Over 20 Years of State Spending Growth

In 2003, Republicans achieved an historic milestone by gaining control of the Texas state government, the executive and both chambers of the Legislature, for the first time in decades.

Since then, Republicans have maintained this trifecta, promising every campaign and legislative cycle to limit government, employ fiscal restraint, lower taxes and govern in a fiscally conservative manner.

Yet, over the past two decades, reality has diverged sharply from these promises. Texas state spending has expanded dramatically, far outpacing population growth and inflation, and raising serious questions about their commitment to conservative fiscal policies.

The Process

To understand this expansion, it’s essential to grasp the Texas appropriations process. Unlike the federal government and other states, Texas operates on a biennial cycle. During the regular legislative session that convenes in odd-numbered years, the Texas Legislature crafts and passes a budget covering the next two fiscal years, starting in the following September. This structure is intended to promote careful planning and restraint, as lawmakers must project needs far in advance.

However, in practice, we have seen initial appropriations of taxpayer money continually increase and accumulate into massive bloat over time, creating a state government apparatus that is far too big and expansive.

By the Numbers

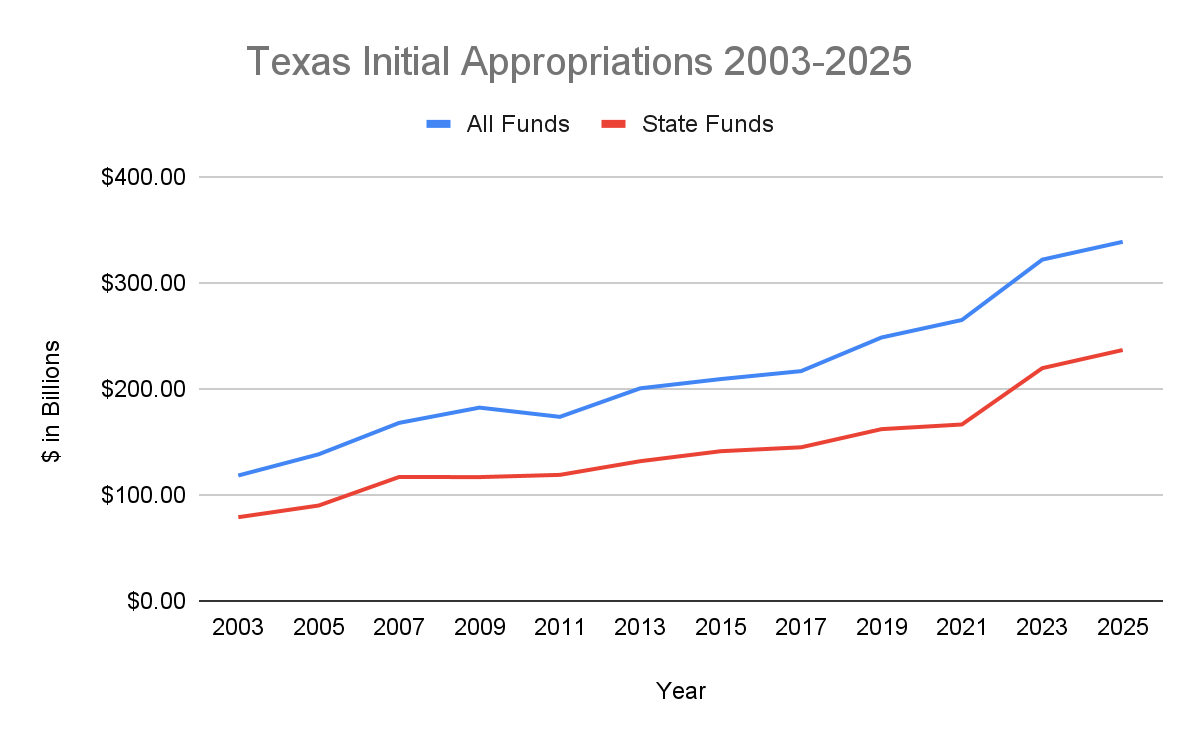

The data1 on spending growth since 2003 paints a stark picture. Starting with the 78th Legislative Session’s 2004-2005 biennium, the initial “All Funds” appropriations—which includes state, federal, and all other revenues—stood at just $118.2 billion, with the “State Funds” portion, which excludes federal money, at just $78.9 billion.

