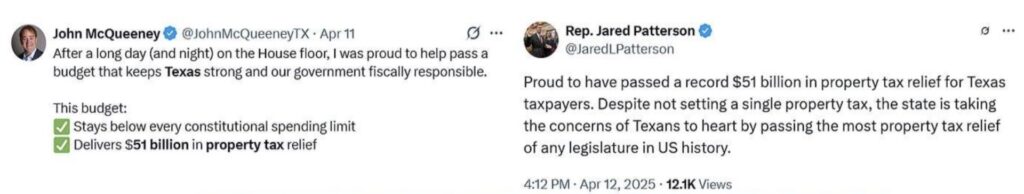

Wherever you turn these days, Texas politicians are claiming that they are spending $51 billion on property tax relief.

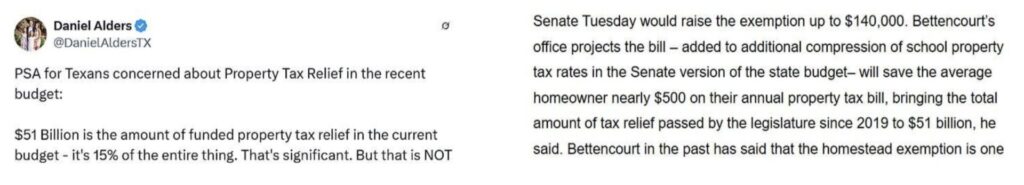

The problem is that the $51 billion figure has no connection to reality. For at least two reasons.

First, if they were really delivering $51 billion of property tax relief, it would eliminate all school property taxes overnight: the 2024 school property tax levy was $42 billion. But this is not happening.

Second, because Texans have not been experiencing property tax relief.

Since 2019—including this session, the Texas Legislature has increased spending on public schools by about $23.6 billion in the name of property tax relief. Figure 1 shows what has happened to Texans’ property tax burden during that period: property taxes have increased $23.6 billion, or 37%.

In other words, the $23.6 billion of increased spending on public schools funded by taxpayers has led to a 37% increase on the average Texan’s property tax bill. My guess is that few Texas property owners are feeling much relief. Especially when considering that they are paying for whatever relief they are getting through other taxes, fees, higher prices, or reduced wages.

Which leads us to 2025. The Texas Legislature is at it again. They have put around $6 billion in the proposed budget for new “property tax relief” for our 2025 property tax bills that are due January 31 of next year. But they are proposing to do it the exact same way they have done the last six years. They’ve increased spending on public schools, reduced our tax rates and/or increased the homestead exemption (we don’t know which yet), and continue to allow schools, cities, counties, and special districts to increase property taxes so much that they wipe way whatever relief we might have received. And then some.

Using recent trends in property tax revenue growth, I project that the statewide total tax levy for all Texans will increase by $2,502,347,747 this year. Which means the average property owner will see an increase of about 3%.

This is unsustainable.

There is only one way to reduce the property tax burden on Texans. It is simple, but has proven politically impossible for one reason: Texas politicians at the state and local level refuse to stop spending our money.

If they ever decide to change course, here is how they could cut property taxes in half in as little as eight years:

- Freeze School Property Taxes

- Limit State Spending Growth to Less Than 2% Per Year

- Buy Down School M&O Property Taxes Using ALL of the State’s Budget Surplus

- Require Cities, Counties, and Special Purpose Districts to Seek Voter Approval for any Revenue Increases

Four simple steps. But for this to happen it requires elected officials at the State level who believe in reducing the size and scope of government.

And there is only one way to get such people in office: Texans need to head to the polls.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!