“Local Jurisdictions Come from Behind Our Backs and Raise Property Taxes”

“Every time we use billions of dollars to buy down your property tax rates at the local level, local jurisdictions come from behind our backs and raise those property taxes.”

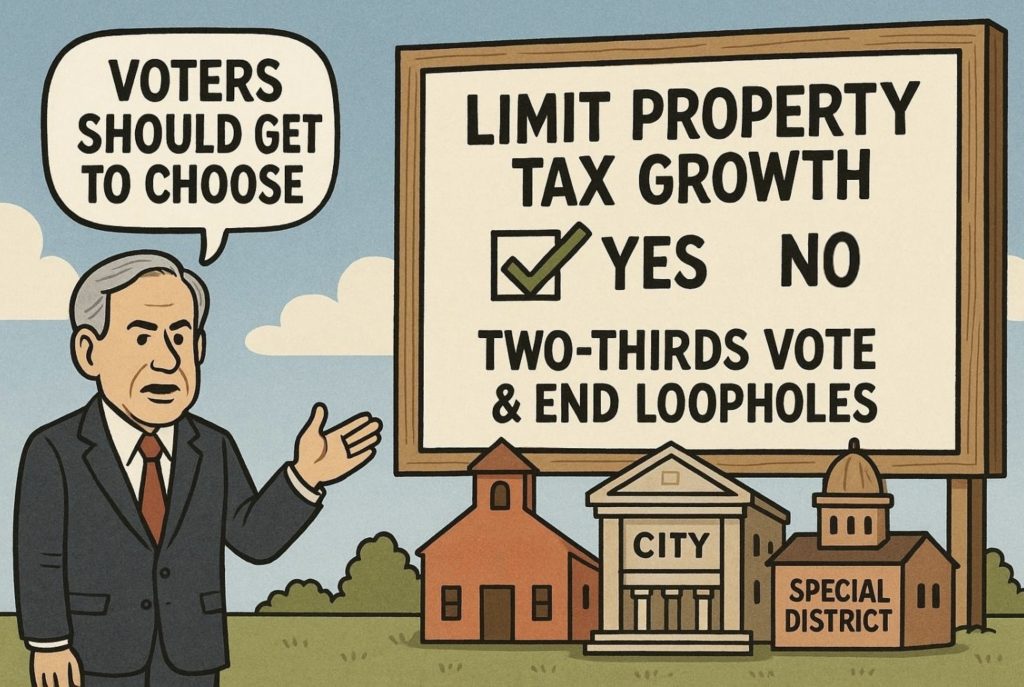

– Gov. Greg Abbott1

Gov. Abbott is right when he says local governments–schools, cities, counties, and special districts have been undermining the Legislature’s effort to lower property taxes. The problem is that this is not happening behind their backs; the governor, lieutenant governor, and legislators know that the local governments have been doing this for years and have done little to stop it.

Instead, they have started complaining they are tired of providing property tax relief,2 that doing so is “too big of a commitment,” and they wonder “how in the heck are we going to pay for this going forward?”

A possible reason for their inaction is that many Texas politicians likely do not want to lower property taxes because they believe government spending needs to increase. This means Texans have a lot of work to do to convince a majority of legislators to vote to reduce or eliminate our property taxes. Before we get to that, though, we need to stop the runaway growth of property taxes. The question is, how do we do that?

I believe Gov. Abbott came up with a simple, yet elegant solution for slowing or stopping local property tax increases in the six-point plan he announced in November. He would “require two-thirds voter approval for tax increases.” If a school, city, county, or special district wants to increase its property tax revenue in a given year, by any amount, they would have to ask the voters for permission to do so. And two-thirds of the voters will have to say yes. Crucially, however, all the loopholes that allow for growth beyond the limit would have to be eliminated as well.

This one step is all it will take to stop the ever-increasing burden of property taxes on homeowners, renters, and businesses. And if local governments believe they need more revenue from property taxes, all they have to do is convince voters that higher taxes are a good idea.

This is the fifth article in a series setting the record straight on property tax misinformation.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!