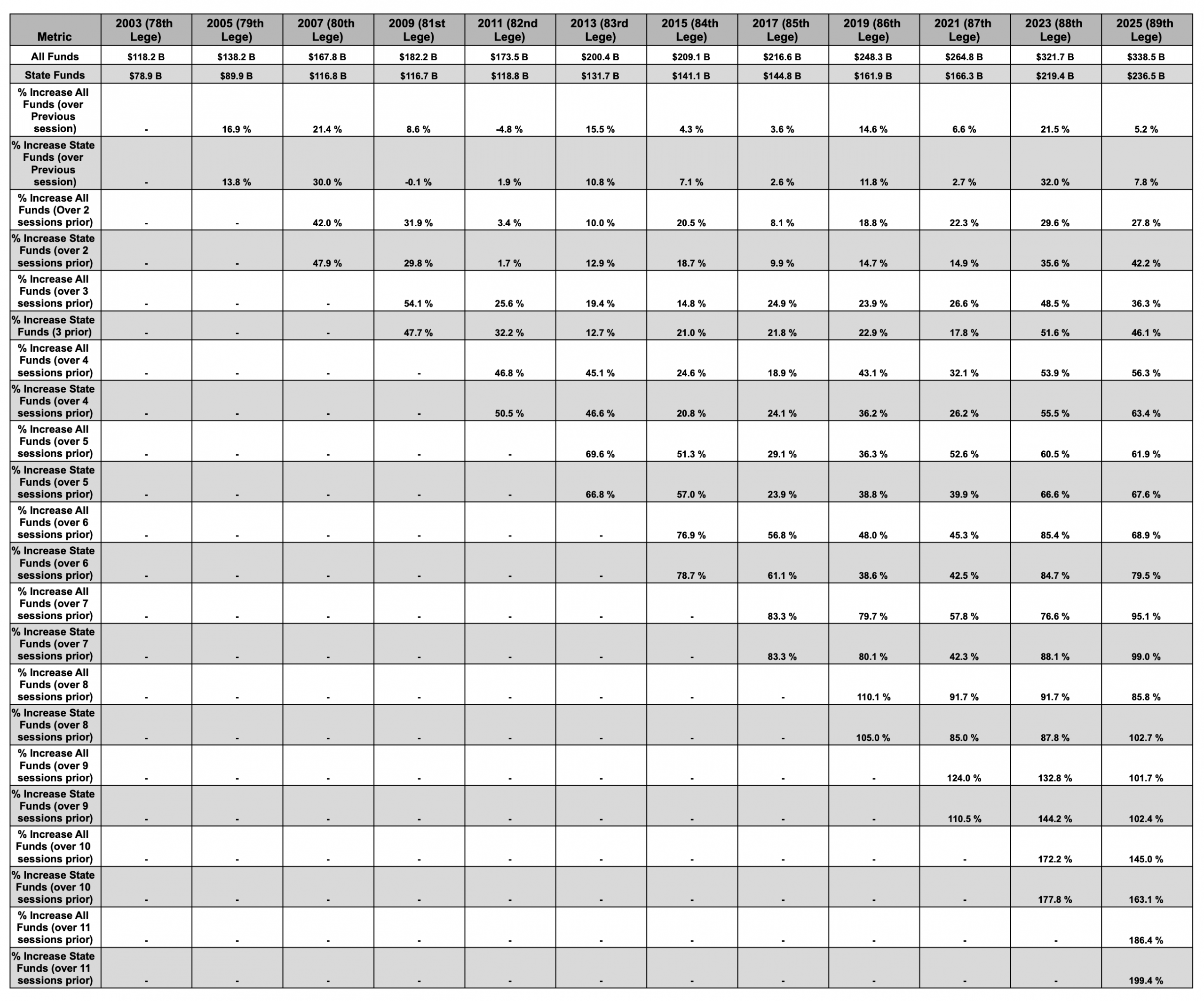

By the 89th Session’s 2026-2027 biennium, these figures have ballooned to a massive $338.5 billion in All Funds and $236.5 billion in State Funds, as shown in Figure 1 below. This represents a staggering total increase of 186.4% in All Funds initial appropriations and 199.4% in State Funds initial appropriations over the 2003 baseline.

