Texas is considered a conservative state. Yet, when it comes to the size and scope of government, Texans ought to take a closer look.

This is the first is a series of papers in which we will examine the growth of Texas’ state and local governments over the last decade. The purpose of these papers it to help Texans hold their elected officials accountable for the runaway growth of government taxes and spending. While Texas government—particularly at the state level—has accomplished some good things over the last 10 years, advancing fiscal conservatism is not one of them.

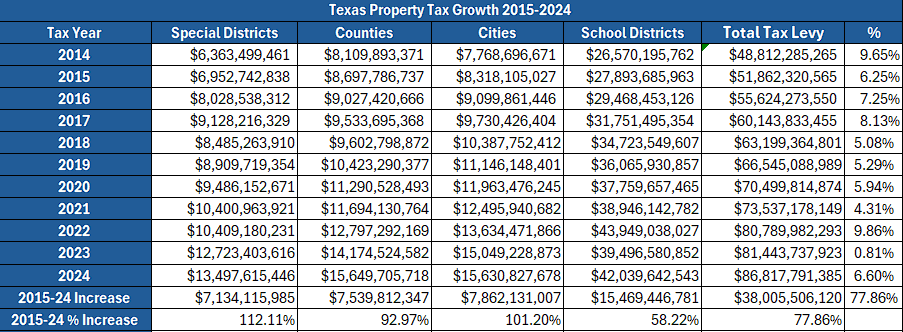

The chart above shows the annual property tax payments made by Texans have increased $38 billion over the last decade. That is a 78% increase. The increases are driven by rapid increases in spending at the local level. For example, adjusted for inflation, the $48.8 billion levy in 2014 would have equaled $65.6 billion in 2024. While the levy for 2024 was actually $86.8 billion, 32% higher than inflation. That extra $21 billion is all being spent.

Yet, these numbers mask the true growth of local government spending. This is because members of the Texas Legislature claim they have increased state spending on public schools by $51 billion to reduce school property taxes. While there is some question about the accuracy of this figure, let’s take them at their word for our purposes here.

School property taxes increased $15.5 billion over the last 10 years. Because of the increased state funding, their growth rate is close to half that of other local governments. If we add the $51 of increased state funding, however, we see that school district spending supported by property taxes and property tax replacement funding has grown by $65.5 billion over the last decade, a 250% increase. Whatever the actual increase in school spending has been, local government spending supported by property taxes is draining local taxpayers’ wallets.

Just to show that these increases have real world consequences, we will look at the house in Austin I used to live in. Back in 2014, my tax bill was $12,013.76. In 2024, the present owner paid a whopping $22,119.29 (I’m very glad we moved out of Travis County). That is an 84% increase, higher than the statewide 78% increase.

Despite claims to the contrary, there has been no tax relief—property tax or otherwise—in Texas over the last ten years. Unfortunately, we will face more of the same unless the Texas Legislature does something different to address the problem.

What they have been doing does not work.

Fortunately, two recent proposals by Gov. Greg Abbott can help stop the growth of property taxes.

First, Abbott provides a simple, yet elegant solution for slowing or stopping local property tax increases: “require two-thirds voter approval for tax increases.” If a school, city, county, or special district wants to increase its property tax revenue in a given year, they have to ask the voters for permission to do so. And two-thirds of the voters will have to say yes.

Second, Abbott has a plan for rolling back taxes. Under his plan, “if 15% of registered voters in a local area sign a petition, they can force a rollback election to lower rates.” The beauty of this is that for decades, Texans have had to rely on the Texas Legislature to do something about property taxes. They have failed us. Under this plan, we can take matters into our own hands. One important safeguard must be included in this plan. The rollback should focus on cutting the amount of property tax revenue collected by the local government, not the rates they set; local governments can game the system by manipulating tax rates.

Most Texans would love to eliminate all property taxes. This is important and should be pursued. However, more important in the short run is stopping property tax increases. If we do not do this, we will never be able to eliminate property taxes.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!