On Thursday, the Texas House of Representatives considered House Bill 5 (HB 5), or what was dubbed the “Texas Jobs and Security Act” by both the legislation’s author, Republican State Rep. Todd Hunter (Corpus Christi), and Texas House Speaker Dade Phelan (R-Beaumont).

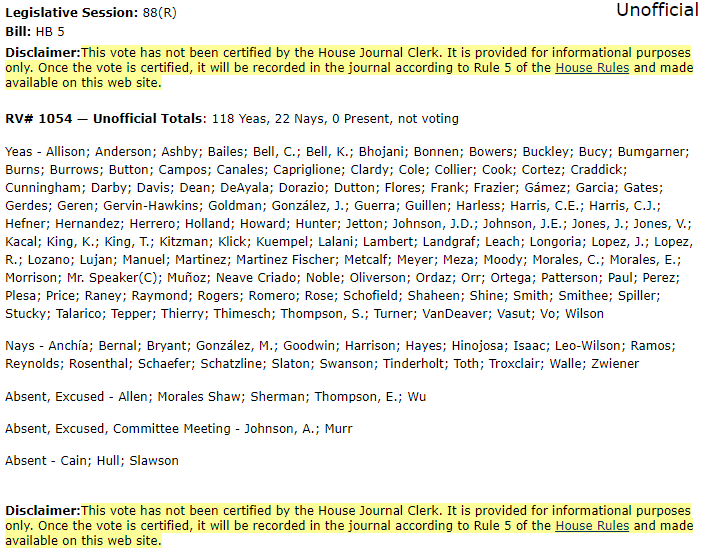

After several hours of questions, amendment attempts, and points of order, the legislation passed its initial hurdle by a vote of 118-22 (list seen below). It will be considered for a final time on Friday.

Notable Amendment Efforts

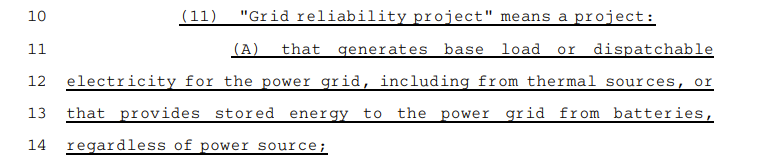

Ahead of the deliberations on HB 5, it was pointed out that though the author and supporters previously claimed that renewable energy was not included in the legislation as projects that would qualify for an abatement, language surrounding battery storage projects is included, leaving doubt about what sort of energy projects would use such storage.

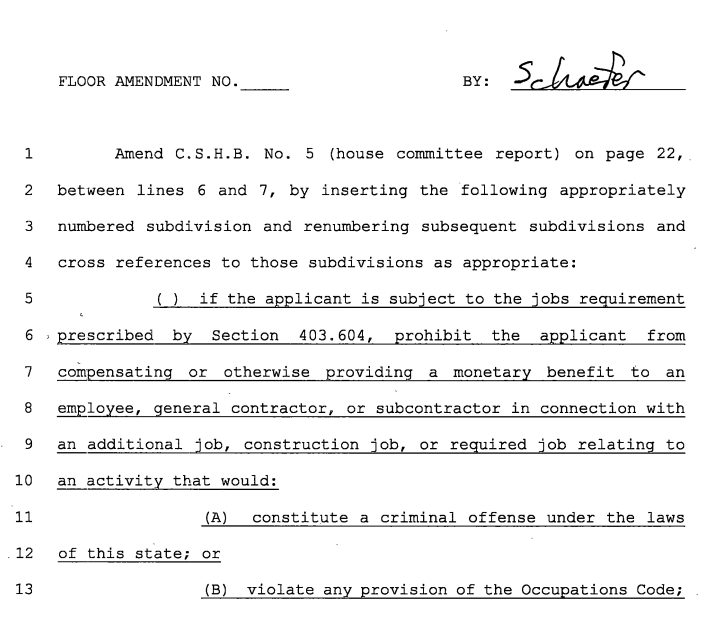

In response, Republican State Rep. Matt Schaefer (Tyler), who also happens to be chairman of the Texas Freedom Caucus, authored an amendment that sought to ensure that only thermal energy sources would be included.

Initially, the amendment was successfully adopted, having the purported blessing of the author. A few moments later, however, Republican State Rep. Hugh Shine (Temple), who was aiding the author in fielding questions and explaining the mechanics of the legislation, made a parliamentary motion to reconsider the amendment.

There was objection, so a division vote ensued (meaning there is no record vote), and the motion prevailed. Shortly after, Hunter got up to speak in opposition to the amendment, requesting he take it down, citing “previous agreements having been made.” Schaefer responded by saying he “was not aware of any agreements” that were previously made regarding amendments to the legislation and chose not take the amendment down, moving passage. The amendment failed to adopt by a vote of only 20 in support and 107 in opposition.

