“With the homestead exemption…the state of Texas is writing a check to pay your school taxes.”

““With the homestead exemption, $10 billion in state funding equals about $1,300 in property tax relief. … In short, the state of Texas is writing a check to pay your school taxes.”

– – Lt. Gov. Dan Patrick1

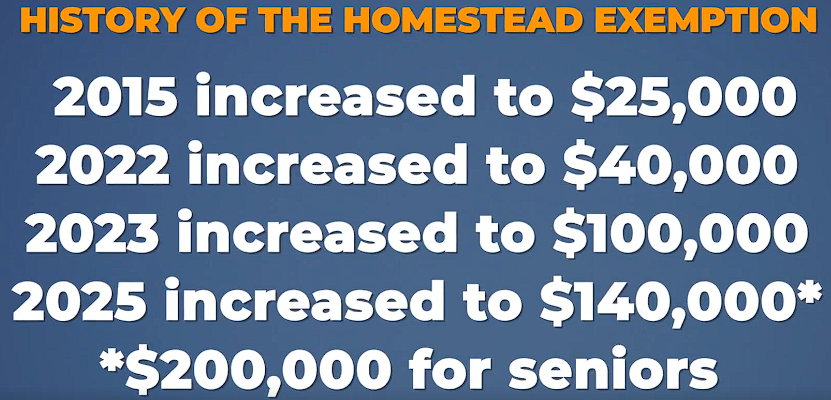

Lt. Gov. Dan Patrick recently released a new property tax relief plan,2 about a month after Gov. Greg Abbott released his own plan.3 In his plan, Patrick intends to rely on the homestead exemption as the primary means of providing property tax relief. As Patrick’s graphic above shows, the state has been doing this for the last ten years, particularly since 2022. The cost to Texas taxpayers for increasing the homestead exemption since 2022, according to the Texas Legislative Budget Board,4 has been $12.5 billion.

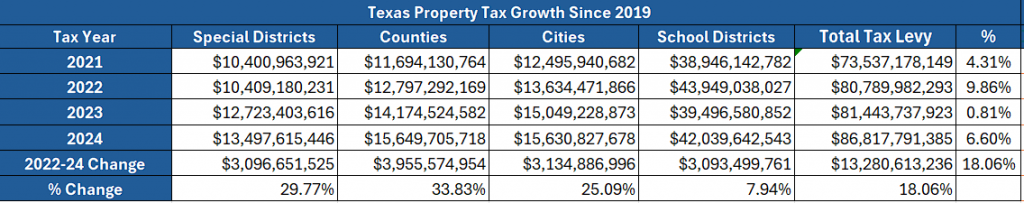

So what has happened to property taxes as the Legislature has focused on increasing the homestead exemption? Total property tax revenue has increased $13.3 billion, up 18% over the three property tax years (2022, 2023, and 2024) during this time. In other words, Texas state taxpayers have paid $12.5 billion for increased spending on public education so that taxes on Texas property owners could increase by “only” $13.3 billion. This does not fit the definition of what most Texans would call property tax relief.

Why has this happened? First, all property taxes are local, therefore, only local governments–not the state–can raise or lower our property taxes. Therefore, when the state increases the homestead exemption in the name of property tax relief, what they are really doing is sending state tax dollars to school districts to make up for the schools lost revenue. None of the money goes directly to property tax relief.

The increase in the homestead exemption would reduce property taxes if all other property taxes remained the same. But they do not. Instead, counties, cities, special districts AND school districts increase property taxes at the same time. The Legislature could have stopped them from doing this, but they did not. There are some restrictions on increases in place, but they are riddled with loopholes. That is why, for instance, county and city property taxes have increased on average by 9% annually over the last three years even though they are supposedly limited to a 3.5% increase.

Patrick’s plan does call for “rein[ing] in local government spending while allowing for reasonable growth.” The problem with this is that limits on government spending do not limit property tax increases. Then there is also the question of who gets to define “reasonable growth;” recent history suggests it will not be taxpayers. A much better option is Gov. Abbott’s plan to “require two-thirds voter approval for tax increases.” If a school, city, county, or special district wants to increase its property tax revenue in a given year, they have to ask the voters for permission to do so. And unless they can convince two-thirds of the voters to say yes, property taxes will stay the same.

This is the third article in a series setting the record straight on property tax misinformation.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!

- https://x.com/DanPatrick/status/1998512077091090576?s=20 ↩︎

- https://x.com/DanPatrick/status/1998512077091090576?s=20 ↩︎

- https://www.gregabbott.com/governor-abbott-announces-bid-for-re-election-in-houston/ ↩︎

- https://excellentthought.substack.com/p/did-the-texas-legislature-really?utm_source=publication-search ↩︎