Introduction

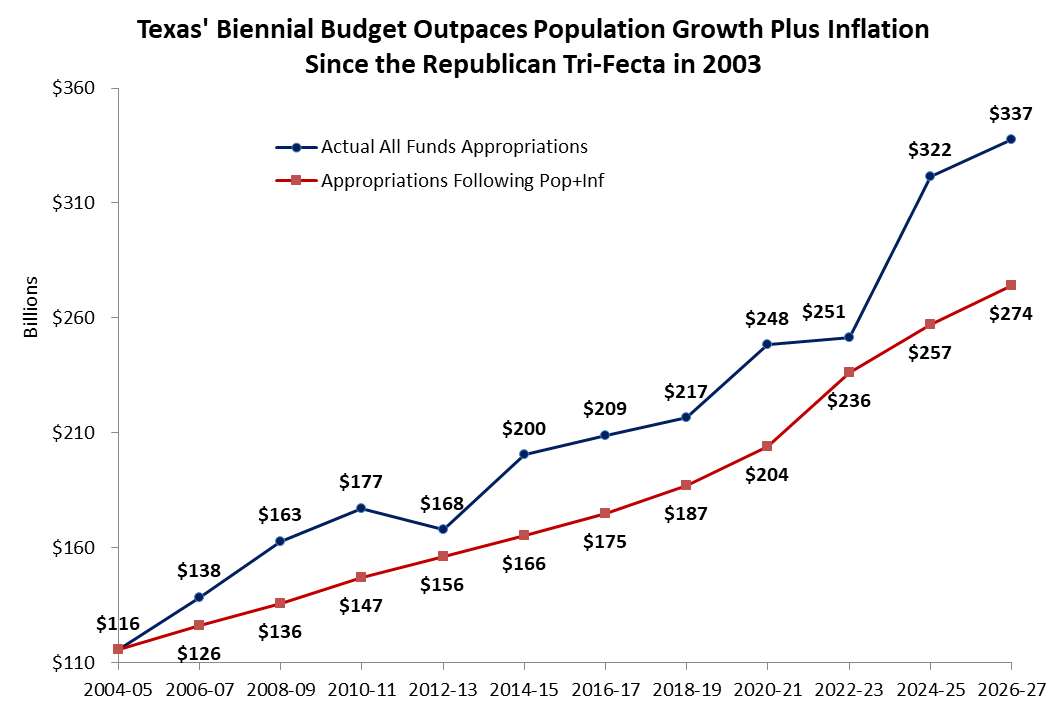

The 2026–27 Texas proposed biennial budget should be rejected this week when brought to the House floor on Thursday, April 10th. This budget, and many before it over the last two decades since Republicans gained a trifecta in 2003, appropriates too much compared with population growth plus inflation, a good measure of the average taxpayer’s ability to pay for government spending.

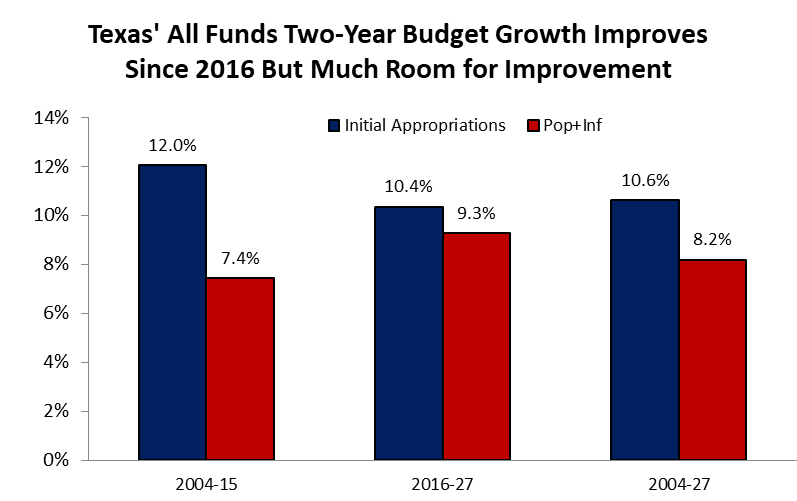

This budget also delivers too little tax relief. It puts Texas on a path that mirrors the bloated budgets of states like California, not the fiscally responsible model that Texans have long preferred. While the state has appropriated less per biennium since the 2016-17 budget than prior budgets back to 2004-05, appropriations in both periods in the table below show they are above population growth plus inflation and for the entire period.

