In a previous paper1 examining the growth of Texas government over the last 10 years, we’ve seen that appropriations of Texas taxpayer funds increased by $110 billion, or 78%, during that time.

Have you ever wondered what the Legislature did with all that money it took from you?

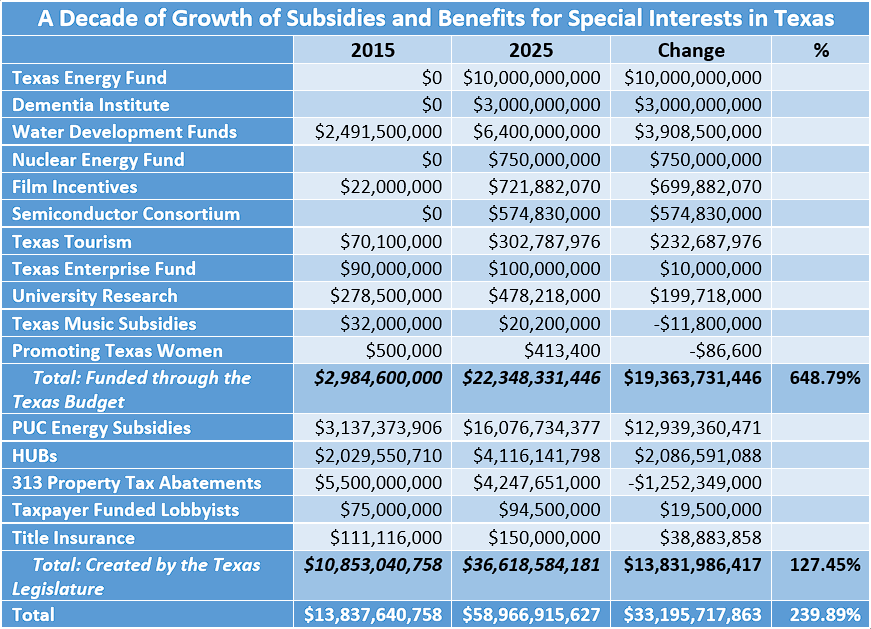

The chart above provides part of the answer. Over the last decade, the Texas Legislature increased handouts of at least $33 billion to special interests, 30% of all new funding. And that is a minimum; the chart is not a comprehensive overview of all corporate welfare in Texas.

The amounts for 2015 and 2025 represent how much money is available or provided to recipients. Sometimes the money was appropriated or authorized in one session, in other instances it has accumulated over a few years; in a few cases, figures are estimates or from a different year due to data limitations. As we examine a few of the programs in the chart, we should note that while we are including all this spending under the umbrella of corporate welfare, some of the special interest funding goes to small businesses.

Energy Subsidies

Payments to energy businesses represent the biggest increase in corporate welfare over the last decade. Between the increase in appropriated spending and mandated benefits that increase electricity prices, Texas energy subsidies have skyrocketed by $23 billion. The Texas Energy Fund received $10 billion of this in 2023 and 2025. The $16 billion PUC energy subsidies represent numerous costs imposed on consumers and/or taxpayers by the Public Utility Commission of Texas, always with the approval of the Legislature. The money produced by these charges generally wind up in the pockets of traditional and renewable energy businesses with multi-million- or multi-billion-dollar market caps. The Legislature has chosen this path toward reliability because it refuses to end subsidies for renewable energy. Unfortunately, this is not working; it is simply making electricity more expensive.

Historically Underutilized Businesses (HUBS)

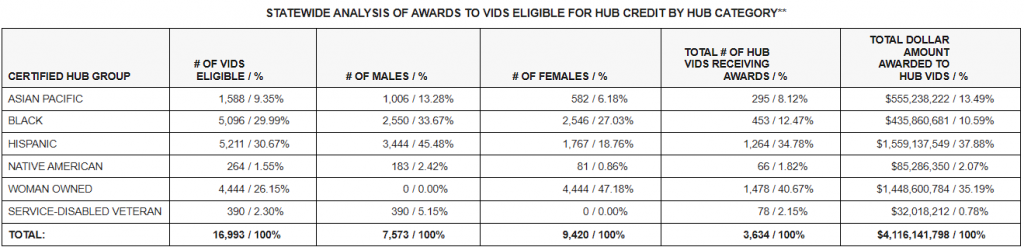

The Disadvantaged Business Program was created by the Texas Legislature in 1995. It became the HUB program in 1995. Since then, blacks, Hispanics, Native Americans, those of Asian Pacific heritage, women, and veterans have had special access to gaining government contracts from the state. HUBs received $4.1 billion in state contracts6 in 2024—up from $2 billion in 2015,7 the vast majority of those contracts going to businesses because of the color or gender of their owner or a principal.

Taxpayer Funded Lobbying

Taxpayer-funded lobbying occurs when cities, counties, school districts, and other local entities use public dollars to hire lobbyists or pay associations whose staff lobby the Legislature on their behalf. This practice directs taxpayer money to influence state law for larger budgets, expanded taxing authority, and broader regulatory power, often contrary to many residents’ interests. In 2025, local governments are estimated to have spent nearly $94.5 million on contract lobbyists,8 up from $75 million in 2021.

To address this, lawmakers have filed multiple bills to prohibit the use of public funds for taxpayer funded lobbying. Not surprisingly, lobbyists and legislators beholden to lobbyists have, to date, defeated the bills.

Handouts for Hollywood

Texas provides financial incentives to support film, television, and multimedia production as part of a so-called “economic development strategy.” State programs promote in-state film and TV industries, maintain business directories and referral networks, and administer grant programs tied to cultural and educational initiatives. Over time, legislative appropriations and incentive funds for moving image production have expanded significantly. State subsidies for film and television have increased markedly, rising from about $22 million in 2015 to approximately $722 million by 2025. This includes the passage of legislation in 2025 to provide $1.5 billion to the program over the 10 years ending in 2035.

This is the fourth paper in a series examining the growth of government in Texas over the last decade.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!

- https://texastaxpayers.com/a-decade-of-government-growth-legislative-appropriations/ ↩︎

- https://www.lbb.texas.gov/Archives.aspx ↩︎

- https://www.theenergyalliance.com/ ↩︎

- https://comptroller.texas.gov/economy/development/prop-tax/ch313/docs/96-1359-2015.pdf ↩︎

- https://www.texaspolicy.com/wp-content/uploads/2018/12/Title-Insurance-Needs-Competition.pdf ↩︎

- https://comptroller.texas.gov/data/purchasing/hub/fy24/ ↩︎

- https://www.utsystem.edu/sites/default/files/documents/HUB%20Annual%20Report%202015%20%26amp%3B%20Supplemental%20Letter/720cons.pdf ↩︎

- https://www.texaspolicy.com/wp-content/uploads/2025/03/2025-03-TPP-Ban-Taxpayer-funded-Lobbying-QuinteroBonura.pdf ↩︎