“We're Kind of Maxed Out at What We Can Do for Property Tax Reform” There is a lot of misinformation floating around the state of Texas when it comes to the ability of the state to reduce or eliminate property taxes. This is the first article in a series where we’ll...

BROWSE ALL POSTS IN:

Explainers

Property Tax Swap or Property Tax Buydown? Conservatives Must Make Up Their Mind

For almost 20 years, there have been serious discussions in Texas about eliminating property taxes. And during that period, few Texas politicians have made serious attempts to do anything about this. In fact, as a body, the Texas Legislature (including state-wide...

Texas Bonds, Property Taxes, and the Debt That Harms Texans

Executive Summary Texas continues to attract families and businesses from across the country, but government debt threatens to erode that incentive. According to the Texas Bond Review Board (BRB),1 local governments carried $330.9 billion in outstanding debt in FY...

The Games Local Governments Play

Unmasking Taxing Tactics in Texas In Texas, local governments wield significant authority over taxation and spending decisions that directly impact residents' financial well-being. Local entities such as cities, counties, school districts, and special districts often...

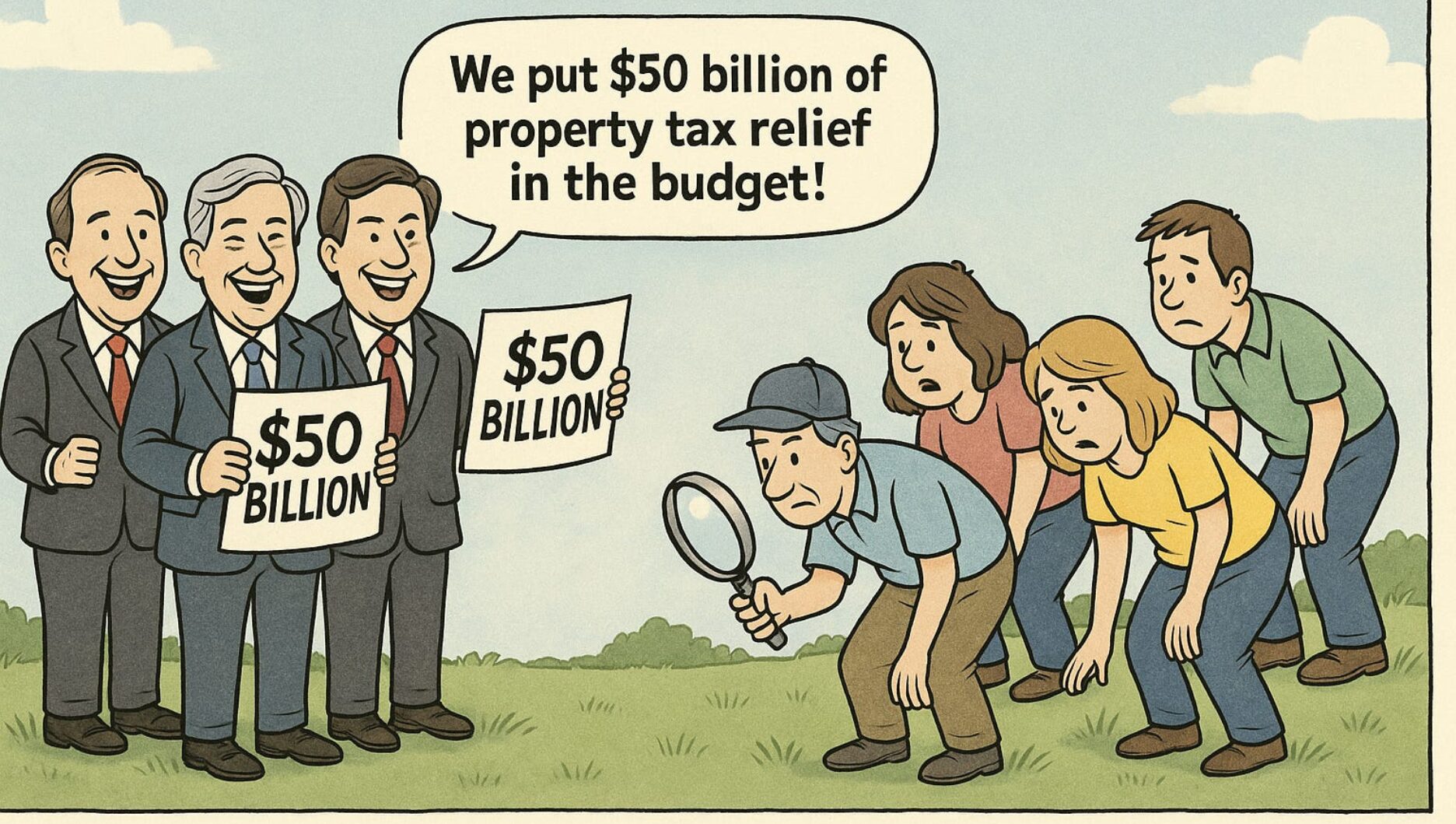

Explainer: Did the Texas Legislature Really Spend $51 billion On Property Tax Relief This Session?

Executive Summary Gov. Greg Abbott recently signed property tax legislation passed this session by the Texas Legislature. Since then, quite a few Texas politicians have been claiming that the Legislature committed $50 billion or so property tax relief this session....

Sustainable Tax Relief: Why Surplus Triggers Are Better Than Revenue Triggers

States across the country are rethinking tax reform to stay competitive for residents and businesses. Many are exploring ways to phase out personal income, business franchise, and property taxes to attract workers, foster economic growth, and ensure property rights....