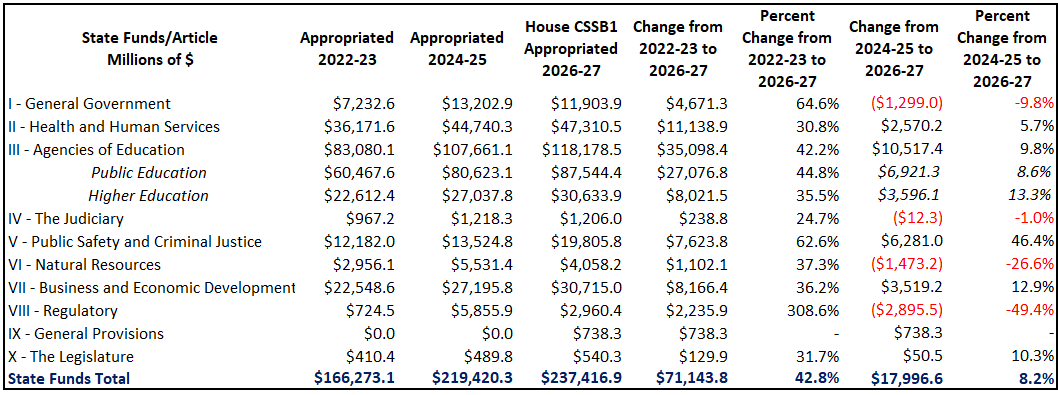

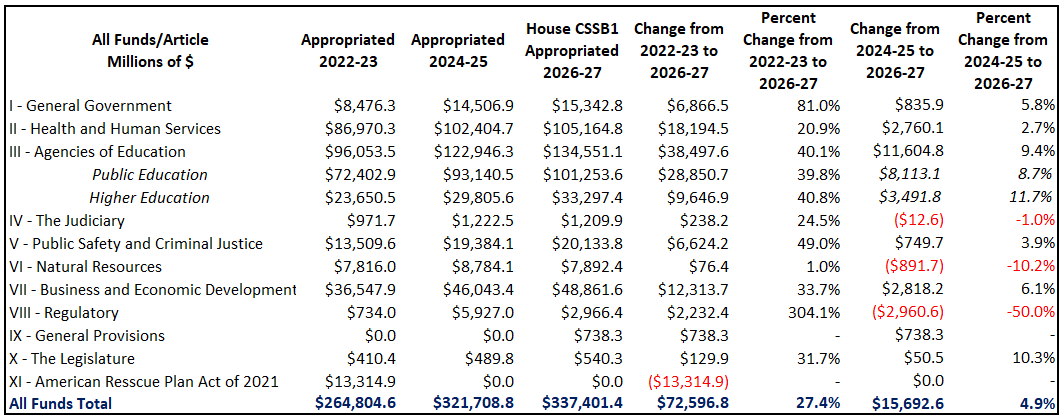

In the Legislature’s 2026-27 proposed budget, state funds appropriations that exclude federal funds rise by 8.2% from the 2024-25 biennium and nearly 43% compared to the 2022–23 biennium—well above the maximum rate of population growth plus inflation. But even that is too high as the goal should be freezing or even reducing the budget after past spending excesses. The all-funds budget with state and federal funds would rise nearly 5% from 2024–25 and 27% since 2022–23. Yet, despite a historic $24 billion surplus, just $6 billion is earmarked for property tax relief—leaving most of the surplus untouched or wasted on expanding government instead of returning it to taxpayers. Another expected $28 billion in the state’s rainy day fund (Economic Stabilization Fund) is sitting outside of the productive private sector. The budget does almost nothing to put school district M&O property taxes on a path to elimination and continues to fund outdated or ineffective programs.

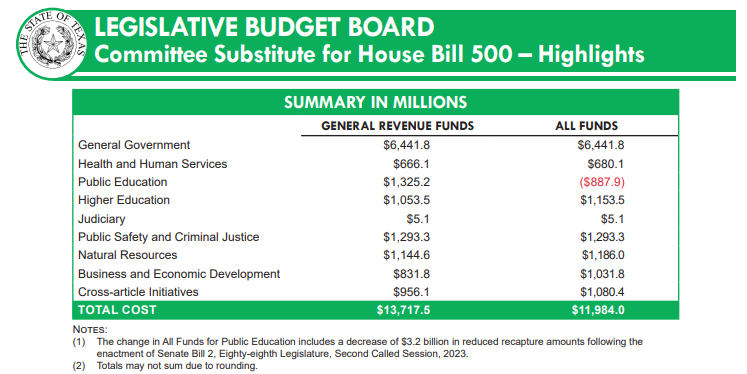

This budget grows spending across nearly every article of the budget without meaningful reforms. Education funding grows substantially, yet universal school choice is mainly ignored. Meanwhile, corporate welfare schemes—such as $500 million in film subsidies and billions more for government expansion and handouts to contractors for natural gas, water, nuclear energy projects, and more—balloon at the expense of tax relief. It gets worse in the supplemental budget bill (HB 500), which piles on $13.7 billion in additional GR spending and $12 billion in All Funds—most of it going to pet projects, deferred maintenance, and politically motivated funds. These are not emergency items. They’re permanent spending wrapped in a one-time package.

