After Governor Abbott added property tax relief to the special agenda items list, property tax relief has once again taken center stage in the current special session. The only bill that has made any movement is SB 1 by Senator Paul Bettencourt (R-Houston). This is an identical bill to SB 91 from the second called special which TFR has covered in past articles. With its early support in the Senate and House, it is looking more and more likely that SB 1 will be the bill that will be passed as property tax relief in this special session. Most Texans are asking, “How is this confusing bill going to provide property tax relief to Texans?” According to the authors intent in the SB 1 bill analysis:

“S.B. 1 will provide additional school maintenance and operation (M&O) tax rate compression for the 2022-2023 school year of at least $2 billion. Each billion dollars of compression lowers school M&O tax rates by 3.3 pennies. All property owners in Texas would see a reduction of their ISD tax rate by at least 6.6 pennies. The owner of a home with a taxable value of $300,000 would save $200 on their tax bill.”

Let’s unpack what all of this means.

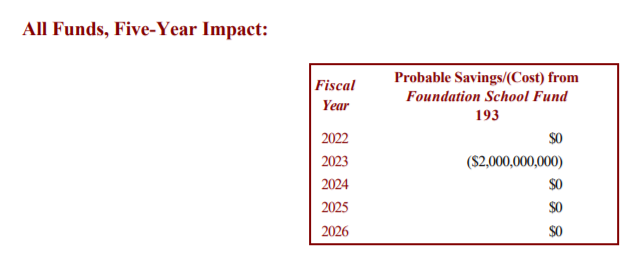

The bill proposes that it will apply a minimum of $2 billion using the $7.85 in surplus funds gained from the new spending limit passed in the 87th regular session. There also is the possibility that additional money could be allocated if the surplus reaches $12.35 billion in the fiscal year 2023 when the comptroller gives an updated BRE. We can only assume this additional relief did not seem likely to the LBB since it was not calculated in the bill’s fiscal note.

We can operate under the assumption that a one-time payment of $2 billion dollars would be the likely relief given to Texas homeowners based on the fiscal impact estimation in SB 1. As stated in the author’s intent above, “every $1 billion in compression lowers school tax rates by 3.3 pennies. What is a penny? In simple terms, a penny represents $1 for every $100 in a home’s value.

In the example given in the analysis, a $300k home would expect a 6.6 penny reduction (This can be found by dividing $300k by 100, then multiplying times .066). This gives us a $198 reduction in property taxes for that home. This calculation can be done on any home value to see the tax reduction based on SB1. So, a $200k home would see a $132 reduction, and a $400k home would see a $264 reduction. To determine how significant of a reduction in taxes this would be, we need to know the average rate paid by Texans on their homes.

What is the average property tax rate in Texas?

The average county tax rate in Texas is $1.81 according to tax-rates.org. On that same $300k home we would expect on average to pay $5430 in property taxes in 2020. Now, let’s apply the same $198 in relief from SB 1 and calculate the percentage of relief for the homeowner (calculated by 198/5430). This results in a 3.65% average reduction of property taxes for a $300k home.

But wait, it gets worse!

Based on Zillow home value estimates, Texas home values have gone up an average of 7.85% year over year since August 2016. This means that the net tax burden change after the appraisal increase for taxpayers on a $300k home would be an increase of 4.2% (subtracting 3.65% from appraisal increase of 7.85%-3.65%).

If SB1 passes, taxpayers can expect a 4.2% increase in property taxes next year! Not exactly the property tax relief you were hoping for?

This is because when politicians administer the minimum effective dose (a common tactic to get reelected), the results are always disappointing. This is why TFR has suggested that the entire surplus be used for the compression rate reduction. Based on the “$1 billion = 3.3 pennies” in the author’s intent of the SB1 bill analysis, this would mean if we used the entire $7.85 billion for a compression rate reduction, it would result in 25.90 pennies! Using the $300k home value as an example this would be a $777 reduction in taxes or 14.3%.

But it gets better!

This could repeat every biennium until the M&O rate is zero. Even adding in the year-over-year appraisal increase there is a net reduction of 6.4% in property taxes for your average Texan. This superior result is why TFR opposes SB1. It is a bill that claims to provide property tax relief but ultimately would only limit the growth of our taxes due to out-of-control appraisal value increases. TFR continues to advocate for our plan that uses 100% of the $7.85 billion surplus to provide meaningful relief to taxpayers, ultimately ending in school property tax elimination!

The closest bill that accomplishes this is HB 90 by Rep. Tom Oliverson (R-Cypress) which would use 90% of the surplus to accomplish this (and is not a one-time payment). HB 90 would continue to reduce compression rates for every biennium that there is a surplus. We believe this would eventually end in the elimination of the M&O property tax. TFR will continue to keep taxpayers updated on where these bills are in the process this legislative session and continue to fight for the complete elimination of property taxes.