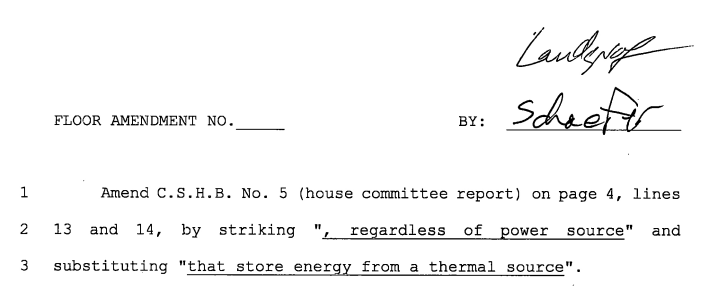

Republican State Rep. Brian Harrison (Midlothian) authored an amendment, but Republican State Rep. Ken King (Canadian) subjected it to a point of order before Harrison could explain it to the full House. The amendment would have required that a school district could only approve of a property tax abatement application if in the preceding year the district used at least 50 percent of its maintenance and operations (M&O) to pay for the salaries of classroom teachers. The point of order on Harrison’s amendment was sustained by Speaker Phelan, ending the amendment’s prospects.

Democrat State Rep. Donna Howard (Austin) offered an amendment that changed the proposed sunset provision in the legislation from the year 2036 to the year 2033, meaning that the new corporate welfare program, if it becomes law, would be up for renewal by the Texas Legislature again in 2033. The amendment was acceptable to the author and was successfully adopted.

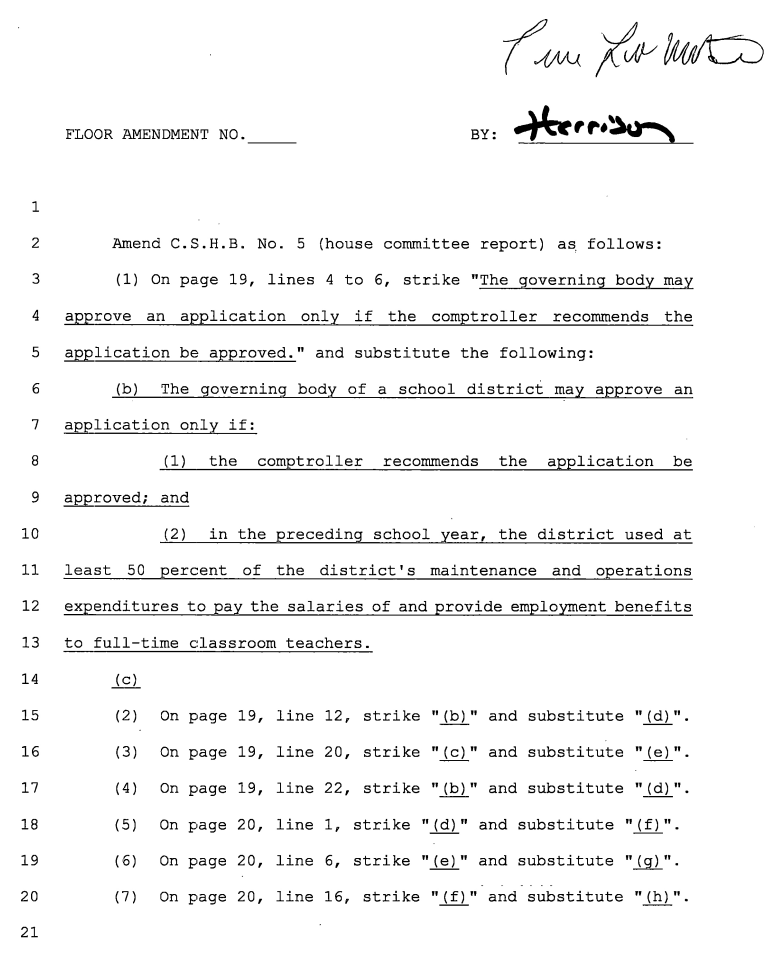

Republican State Rep. Terry Wilson (Georgetown) offered a unique amendment aimed at ensuring that after the abatement rolls off at 10 years, the improvements built on the property that was abated be included in the school district’s revenue calculation, meaning that the M&O is compressed further. The amendment was successful, passing unanimously.

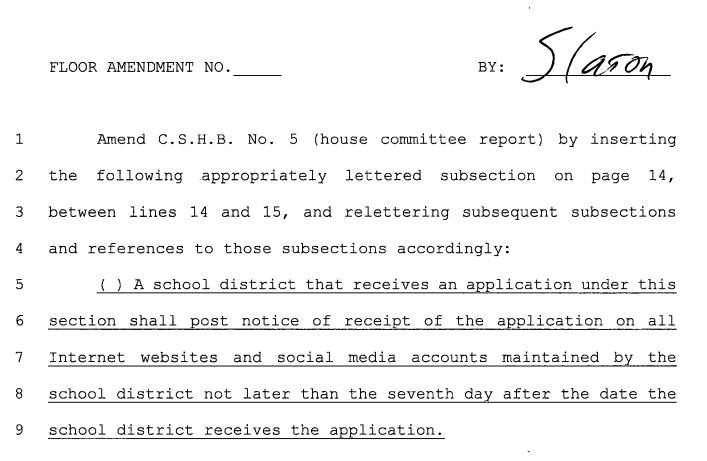

State Rep. Bryan Slaton (R-Royse City) offered an amendment seeking to bring additional transparency to the process. As proposed, the amendment sought to require that any school district that receives an application for a property tax abatement under HB 5 would be required to post notice of receipt of that application on all websites and social media accounts maintained by the school district no later than seven days after receiving the application.

