One saying that circulates around the Texas Capitol when the Legislature convenes every two years is that the legislators have only one job they are required to do: adopt a budget.

Every legislative session the legislators manage to do this. In fact, the evidence shows that members of the Legislature have become extremely adept at spending taxpayer money. And even more so at masking how much taxpayer money they are spending.

Ten Years of Government Spending Growth

There are several ways to measure how much money the Legislature appropriates each session. But there is only one method by which taxpayers can accurately hold politicians accountable in real time. That is by examining how much total money the Legislature appropriates when they gather for their legislative session every two years.

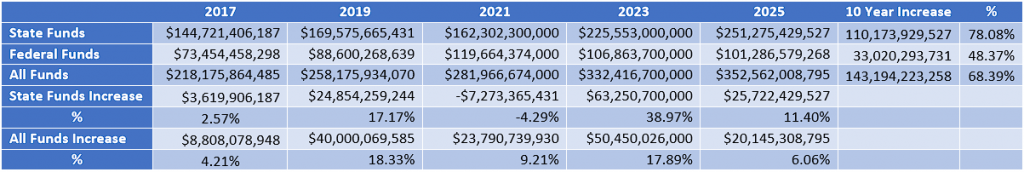

The table above shows that over the last 10 years—five biennial legislative sessions, total legislative appropriations have increased $143 billion, or 68.4%. But the appropriation of state funds has grown even faster; an increase of 78.1%. This compares to inflation of only 35% and an increase of Texas’ population by only 16% over the same period. Not to mention an increase in Texans’ median household income growth of approximately 35%.

We should note that the growth in median household income over this period was completely wiped out by inflation, yet the increase of state funds appropriations more than doubled that amount. Texas state spending has clearly outpaced the average Texan’s ability to maintain an affordable standard of living.

While the increase in appropriation of all funds is important, the growth of spending paid for by state funds is even more so. This is because the federal government largely controls federal funds. The Texas Legislature, however, completely controls the taxes and spending of state funds. If Texans want lower taxes and less government spending, the place to start is reducing the expenditure of state funds.

Accelerating Appropriations

Yet just the opposite is happening. Spending of state funds in the Texas budget is accelerating. The average increase in appropriated state funds in 2017, 2019, and 2021 was 5.15% per biennium. But over the last two legislation sessions—2023 and 2025, the average increase was 25.19%. The appropriation of state funds over the last two sessions has increased $90 billion, or 54.8%.

Masking the Growth

The facts are clear; the Texas Legislature excels in spending taxpayer money. Here, we will further examine how members hide from taxpayers exactly how much they are spending.

Let’s look at growth for the most recent two-year period. As the chart above shows, the appropriation of state funds increased $25.7 billion from 2023 to 2025, an 11.4% increase.

