Recently, the House and Senate released their versions of the appropriation bill. House Bill 1 and Senate Bill 1 respectively lay out the biennial budget for the 2024-2025 biennium. Texans for Fiscal Responsibility has already highlighted that $15 billion in property tax relief was included in both bills, which is being called the “biggest property tax cut in Texas history.” But is the $15 billion going to new relief, or is this just smoke and mirrors?

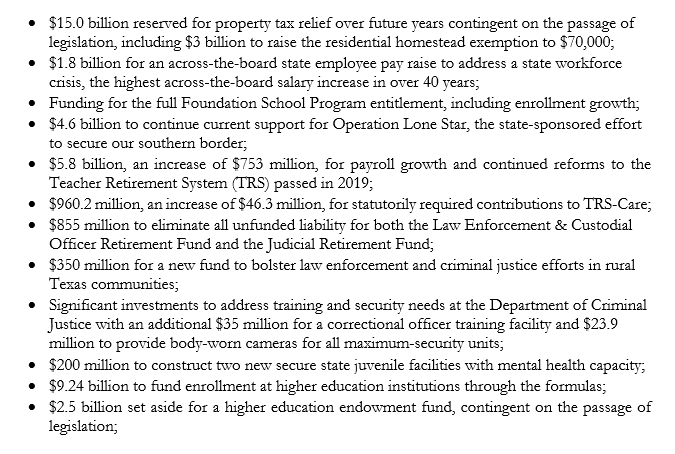

According to a press release from Senate Finance Chairman State Sen. Joan Huffman (R-Houston), there is “$15 billion reserved for property tax relief over future years contingent on the passage of legislation, including $3 billion to raise the residential homestead exemption to $70,000.”

When one reads these statements, it is easy to think they are giving us $15 billion in new Maintenance and Operations (M&O) compression—but that is not what it says, is it? It specifies that $3 billion of that $15 billion is reserved for the homestead exemption increase; in TFR’s opinion, this is an inferior way of providing tax relief. But when we look closer at the bill itself, we find out more.

Rider 81 in SB 1 reads:

- Property Tax Relief.

(a) Out of amounts appropriated above in Strategy A.1.1, an estimated $3,118,000,000 for

the 2024-25 biennium is appropriated from Foundation School Fund No. 193 for

compression of district property tax rates due to district property value growth, pursuant

to Education Code, Sections 48.2551 and 48.2552 (a) and (b).

(b) Out of amounts appropriated above in Strategy A.1.1 and in addition to amounts in

Subsection (a), an estimated $2,156,100,000 for the 2024-25 biennium is appropriated

from Foundation School Fund No. 193 to reduce the state compression percentage by

7.75 percent, due to state savings resulting from the limitation on district Maximum

Compressed Rates during the prior biennium, pursuant to Education Code, Section

48.2552(c).

(c) On September 1, 2023, the Comptroller of Public Accounts shall transfer from the

General Revenue Fund into the Property Tax Relief Fund $9,725,900,000.

(d) Out of amounts transferred in Subsection (c), $9,725,900,000 is appropriated in Strategy

A.1.1 for the 2024-25 biennium out of the Property Tax Relief Fund for district property

tax relief, contingent on actions of the Eighty-eighth Legislature, Regular Session to

increase state aid and reduce recapture payments through additional constitutionally

dedicated property tax relief. Of the $9,725,900,000 appropriated out of the Property

Tax Relief Fund, $3,000,000,000 shall be used to increase the residential homestead

exemption under Tax Code, Section 11.13(b), from $40,000 to $70,000. Other actions

for district property tax relief include, but are not limited to, reducing the State

Compression Percentage pursuant to Education Code, Section 48.255(b)(1); reducing

district Maximum Compressed Rates under Education Code, Sections 48.2551 and

48.2552; reducing the rate of district property tax levy growth in the calculation of the

State Compression Percentage and Maximum Compressed Rate under Education Code,

Sections 48.255(b)(2) and 48.2551(b)(1)(A); and changing the limitation on taxable

value under Tax Code, Chapter 11.

(e) It is the intent of the Legislature that any property tax relief directed by Subsection (d)

shall be structured so as to not exceed the limit provided under Texas Constitution, Article VIII, Section 22, Limitation on the Rate of Growth of Appropriations.

To break this down:

- a & b in the rider are the $5.3 billion to maintain property tax relief in law for the 2024-25 biennium.

- c & d note that $9.7 billion will be used for relief through:

- raising the homestead exemption by $30,000 to $70,000 in the amount of $3 billion for the 2024-25 biennium.

- compressing the rates over time in the amount of $6.7 billion for the biennium. Given it’s about $650 million per penny of compression per biennium, this would be about a 10-penny compression of the ISD M&O property tax rates for the 2024-25 biennium.

So, out of the $15 billion in total relief, one-third of this taxpayer money will be used to maintain compression given in 2019 (not new tax relief), and two-thirds will be used to provide actual new relief. Out of the $9.7 billion in new relief, $3 billion will be used to raise the homestead exemption. Homestead exemptions are not the ideal way to lower property taxes and actually make it more difficult in the long run to eliminate M&O. This is because it is easier to compress M&O rates to zero, and compression affects all homes and benefits all property owners and renters, whereas homesteads benefit only homeowners’ primary residence across the state.

According to this bill, we are still about $4 billion under the constitutional spending cap. So, if the Legislature wants to avoid breaking the cap (which we disagree with, as caps can and should be broken for property tax compression, which only takes a simple majority to break) then they can increase the amount of tax relief in the bill to close to $20 billion.

TFR’s stance is that all tax relief is good, and we support the efforts of the Legislature to reduce and ultimately eliminate property taxes in Texas. For taxpayers who do not have the time to look through budgets, it is our job to provide transparency to the claims of lawmakers. Is there $15 billion in relief? Technically, yes, but one-third is maintaining old relief from 2019 and only $6.7 billion in new compression would result from SB 1 in its current form.

We encourage taxpayers who are concerned about property taxes to call their legislators and demand all of the surplus, break the spending cap, and deliver on Governor Abbott’s goal of eliminating school property taxes to let Texans actually own their property. Remember, the current surplus is at $32.7 billion, and we are currently using less than half of that for tax relief. The time is now to go big in giving the money back to hardworking Texans.