Right now, early voting is underway for the March 3, 2026, Primary Elections, running from February 17 through February 27. This is your chance to help shape the future of our state by selecting party nominees for key offices, from state representatives and senators,...

BROWSE ALL POSTS IN:

Commentary

The Most Valuable Political Currency in America? A Texas Republican Primary Vote.

The Texas primaries run February 17-27, Republicans must decide “Which Kind” of Republicans they want. Guest article by Mr. Adam Kazmierski. What happens when you combine the nation’s second largest state budget with one of its lowest primary voter turnouts? The...

Double Dipping Stan? Why Is a Sitting State Lawmaker Acting as a Drainage District “General Manager” for a Taxpayer Funded Entity?

Texas House members are not allowed to hold another paid public office. Yet, State Rep. Stan Kitzman1 (R-Brookshire) appears to be doing exactly that. Stan Kitzman the General Manager? Documents obtained by Texans for Fiscal Responsibility show that Kitzman,...

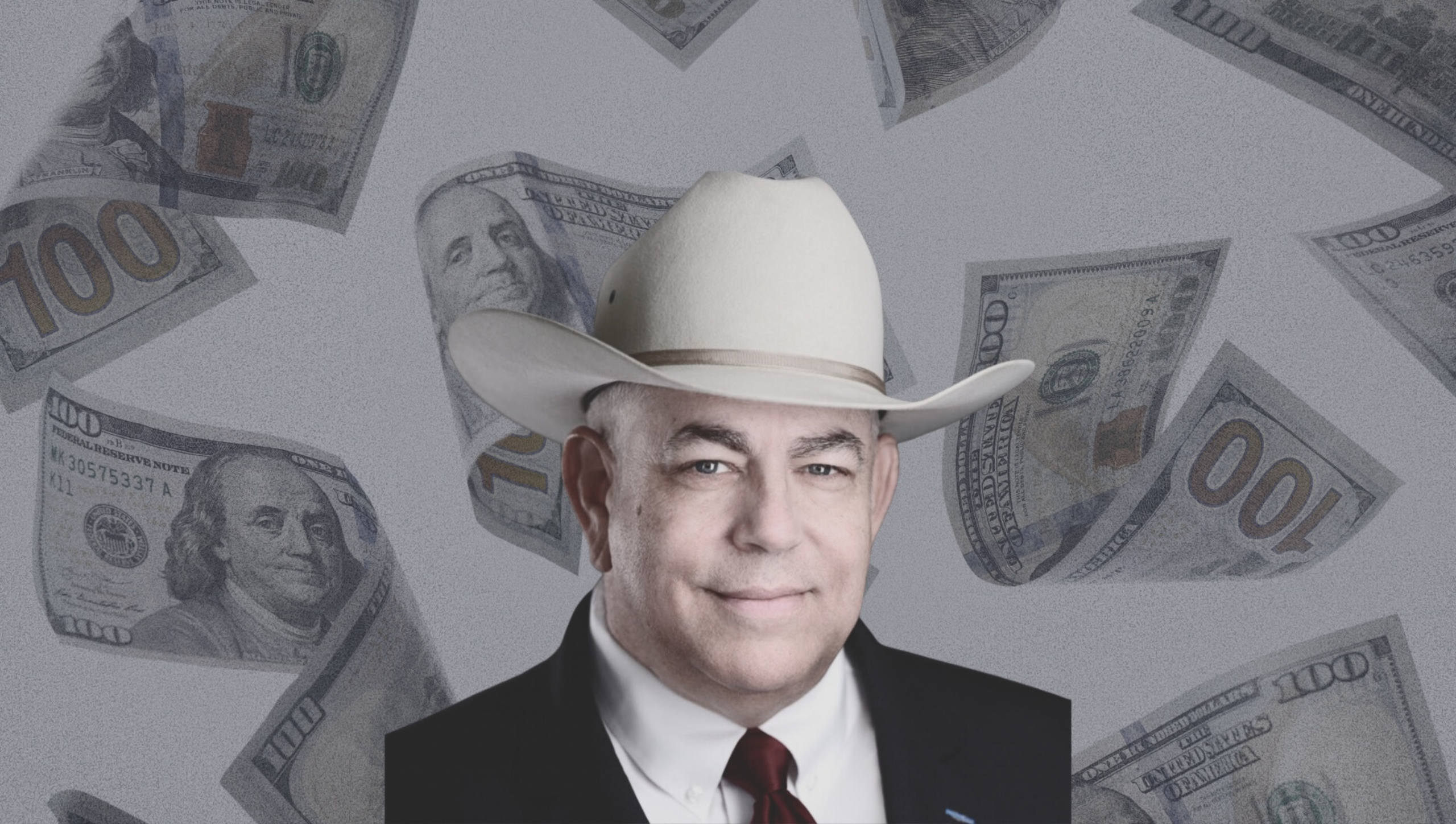

Ken King: Failing Texas Taxpayers for over a Decade

Texas State Representative Ken King, a Republican from Canadian, Texas, has represented House District 88 since 2013. Over seven regular legislative sessions, King has positioned himself as a conservative representing Panhandle and South Plains values. However, a...

Young Republicans in Texas Are Turning a Corner, And Texas Taxpayers Should Take Notice

For years, institutional Young Republican organizations were known more for cocktail-party conservatism than real grassroots work. They showed up for selfies with Fox News personalities and political galas, but rarely for Saturday block walks or committee hearings at...

A Christmas Reflection

As Christmas Day arrives, all of us at Texans for Fiscal Responsibility pause to reflect on the profound meaning of this season. In a world often consumed by the hustle of shopping, parties, and travels, it's easy to lose sight of what truly matters. Christmas is not...