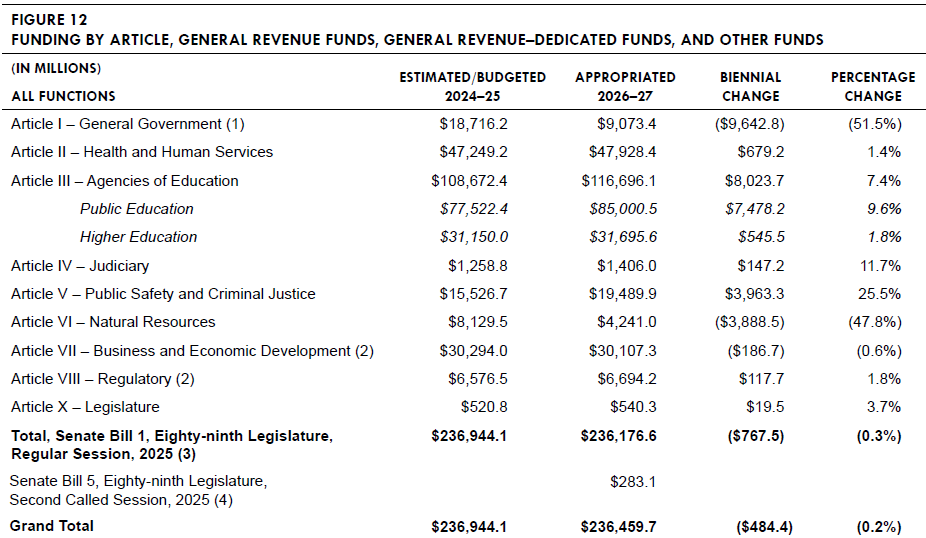

Yet numbers from the Legislature tell a different story. Figure 12 from Texas’ Legislative Budget Board’s (LBB) Fiscal Size-up1 shows that the spending of all state funds (which are comprised of general revenue funds, general revenue-dedicated funds, and other funds) decreased 0.2%, or $484.4 million, this session. How can this be?

The first thing to note is that instead of reporting how much money the Legislature appropriated during the session, the LBB reports only a portion of that sum; the amount the Legislature appropriated for the 2026-27 budget. Now, there is nothing wrong with this as far as it goes—Texas state government agencies need to know how much money they have to spend over the next two years.

What is missing from this picture, however, is the $236.5 billion is not the full amount of state funds that the Legislature will appropriate for the 2026-27 biennium. When the Legislature returns in 2027, it will appropriate billions more for 2026-27 budget cycle. This process, known as backfilling (the current budget), happens every legislative session. For example, during its 2025 session, the Legislature appropriated approximately $14 billion to backfill the 2024-25 budget. This tells us that at this point, the total appropriations figure for the 2026-27 is unknown.

This is how the LBB and politicians can claim that spending of state funds dropped in 2025. Because the LBB compared the total appropriations for 2024-25 (the original amount from 2023 and the backfilled amount from 2025) with the partial appropriations for 2026-27. It is like comparing apples to oranges.

The result of this manipulation, the 0.2% decrease, does not accurately portray reality and inform voters whether Texas politicians are maintaining fiscal discipline. If the Legislature comes back in 2027 and appropriates another $14 billion for the 2026-27 biennium as they did this session, the reported $484 million decrease for the 2026-27 biennium turns into a $13.5 billion increase.

Now, will that happen? We do not know. This is a key point to understanding what the Legislature is doing. From the perspective of Texas senators, Texas house members, the Texas governor, and the Texas lieutenant governor, this is a feature, not a bug. Texas will not be able to hold them accountable for a budget they passed on the spring of 2025 until at least the summer of 2027—when the press and public are no longer paying attention. And they will do the same thing again in 2027 and in future years until Texans speak up and require accountability and fiscal discipline in Texas politicians.

| 2017 | 2019 | 2021 | 2023 | 2025 | 10 Year Increase | % | |

|---|---|---|---|---|---|---|---|

| State Funds | $144,721,406,187 | $169,575,665,431 | $162,302,300,000 | $225,553,000,000 | $251,275,429,527 | 110,173,929,527 | 78.08% |

| Federal Funds | $73,454,458,298 | $88,600,268,639 | $119,664,374,000 | $106,863,700,000 | $101,286,579,268 | 33,020,293,731 | 48.37% |

| All Funds | $218,175,864,485 | $258,175,934,070 | $281,966,674,000 | $332,416,700,000 | $352,562,008,795 | 143,194,223,258 | 68.39% |

| State Funds Increase | $3,619,906,187 | $24,854,259,244 | -$7,273,365,431 | $63,250,700,000 | $25,722,429,527 | ||

| % | 2.57% | 17.17% | -4.29% | 38.97% | 11.40% | ||

| All Funds Increase | $8,808,078,948 | $40,000,069,585 | $23,790,739,930 | $50,450,026,000 | $20,145,308,795 | ||

| % | 4.21% | 18.33% | 9.21% | 17.89% | 6.06% |

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!

- https://www.lbb.texas.gov/Documents/Publications/Fiscal_SizeUp/9046_Fiscal_Size-up_26-27_Biennium.pdf ↩︎