“How in the Heck Are We Going to Pay for $51 Billion in Property Tax Relief Going Forward?”

“I do have a lot of concerns, as the senator does, about how in the heck are we going to pay for this going forward? $51 billion ongoing —it’s a huge amount to continue to support & to think about doing anything more seems very fiscally irresponsible.”

– Texas State Rep. Donna Howard1

Rep. Howard’s remarks are similar to those of Sen. Perry in our previous article2. But she mentions a specific number, $51 billion. This is the same number that Gov. Greg Abbott, Lt. Gov. Dan Patrick, and others have suggested3 is the amount of property tax relief provided by the Legislature since 2019. However, the available evidence suggests that the $51 billion is either greatly exaggerated or much of it is not actually tax relief.

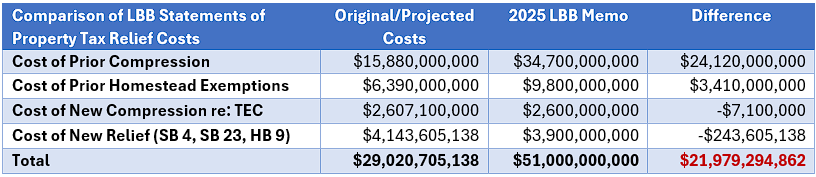

The table below shows that the Texas’ Legislative Budget Board’s (LBB) original cost estimates of all increased spending on public schools in the name of property tax relief since 2019 is $29 billion. Yet, the LBB then released a memo earlier this year with the $51 billion figure but provided no details how the cost increased by $22 billion. Given what is publicly available, then, it appears that the $51 billion is too high.

There is one other possible explanation, though. That would be that the increased spending for property tax relief that originally cost $29 billion now costs $51 billion. If that is the case, that would mean that the state’s efforts at property tax relief have completely failed and that the additional $22 billion is making up for the Legislature’s mistakes, not providing property tax relief.

This brings us to Rep. Howard’s last comment. Can you imagine a world where trying to reduce the tax burden on citizens is viewed as being “fiscally irresponsible”? Well, you do not have to, because it is the world we live in today. Of course, what Rep. Howard and many other Texas politicians are trying to do by spreading such misinformation is cover up their own—and our local governments’—fiscal responsibility.

Runaway spending at the local level (more on that in future papers) is what is making it so expensive to provide property tax relief. And runaway spending at the state level is what is making it difficult for the state to come up with money to buy down property taxes. True fiscal responsibility, i.e., less spending of taxpayer money, is the only path forward to true and lasting property tax relief.

This is the second article in a series setting the record straight on property tax misinformation.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!

- https://communityimpact.com/austin/south-central-austin/texas-legislature/2025/11/26/kind-of-maxed-out-texas-lawmakers-question-whether-state-can-afford-to-fund-larger-property-tax-breaks/ ↩︎

- https://texastaxpayers.com/setting-the-record-straight-on-property-taxes-part-1/ ↩︎

- https://excellentthought.substack.com/p/did-the-texas-legislature-really ↩︎