This report thoroughly examines the spending growth by fund and article, highlights the most wasteful programs, and provides clear policy recommendations. It urges lawmakers to reject this budget version, eliminate corporate subsidies, restore transparency, empower oversight through the DOGE Committee, and use surplus dollars to compress and eliminate school M&O property taxes until they are zero. Texans deserve a government that spends less so they can keep more—and this budget falls far short of that goal.

I. Unchecked Budget Growth

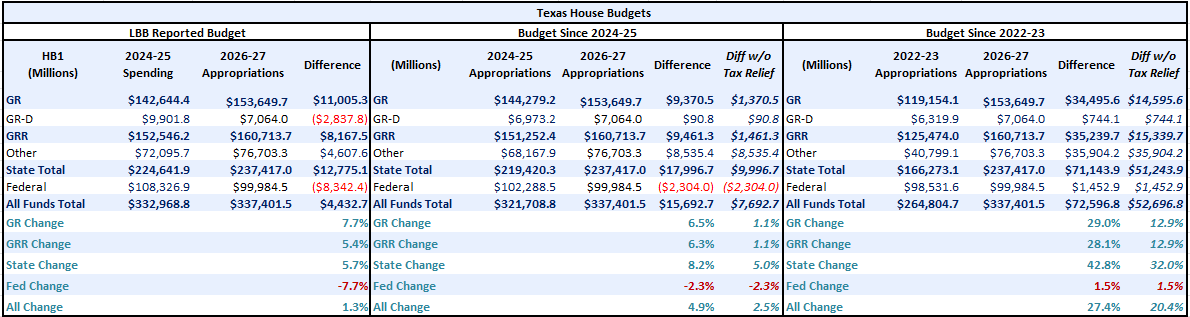

This section incorporates detailed initial appropriations data from the full House Appropriations Bill (HCSSB1) and the summary document (Summary). Together, they provide a comprehensive look at the true scale and structure of spending in the 2026–27 budget. The summary document is especially useful in tracking changes across major funding categories.

For example, according to the LBB summary, Article III (Education) alone accounts for $134.55 billion in All Funds in the House budget. Public education funding rises by $8.1 billion, and higher education climbs nearly $3.5 billion. Article VII (Business and Economic Development) grows to almost $49 billion, including expanding economic incentive programs and subsidies, including the Texas Energy Fund, Water Fund, and others.

These are not short-term outlays; they will become part of the base budget going forward. These data validate that spending increases have far outpaced reasonable benchmarks.

Unlike the Legislative Budget Board’s practice of comparing spending from one biennium to initial appropriations in the next—which makes current proposals appear smaller—this report compares appropriations to appropriations for a clearer, more accurate picture.

Texans deserve a transparent, sustainable budget rooted in conservative principles. The numbers here show just how far we’ve strayed from that path.

Fundamentally, the Texas House’s proposed 2026–27 budget reflects a dramatic expansion in government appropriations detached from Texas’ conservative fiscal roots. Comparing biennium appropriations from 2022–23 to 2026–27 reveals how far off course we’ve veered. These are not modest or strategic increases; they are sweeping and unrestrained expansions that far exceed the maximum rate of population growth plus inflation or, even better, the Frozen Texas Budget.

The following table provides an overview of the Texas House budgets based on the inconsistent comparison by the LBB since 2024-25 and consistent comparisons since 2024-25 or 2022-23. The latter two comparisons include the differences and percent changes in appropriations without property tax relief efforts.

You will quickly notice that the growth in the budget based on the inconsistent view by the LBB shows relatively small increases compared with the consistent approach. There is nothing illegal about reporting the budget this way, but it is, at best, manipulative of taxpayers because they do not see the accurate comparison. After all, we don’t have full spending in the 2026-27 period. The table shows that state funds are up 42.8%, or all funds are up by 27.4% since the 2022-23 budget. Meanwhile, general revenue appropriations—what lawmakers say they have the most control over—are up 29%.

