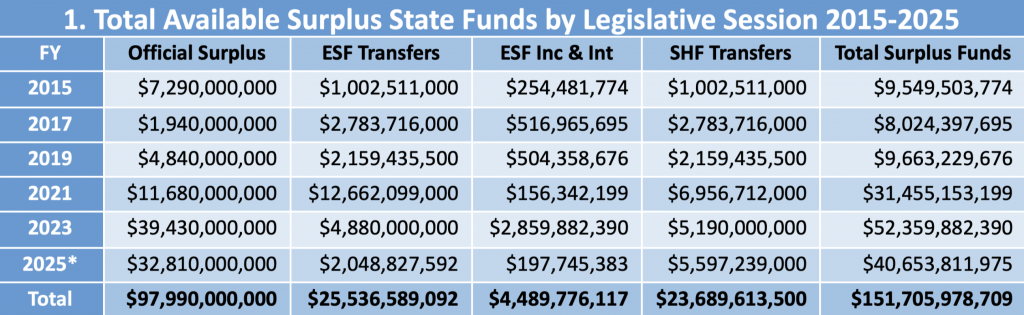

Over the last decade, the state of Texas has experienced unprecedented budget surpluses. These budget surpluses are state tax revenue that exceeds the normal needs of the state. Put another way, the people were “over-taxed.” Covering six legislative sessions since 2015, the total available state only (not federal funds) surplus funds totaled $151.7 billion.

Table 1 shows that the amount of available surplus funds is larger than the official budget surpluses published by the Comptroller1 each biennium. This is because billions of dollars of surplus funds are “hidden” from the public. When, for example, the Legislature met to adopt a budget in 2023, more than $10 billion of surplus revenue was removed from the Comptroller’s surplus calculations through a legislatively mandated transfer to the Economic Stabilization Fund (ESF) and the State Highway Fund. Additionally, almost $3 billion of ESF income and interest that would be earned in the upcoming biennium was not included because it did not meet the Legislature’s definition of available funds. That’s $13 billion of surplus for which politicians did not have to be accountable to taxpayers.

Many Texas taxpayers have been frustrated by how Texas politicians decided to spend the state’s budget surplus over this period. Or perhaps more accurately, they have been frustrated because Texas politicians decided to spend most of that money instead of giving it back to them in the form of tax relief.

There were several options available to the Legislature for providing tax relief. The most discussed option has been providing property tax relief. Since 2019, the Legislature has spent about $29 billion on public schools in the name of property tax relief. However, given that property taxes increased $23 billion during that period (a 34.6% increase), it is uncertain how much of the new spending on public schools found its way to taxpayers.

Another option would have been to reduce the sales tax. The challenge has been that any serious effort to reduce taxes would have meant permanently reducing government revenue, something anathema to most politicians who use spending that favors special interests to help secure their reelection.

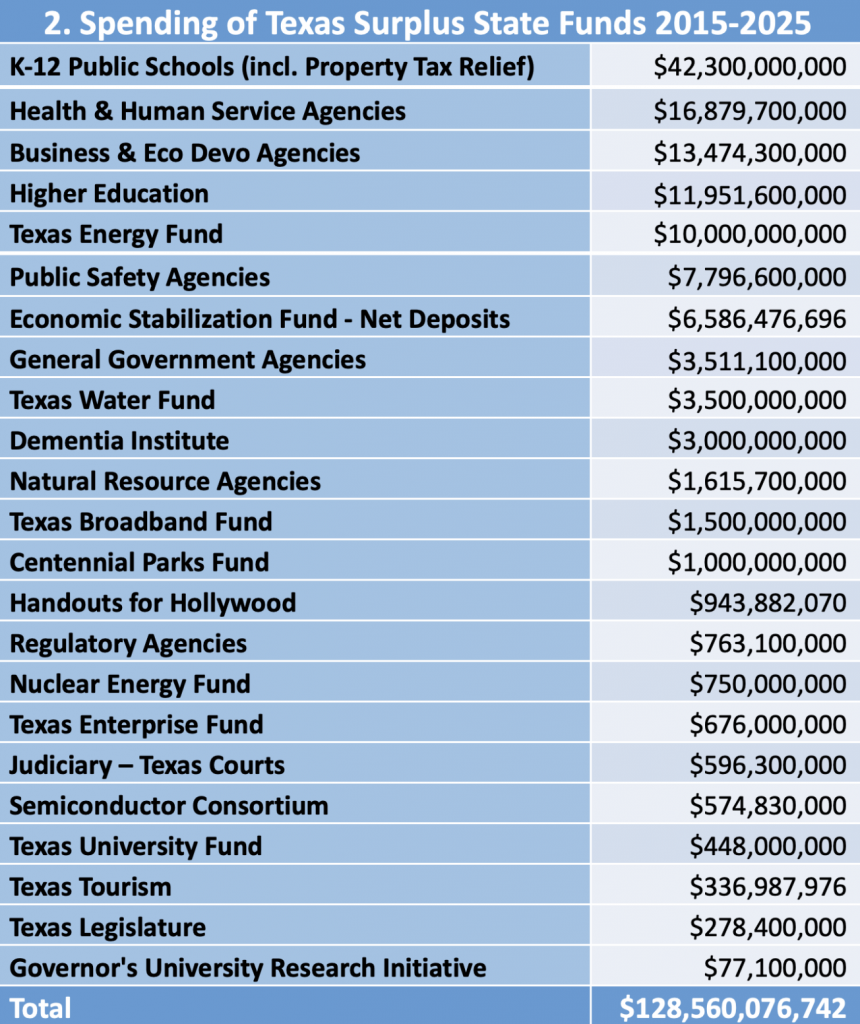

Table 2 shows how Texas politicians in the Texas Legislature and state leadership decided to spend $129 billion of the $152 state budget surplus over the course of legislative sessions from 2015 to 2025.

Some of the surplus was spent through one-time appropriations such as the Texas Energy Fund, the Texas Broadband Fund, and the Texas Dementia Institute. Significant portions of the surplus were also used to increase spending in ongoing state programs such as public education, health and human services, transportation, and regulatory agencies. Much of it went to special interests in the form of corporate welfare, which we dive into HERE.

Where most of the surplus did not go was to taxpayers. Even if we were to allow, for argument’s sake, that all $29 billion of state “property tax relief” spending on public schools actually provided property tax relief, that still means that $122 billion of the $151 billion in budget surpluses were spent elsewhere.

Almost all of this is invisible to Texas taxpayers because Texas politicians have become very adept at hiding how much taxpayer money they are spending (see examples here5 and here6). If Texans want politicians to stop spending their money and reduce taxes, one of the first things we must do is greatly increase budget transparency. The Legislature is unlikely to do this; perhaps the next Texas Comptroller can provide taxpayers with the information the Legislature will not?

This is the fifth paper in a series examining the growth of Texas government over the last decade.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!

- https://comptroller.texas.gov/transparency/reports/biennial-revenue-estimate/ ↩︎

- https://comptroller.texas.gov/transparency/reports/biennial-revenue-estimate/ ↩︎

- https://comptroller.texas.gov/transparency/budget/docs/EconomicStabilizationFund.pdf ↩︎

- https://www.lbb.texas.gov/Archives.aspx ↩︎

- https://texastaxpayers.com/why-republicans-should-vote-against-the-texas-budget-reason-4-the-texas-legislature-is-using-sleight-of-hand-to-exceed-the-tax-spending-limit-by-7-6-billion/ ↩︎

- https://excellentthought.substack.com/p/texas-government-on-track-to-spend ↩︎