“Sometimes I Think That Property Tax Relief Actually Hurts People”

“Sometimes I think that the result of this tax policy actually hurts people. In the instance of San Antonio, we [would] have the potential to actually lose jobs and major economic development should our tax spending policy change at the local level.“

– Texas State Rep. Trey Martinez Fischer1

Rep. Martinez Fischer is not alone in his belief that government spending drives economic growth. Plenty of other Texas politicians–Democrats and Republicans–believe this as well. But they are fundamentally wrong. Economic growth comes from entrepreneurs and investors risking their own capital building ventures that make a profit through meeting consumer needs. The more capital entrepreneurs and investors have available to invest and the more capital consumers have to make purchases, the more the economy will grow.

It is when governments intervene in this process through higher regulation, taxes, and spending that economic growth falters. And as we have already seen in previous papers, both the state and local governments are doing their fair share of intervening. If we want economic growth to increase and Texans to get better, higher-paying jobs, Texas politicians need to start practicing fiscal discipline. This also happens to be the only way to eliminate property taxes.

In other words, reducing or eliminating property taxes–which currently bring in $86 billion a year–will require a willingness to spend less money on other things.

Fortunately, this can be done in fairly short order. The concept is simple. Every year, Texas state tax revenue increases on average by about 5.5%. Applying the average to 2025, that would produce a surplus of about $4.6 billion. Instead of spending that money on subsidies for energy and water companies, Hollywood filmmakers, and more state employees, the money could be used to reduce property taxes. If done in conjunction with Abbott’s two-thirds voter approval and a freeze of school property taxes, we could entirely eliminate school maintenance and operations taxes (about 40% of property taxes across the state) in 5 to 6 years.

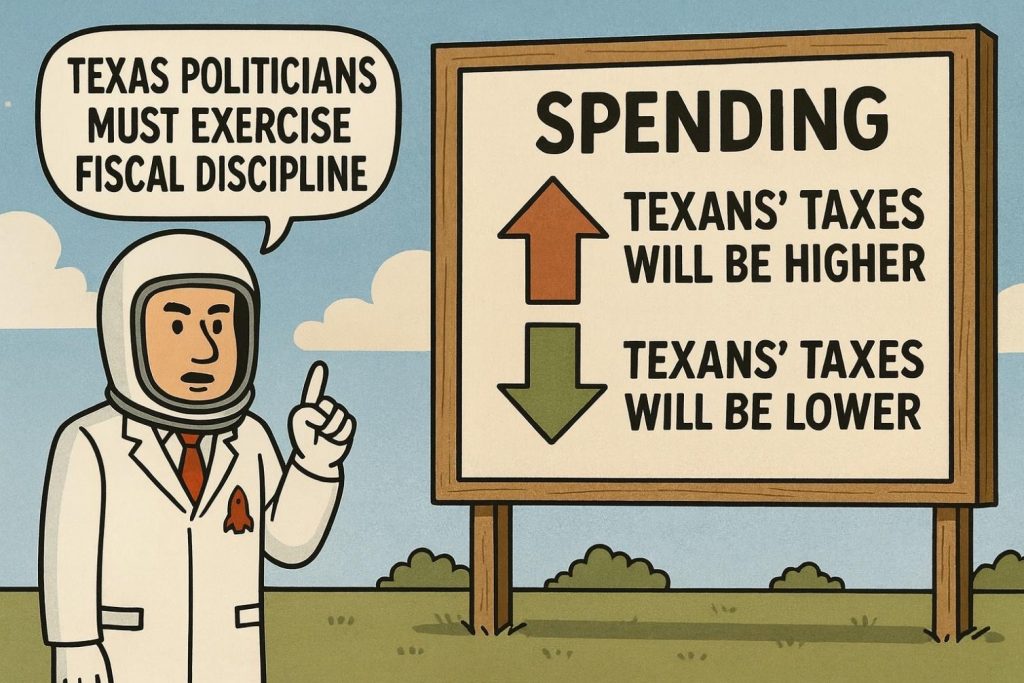

None of this is rocket science. If our state and local governments spend less, our taxes will be lower. If they spend more, our taxes will be higher.

If we want to lower or eliminate property taxes, fiscal discipline is required.

This is the sixth and final article in a series setting the record straight on property tax misinformation.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!

- https://communityimpact.com/austin/south-central-austin/texas-legislature/2025/11/26/kind-of-maxed-out-texas-lawmakers-question-whether-state-can-afford-to-fund-larger-property-tax-breaks/ ↩︎