These surges reduce the available surplus for tax relief and create new baselines that will drive future obligations, making it harder to reverse course. This level of growth is not only unnecessary—it’s completely irresponsible. Conservative budgeting means prioritizing needs, evaluating outcomes, and returning surplus dollars to the people. Instead, this budget bloats nearly every government area while giving taxpayers only a tiny fraction back. These increases dramatically exceed a conservative benchmark of population growth plus inflation, estimated at roughly 20% since the 2022-23 budget.

By any metric, this is unsustainable growth, driven more by government appetite than actual need.

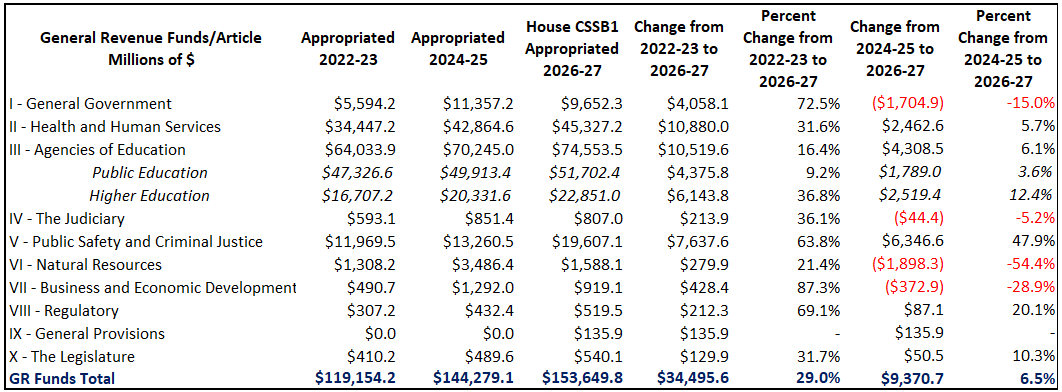

II. Article-by-Article Budget Breakdown

To truly grasp the magnitude of this budget’s excesses, it’s helpful to break down how appropriations change across each area of state government, referred to as “Articles” in the Texas budget. These articles provide insight into where money is being spent and how those priorities reflect the state’s policy direction—or lack thereof. The following tables highlight how the House budget allocates general revenue, state, and all funds by article since 2022-23 or 2024-25..

Each article deserves scrutiny, especially with the substantial increases in just two sessions since the 2022-23 budget that are well above the 20% increase in population growth plus inflation over that period. The House budget ramps up appropriations in most articles without serious reforms. Massive increases come without accountability for public education outcomes, no truly universal school choice, and no transparency in allocating economic development funds. These appropriations are mostly for ongoing expenditures that set a new baseline for future budgets, baking in bloat and leaving less room for tax relief. The budget explosion is not just about the overall numbers—it’s also about where those dollars are going. Rather than limiting spending to essential services and taxpayer priorities, the House budget is riddled with costly, unnecessary, and often counterproductive programs. Lawmakers are not just overspending but also appropriating in many wrong places, including film subsidies, energy project breaks, and water subsidies for contractors without providing pathways to more market-oriented reforms. These items don’t just waste money—they represent a dangerous shift toward centralized economic planning and cronyism. The Legislature allocates massive sums to special-interest projects instead of prioritizing property tax relief. Texans want accountability and restraint. This budget delivers neither. It is time for lawmakers to reset the course.

III. The Supplemental Bill: HB 500

HB 500 represents a concerning example of how the Legislature uses supplemental appropriations to further inflate the state budget with minimal transparency or restraint.

Instead of responsibly directing excess general revenue funds toward meaningful tax relief, the House has funneled billions of taxpayer dollars into ongoing programs, one-time capital projects, and politically popular but economically questionable handouts. The following table shows that total GR appropriations in HB 500 is $13.7 billion. In comparison, all funds reach nearly $12 billion as there is a decline of $888 million in federal funds for the School Health and Related Services (SHARS) program.

Many of these supplemental expenditures would be considered new base-level spending going forward. Worse, they lock the state into future liabilities and crowd out future tax relief options. Instead of being a responsible tool to manage emergencies or fund shortfalls, HB 500 has become a wishlist for well-connected interests and a backdoor method to increase base year expenditures to increase the spending limit for the next period. Lawmakers should reject these items outright or move their funding into the Property Tax Relief Fund.

