The Texas Senate is set to deliberate and vote on Senate Bill 12 (SB 12) during the current special session, a pivotal measure introduced by State Senator Mayes Middleton (R-Galveston) to ban taxpayer-funded lobbying by local governments. This bill follows Senate Bill...

BROWSE ALL POSTS IN:

89th TXLege

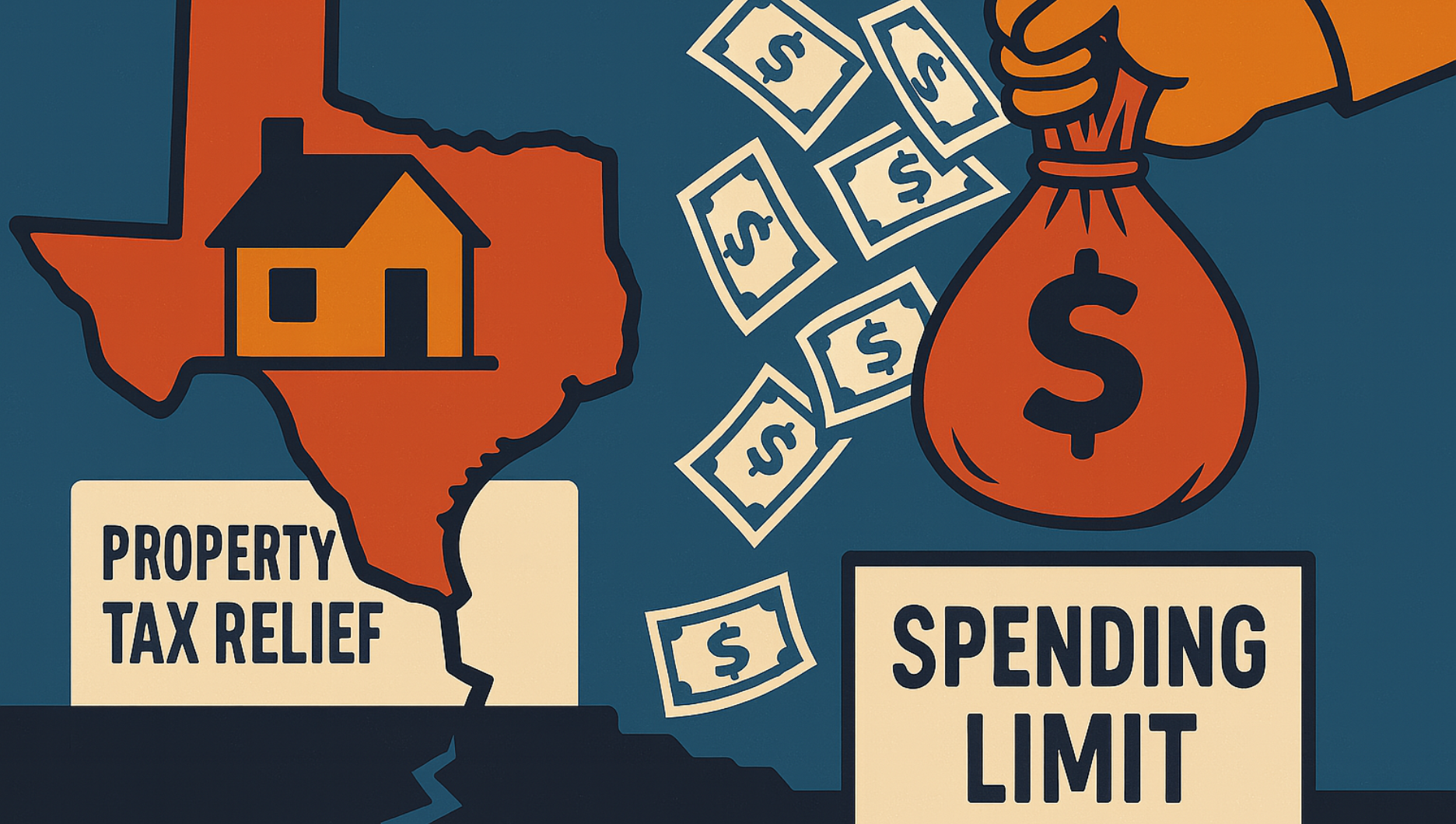

The Path to Real Property Tax Relief: Stopping Local Government Revenue Growth

Executive Summary Texas’ political leaders claim they will spend $51 billion (of taxpayer money) the next two years on public schools to provide property tax relief to homeowners, small businesses, and other landowners. Yet over the last six years of legislative...

Lobbying on the Taxpayer’s Dime

On July 21, 2025, State Senator Mayes Middleton (R-Galveston) introduced Senate Bill 12, a measure to outlaw taxpayer-funded lobbying. If signed into law, SB 12 would mark a major victory for Texas taxpayers, targeting the unjust practice of governments using public...

Local Overspending Undermines Property Tax Relief—Texas Needs a Strong Local Spending Limit

Overview Despite historic efforts to deliver property tax relief by the Legislature, Texans continue to face rising property tax bills. Why? While the state has reduced school district M&O property tax rates and increased the Homestead exemption, cities,...

The Index is Here. Who Fought for Taxpayers?

The 2025 Fiscal Responsibility Index by Texans for Fiscal Responsibility has officially launched, and taxpayers across the State are already diving into the scores and analysis. The Index is the go-to resource for understanding how Texas lawmakers vote to spend...

The Special Session Agenda: A Win for Texas Taxpayers

On July 9, Governor Greg Abbott announced a robust agenda for a special session of the 89th Texas Legislature, set to convene on July 21. The agenda, detailed in a proclamation, includes a range of priorities that resonate strongly with the pro-taxpayer and pro-family...