencies favored by the Austin lobby (Hollywood film makers, thermal and renewable energy generators, state employees and teachers, local telephone companies, etc.), why not just use the surplus to buydown the property tax? When we published our work on this in 2018, we estimated—using modest assumptions—that Texas could eliminate the school district maintenance and operations tax in about 11 years. I estimate that if we used 100% of the state tax revenue growth for property tax relief starting in 2027, the school M&O tax could be abolished in 5 to 6 years.

Two Competing Ideas

Putting this into perspective, we now have two competing ideas for reducing or eliminating property taxes: the tax swap or the buydown. Unfortunately, Texas politicians do not like either one. They do not like the tax swap because they do not want to vote for a massive state tax increase. They do not like the tax buydown because they do not like to practice fiscal discipline.

As a result, they have come up with half-hearted plans since 1997 that don’t accomplish anything meaningful, with the result being that property taxes continue to increase.

Since most of our political leaders do not want to eliminate property taxes, we conservatives must force them to do it. Unfortunately, despite our agreement on the importance of eliminating property taxes, conservatives seem to be split between the two options. We do not have a united front on this.

Tax Swap vs Buydown

The question conservatives must answer then, is, which is better? In my mind, there is no question that fiscal discipline using the buydown option is by far the best. Here’s why:

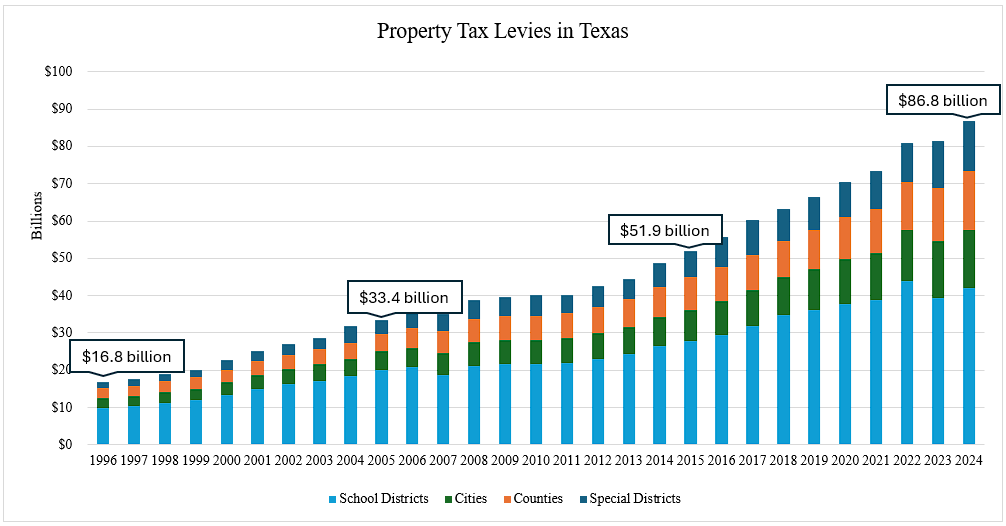

To understand why the buydown is the best option, we have to understand that the primary cause of runaway property tax increases is runaway spending increases by school districts, cities, counties, and special districts. A tax swap does nothing to address this. The state simply implements a massive tax increase (see more below) and gives the new money to local taxing entities (although no one has come up with any ideas about how the money would be distributed). The local taxing entities, in turn, keep right on going with their runaway spending growth. The only difference is that instead of runaway property tax growth, after a tax swap we will have runaway state tax growth. A look at the numbers helps explain this problem.

Total state tax revenue in 2025 was $84.2 billion. Property tax revenue in the most recent year (2024) was $86.8 billion (2025 will be higher). The problem here is very clear. In order to make a tax swap work the state would have to double current state taxes. This is the approach taken by some advocates of the tax swap; they would double state tax revenue by combining a lot of state taxes into one Value Added Tax (VAT), similar to what is used in many European countries.

Other tax swap supporters advocate increasing the sales tax to fund a swap. The numbers also show the difficulty of this approach. In 2025, sales tax revenue was $49.1 billion. This means to fund a tax swap to eliminate property taxes, Texas would have to raise its sales tax by 177%; the sales tax would almost triple. Whether that is done by broadening the base, increasing the rate, or a combination of both, the result would be a massive shock to the Texas economy and to Texas consumers.

Regardless of how a tax swap is funded, the end result is the same. State taxes would increase by close to $90 billion. Local government and state government spending would continue to increase at current rates of growth. The tax burden on Texas would initially be the same; there would be no overall tax cut for Texans. And it is likely that the tax burden in the future would increase more rapidly because with the state funding spending at all levels of Texas government there would no longer be any ability of local taxpayers to fight back against higher taxes. This is a very different outcome from what we would see if the Texas Legislature used the fiscally disciplined buydown approach.

The Bottom Line

Under the status quo the Texas Legislature spends (or hides from taxpayers for future spending) almost every single penny of the annual budget surplus. Using the average revenue growth numbers, the biennial (two-year) surplus would be over $9.2 billion ($4.6 x 2) for the current biennium. Though as we have seen in recent years it has gone as high as $32 billion. If the Texas Legislature devoted all of the surplus to reducing property taxes, state spending would stay flat—a 0% increase. If at the same time the Legislature put meaningful restraints on local government and school tax increases, government spending growth in Texas (state and local) would be minimal. And the overall tax burden on Texans would decline, with the property tax burden dropping by about one-third in just a few years.

None of this is rocket science. If our state and local governments spend less, our taxes will be lower. If they spend more, our taxes will be higher. If we want to lower or eliminate property taxes, fiscal discipline is required. And the only sustainable option for reducing or eliminating property taxes is using fiscal discipline and buying down property taxes using most or all of the state’s annual budget surplus.

A senior fellow at Texans for Fiscal Responsibility, Bill Peacock has spent the last 30+ years fighting for liberty at the state and national level by combining his love for theology, economics, and public policy. He focuses on a variety of issues, including energy, regulatory, and fiscal policy, property rights, natural resources, public education, and the relationship between faith, free markets, and economic prosperity. After working in Texas government for 10 years, Bill now works with clients and grassroots groups through his company, TortillaCoast, in this effort. Bill also hosts ExcellentThought, where he writes about the intersection of faith, culture, and public policy. He lives with his wife and son in the Texas Hill Country where they attend a reformed church.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!