The amendment was unsuccessful and failed by a vote with only eight lawmakers in support. Those eight included Slaton and Briscoe Cain (R-Deer Park), Mark Dorazio (R-San Antonio), Carrie Isaac (R-Wimberley), Terri Leo-Wilson (R-Galveston), Ana-Maria Ramos (D-Richardson), Matt Schaefer (R-Tyler), and Tony Tinderholt (R-Arlington). In total, 124 lawmakers voted against the Slaton amendment (seen below).

Schaefer offered another amendment that was initially adopted by a vote of 109-24, only to later be subjected to a successful motion to reconsider. The amendment would have prevented companies receiving the abatements from also financing things like gender mutilation procedures or abortions. Almost as soon as the motion to reconsider succeeded, a point of order was called by Democrat State Rep. Erin Zwiener (Driftwood). Speaker Phelan sustained the point of order on the grounds that the amendment was not germane to the overall provisions of HB 5.

Notable Supporters

The effort to renew the now-defunct Chapter 313 tax abatement program in the previous legislative session was unsuccessful largely due to bipartisan opposition. Two pieces of legislation were initially considered.

One would have extended the program by an additional 10 years, but it was defeated in the House of Representatives. The other sought to extend the program by an additional 2 years and narrowly passed the House. It passed the Senate Committee on Natural Resources & Economic Development before ultimately having its legislative prospects ended by Texas Lt. Gov. Dan Patrick, who never set it for consideration by the overall Senate.

The program ended officially at the end of 2022.

In the lead-up to this legislative session, leadership in the Texas House of Representatives (including Speaker Phelan and his lieutenants) made it known they were working on a revival.

The following lawmakers who were opposed to the now-defunct Chapter 313 tax abatement renewal, presumably on the basis that it included renewables, voted in favor of HB 5:

- Republican State Reps. Giovanni Capriglione (Southlake), David Cook (Mansfield), Gary Gates (Richmond), Sam Harless (Spring), Cole Hefner (Mount Pleasant), Justin Holland (Heath), Brooks Landgraf (Odessa), Jeff Leach (Allen), Candy Noble (Lucas), Tom Oliverson (Cypress), Jared Patterson (Frisco), Matt Shaheen (Plano), Reggie Smith (Van Alstyne), David Spiller (Jacksboro), and Terry Wilson (Georgetown).

- Democrat State Rep. Bobby Guerra (Mission).

The unofficial vote count for HB 5 on its initial reading can be seen below:

HB 5 passed its initial reading despite both major political parties in Texas having explicit opposition to such corporate welfare.

The Texas GOP platform states:

“Plank 94: Property Tax Abatements: We support repealing Tax Code Chapter 312 county and municipal property tax abatements, and we oppose reintroducing school property tax abatements, formerly known as Chapter 313.”

The Texas Democratic Party platform states:

“Eliminate tax loopholes and unproductive special breaks to simplify the tax system and provide revenue for essential services.”

That same platform continues:

“Prohibit ‘corporate welfare’ incentives that pit states and communities against each other.”

Also of note was the Texas Freedom Caucus’ declared opposition to HB 5 (seen below). Upon HB 5’s initial passage, three members of the caucus voted in favor of the proposal: Republican State Reps. Gary Gates (Richmond), Matt Shaheen (Plano), and Cody Vasut (Angleton). Oddly, Richard Hayes (R-Hickory Creek), who was signed on as an author of HB 5, voted against the proposal.

What Is Next?

The legislation will be considered one final time on Friday, when it will presumably pass along a similar vote margin. Afterward, it will head to the upper legislative chamber, where its prospects are less clear.

Both Lt. Gov. Patrick and Texas Gov. Greg Abbott previously expressed concerns about the inclusion of renewables in any would-be revival effort. After today’s deliberations on HB 5, the inclusion of renewables still seems to remain cloudy and left up to interpretation.

Regardless, taxpayers bore witness Thursday to House lawmakers’ support for the revival of a corporate welfare program that will only continue to support large multinational corporations at their own expense, shifting the property tax burden upon their backs. It is a sad day for Texas taxpayers. Texas has a lengthy history with regard to corporate handouts.

Concerned taxpayers may contact their lawmakers here.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!