IV. Policy Recommendations

The current fiscal path Texas is on is unsustainable—but it’s also reversible. Legislators have a unique opportunity this session to right the ship, reduce waste, and return power and resources to Texans. The following recommendations outline the clearest path forward for restoring fiscal discipline, spurring economic opportunity, and advancing individual liberty across the state:

- Reduce Current Spending By 15% and Cap Future Spending Growth to a Maximum Rate of Population Plus Inflation: Texas should reduce spending by at least 15% in the budget to deal with past excesses and pass a stronger constitutional spending cap that limits budget growth by state and local governments to a maximum rate of population growth plus inflation. This commonsense metric has long been the gold standard for responsible budgeting. Without such a guardrail, the Legislature can inflate spending well beyond what Texas families can afford, as we’ve seen with this budget.

- Eliminate M&O School Property Taxes via Compression: With nearly $24 billion in overcollected taxpayer money called a surplus, Texas has the means to compress aggressively—and ultimately eliminate—school district maintenance and operations (M&O) property taxes. Rather than continuing to raise the homestead exemption or relying on other temporary fixes, lawmakers should prioritize permanent compression by dedicating surplus dollars to buy down school district M&O rates year after year. Full elimination of these property taxes, nearly half of all property taxes, is achievable within a decade or less. Local governments should use their surpluses to reduce their property tax rates until Texas has zero property taxes.

- Reject Corporate Welfare and Special-Interest Giveaways: The Texas budget includes subsidies and handouts to politically favored industries and institutions of higher education. From millions of dollars in film subsidies to billions of dollars more for the Texas Energy Fund, Water Fund, Dementia Prevention and Research Institute, and Nuclear Fund, these programs inappropriately pick winners and losers with taxpayer money. Eliminating them could save taxpayers more than $7 billion per year. Instead of distorting the free market, Texas should let competition—not cronyism—drive growth and stability.

- Empower the DOGE Committee to Root Out Waste and Inefficiency: The Texas House’s Delivery of Government Efficiency Committee (DOGE) must do more than meet and talk—it must lead. Empower it with the authority and resources for external audits of every state agency, evaluate program outcomes, and recommend permanent government staffing and overhead reductions. Texas taxpayers fund nearly 1.9 million state and local government employees—many in roles that offer minimal public value. Exposing this bloat is key to driving reform.

- Implement Universal Education Savings Accounts (ESAs) If every Texas student were given an ESA worth $12,000, the state could save an estimated $20 billion per year by transitioning students from costly government schools to more efficient, parent-directed options. Universal ESAs would increase competition, improve student outcomes, and finally deliver on the promise of school choice for all—while saving taxpayers billions of dollars.

- Reform Medicaid with a Block Grant-HSA Model: Medicaid continues to consume an ever-larger share of the state budget, with little evidence of improved outcomes. Transitioning to a block grant model with HSAs for recipients would help empower Texas to control costs, eliminate inefficiencies, and tailor services to actual needs. Such a reform could yield $3 billion in annual savings while providing better care.

- Increase Budget Transparency and Accountability: Recent moves to cancel public testimony and negotiate appropriations behind closed doors violate the trust of Texans. The Legislature must recommit to transparency by holding open budget hearings, archiving testimony, and making all appropriations searchable and understandable to the public. Additionally, all budget gimmicks—like shifting spending to off-book funds—must be eliminated. Moreover, the state should use priority-based budgeting that combines performance-based budgeting and zero-based budgeting to start budgets from zero and find constitutional and performance reasoning for every taxpayer dollar spent.

These recommendations aren’t just theoretical. They’re practical, tested, and popular with Texas voters. The only thing standing in the way is political will. Lawmakers who want to be remembered as champions of liberty, prosperity, and good government must act boldly now to restore trust and chart a better path forward. With the reforms above, they could reduce appropriations by as much as $30 billion per year, which would be nearly enough to eliminate school district M&O property taxes forever.

Conclusion: Texas Can Still Choose a Better Path

The evidence laid out in this report is clear: The 2026–27 Texas House budget is a sharp break from the principles of fiscal responsibility, conservative budgeting, and pro-growth governance that once set Texas apart from states like California. Instead of honoring the values of limited government and taxpayer accountability, this budget expands nearly every corner of state bureaucracy and prioritizes new spending over meaningful reform.

Despite a historic budget surplus of $24 billion, only $6 billion is being used for property tax relief—leaving Texans burdened by excessive taxes while the government grows unchecked. From the billions wasted on corporate welfare in HB 500 to the bloated education budget with limited school choice, this budget reflects the interests of bureaucracy and political favoritism, not working families.

Texans deserve better. Legislators must choose whether to defend the status quo or take a stand for fiscal sanity. That begins by rejecting this budget and revisiting the core principles that made Texas an economic powerhouse: small government, low taxes, and trust in the people—not government programs—to drive prosperity.

There is still time to get this right. But that time is running out.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!