Figure 1. Initial Appropriations 2003-2025

Year-over-year trends reveal consistent upward momentum, with only rare exceptions. The All Funds initial appropriations decreased just once during this period, by 4.8% in the 2012-2013 biennium. The State Funds portion dipped minimally by 0.1% in the 2010-2011 biennium, following the Great Recession. Otherwise, growth has been relentless. For instance, between the 2004-2005 and 2006-2007 bienniums, All Funds rose 16.9%, followed by a 21.4% jump in 2008-2009.

More recently, the 2024-2025 biennium saw a 21.5% increase in All Funds and a whopping 32.0% in State Funds over the prior period.

Looking broadly across many sessions, All Funds has grown 145% over the 10 sessions prior to the initial appropriations in 2025, while State Funds has surged 163.1%, as shown in Figure 2.

Figure 2. All Funds and State Funds Percentage Growth Over Prior Sessions 2003-2025

Population and Inflation

These numbers aren’t just abstract; they reflect a government that’s grown far beyond necessity. Even accounting for Texas’s population boom and inflation, spending has risen disproportionately. Inflation2 between 2003 and 2025 has been roughly 75.3%, and population growth3 over the same period has been about 44.5%. Compare that to Texas appropriations of State Funds that have increased nearly 200% since 2003.

When looking at just the two most recent bienniums, we see even more shocking numbers. In just two sessions,4 from 2021 to 2025, the Texas Legislature increased All Funds initial appropriations 27.8%, and State Funds initial appropriations by an historic 42.2% – some of the largest increases in Texas history. Meanwhile, population and inflation increased by just 7.7% and 18.4%, respectively.

This is not fiscally responsible or sustainable. And it is certainly not conservative.

The Effects

The implications of this bigger spending are profound and detrimental to everyday Texans. More spending inevitably leads to higher overall taxes, as the state must generate revenue to match its appetites. Higher spending of taxpayer money empowers a more intrusive government, with increased bureaucracy regulating businesses, families, and individuals. Moreover, it siphons funds away to pet projects, bureaucracy, and corporate welfare, that could have provided meaningful property tax relief—a perennial promise from Texas politicians that has not only fallen short in recent years, but has completely failed.5

This expansion crowds out private sector innovation, stifles economic freedom, and burdens future generations with more debt and higher taxation.

It Doesn’t Have to Be This Way

It’s clear that the status quo is unsustainable. When it comes to spending and the size and scope of Government, Texas is heading down6 the same paths of liberal states like California7 and New York: putting bigger government ahead of the prosperity of families.

It’s time to confront this unchecked growth and demand real reforms. Texans for Fiscal Responsibility has long called for fundamental changes: freeze state spending8 and aggressively cut waste, fraud, and abuse. By auditing and even ending inappropriate programs, eliminating waste, and prioritizing core functions like public safety and infrastructure without excess, we can achieve a leaner, more responsible government. This approach would lower taxes, free up billions for permanent property tax relief, and foster prosperity through individual initiative in the free market. History shows that states with restrained spending, like Florida and Tennessee under similar Republican control, enjoy stronger economies, lower tax burdens, and more prosperous citizens.

Texas can reclaim its conservative roots and stop these out of control spending sprees that threaten our children’s futures, but only if lawmakers act with courage and reject allure of bigger government.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!

- https://www.lbb.texas.gov ↩︎

- https://data.bls.gov/cgi-bin/cpicalc.pl ↩︎

- https://worldpopulationreview.com/states/texas https://www.neilsberg.com/insights/texas-population-by-year/ ↩︎

- https://texastaxpayers.com/texas-house-passes-record-breaking-budget-that-grows-government-sidelines-tax-relief/ ↩︎

- https://texastaxpayers.com/questions-the-texas-legislature-wont-ask-and-answers-they-wont-give-you-about-the-failure-of-property-tax-relief/ ↩︎

- https://texastaxpayers.com/ten-reasons-why-republicans-should-vote-against-the-texas-budget/ ↩︎

- https://texastaxpayers.com/the-texas-budget-a-progressive-california-blueprint-not-the-texas-we-deserve/ ↩︎

- https://texastaxpayers.com/2026-27-frozen-texas-budget-reining-in-unsustainable-spending/ ↩︎