Texas House Leadership Sidesteps Full House Vote In a move that bypasses traditional legislative procedures and disrespects taxpayers, the Texas House Administration Committee has unilaterally approved significant budget increases for legislative offices, including a...

BROWSE ALL POSTS IN:

Texe Lege

The Texas Legislature is Tiring of Property Tax Relief

A sentiment making its way around the Texas Legislature is that providing tax relief for property owners is “too big of a commitment.” An element of this sentiment was expressed several times in a recent Senate Finance Committee hearing where members repeatedly noted...

Sovereign Wealth Funds: A Bad Idea for Texas and the Nation

Recent proposals by President Donald Trump to establish a U.S. Sovereign Wealth Fund (SWF) and by Texas Lieutenant Governor Dan Patrick to remove the cap on Texas’s Economic Stabilization Fund (ESF) are deeply flawed. Both ideas assume that government-run investment...

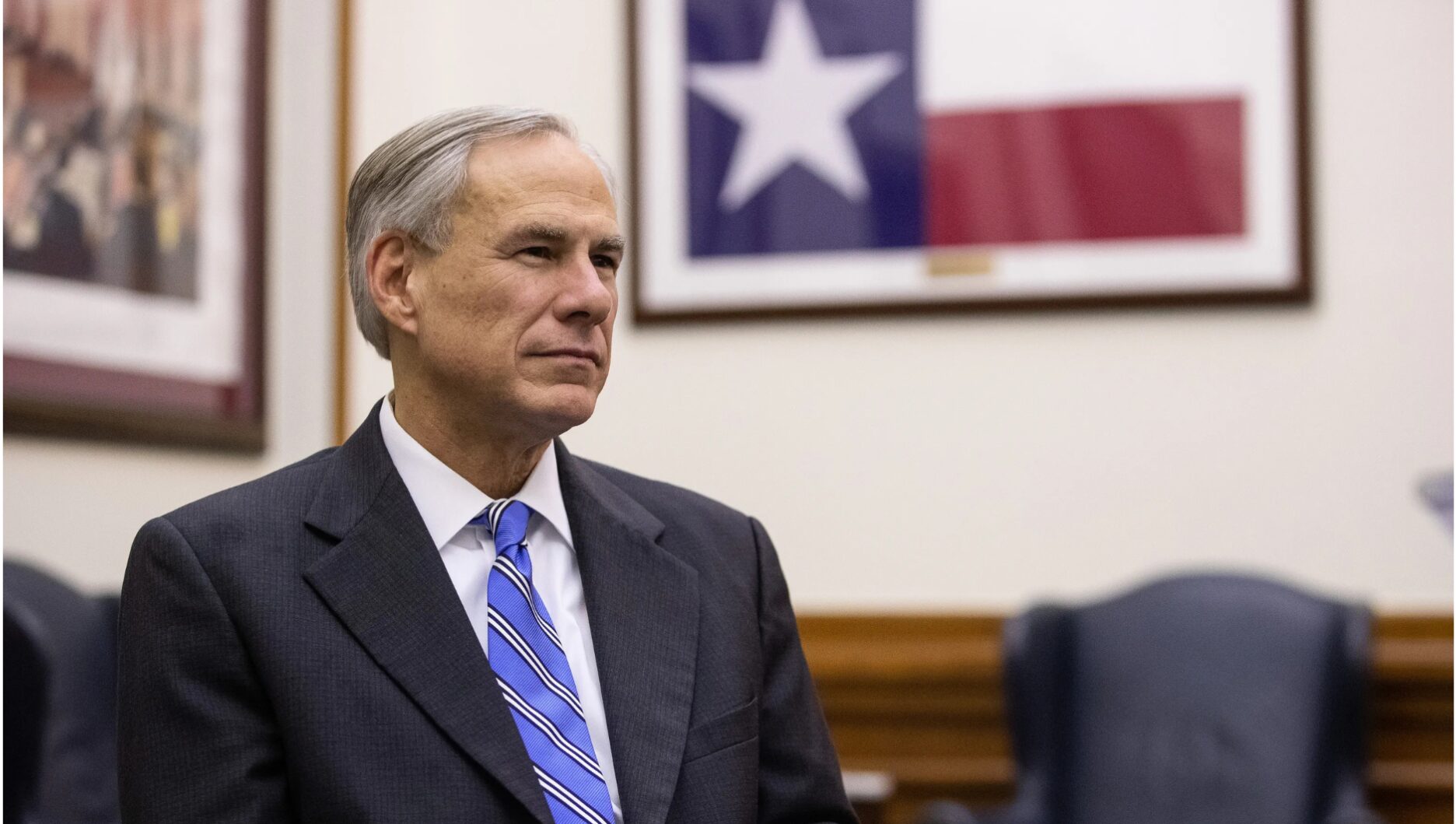

Governor Abbott’s State of the State Address

A Step Toward Fiscal Reform, But More Is Needed Governor Greg Abbott’s recent "State of the State" address highlighted several important priorities for Texas. While Texans for Fiscal Responsibility (TFR) commends the Governor’s efforts to address property tax relief...

Texas Budget Crisis Despite Robust Labor Market

Texas is experiencing economic growth, but the state government isn’t keeping pace with fiscal responsibility. In December 2024, Texas added 37,000 new jobs, marking its twelfth consecutive month of job gains. Total nonfarm employment reached a record...

Proposed Property Tax Relief Falls Short in the 89th Texas Legislature

Texans Will Get Less Than $4 Billion Out of the $24 Billion Budget Surplus Executive Summary Though it is difficult to discern from recent statements made by Texas’ legislative leaders, the Texas Senate has budgeted only $3 billion for new property tax relief this...