“The State of Texas is Staying Within Reasonable Spending Limits”

“We have to find a way to allow people to stay in their homes. I think it’s totally reasonable to have our taxing entities doing exactly what the state of Texas is already doing — staying within reasonable limits.”

– Texas State Rep. Ellen Troxclair1

In our first paper in this series, we solidly established that state of Texas spending growth does not stay within “reasonable limits.” But to expand on that, let us examine the growth of Texas government over the last three legislative sessions.

| Total Appropriations of State Funds by Legislative Session | ||||

| 2021 | 2023 | 2025 | Total | |

| Appropriation | $162,302,300,000 | $225,553,000,000 | $251,275,429,527 | |

| $ Increase | $63,250,700,000 | $25,722,429,527 | $88,973,129,527 | |

| % Increase | 38.97% | 11.40% | 54.82% | |

Total biennial (two-year) appropriations of state funds per session for 2021, 2023, and 2025 have risen from $162.3 billion to $251.3 billion. That is an $89 billion, 54.8% increase. That means the annual growth of Texas’ biennial appropriations is 15.5%.

I suspect that most taxpayers whose taxes are paying for this growth would not see it as reasonable. Thus, as we attempt to decide what reasonable limits for local taxing entities might look like, let’s review current limits on state spending growth that are clearly unreasonable.

First, the limit on state spending that has allowed the 15.5% annual growth of appropriations is population growth plus inflation. The 15.5% growth is actually higher than population growth plus inflation, but the limit has allowed that much growth because of budget gimmicks and loopholes2 that allow the Legislature to ignore it.

Still, even without these, a limit based on population growth plus inflation would be unreasonable because it is based on the false premise that government spending needs to increase. Much less increase as fast as population growth and inflation.

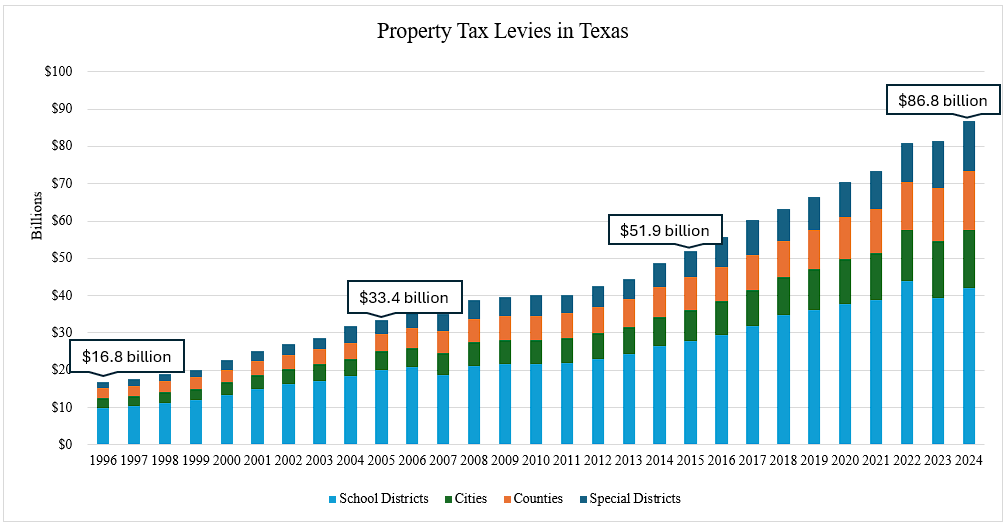

Next, there is already an annual property tax growth limit on counties and cities. This limit is also unreasonable because despite the 3.5% annual limit, city, county, and school taxes have increased by 7.8% annually since 2018. This has happened because, again, the limit is full of loopholes. The chart shows property tax growth is not a recent phenomenon; it has been growing and growing for decades.

So what would be a “reasonable limit” to place on local government? That is a great question, and we will get to it in our next paper.

This is the fourth article in a series setting the record straight on property tax misinformation.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!