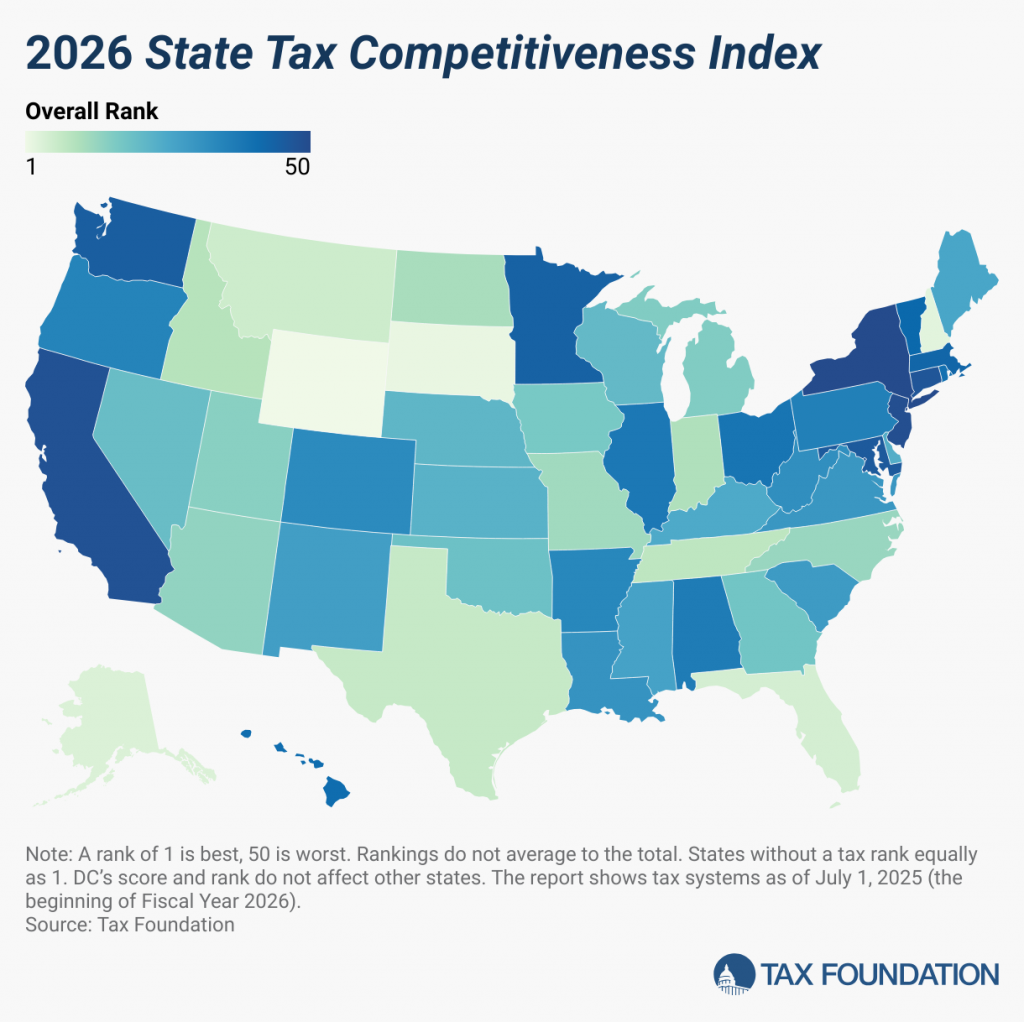

The new Tax Foundation rankings reveal which states are creating opportunity — and which are driving taxpayers away.

How do states compare in taxes?

Jared Walczak just co-authored the Tax Foundation’s 2026 State Tax Competitiveness Index, and the message is clear: tax competition matters! But spending is to blame for high taxes.

States with simple, broad-based, and low tax systems are winning. Those that cling to complex, high-rate, carveout-laden tax codes are falling behind. In short, the states that trust people to prosper are leading America’s economic race.

At the top of the 2026 rankings are Wyoming (#1), South Dakota (#2), and New Hampshire (#3) — all notable for not taxing individual income.

At the bottom: New York (#50), New Jersey (#49), and California (#48), where excessive taxes drive people and businesses away.

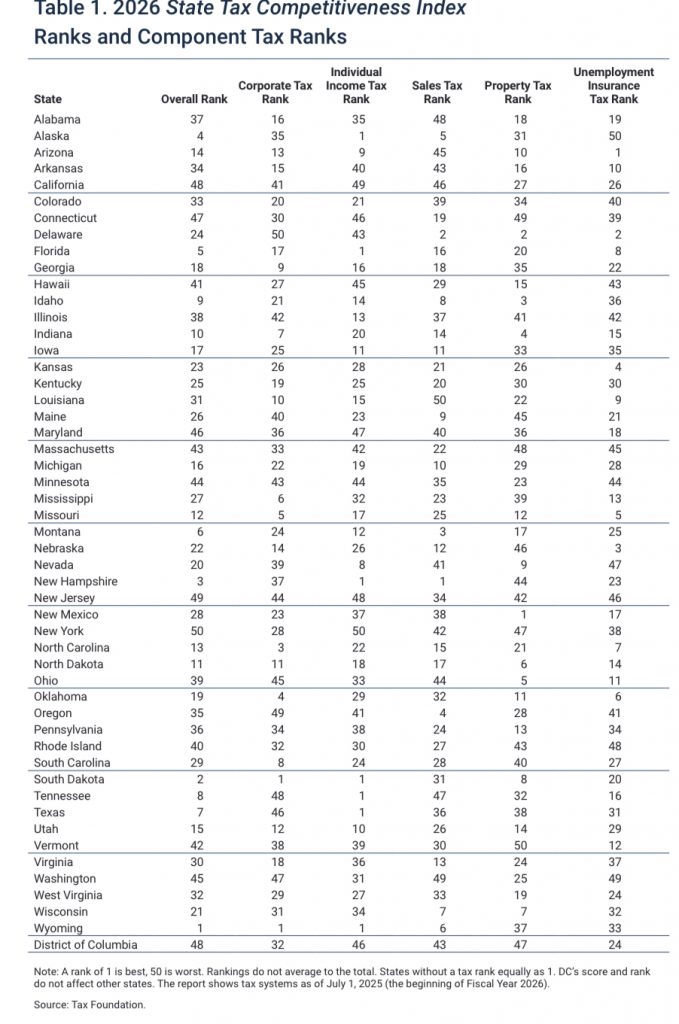

Texas, with its strong no-income-tax model, ranked #7 overall, just below Montana (#6). Property taxes in Texas, however, remain an anchor on competitiveness — ranked 38th among the states. Anyone who’s tried to buy a home in Austin or Dallas knows the frustration: it’s not freedom if you’re effectively renting your home from the government through endless tax bills.

What Makes a State Competitive?

The Index evaluates five major areas of each state’s tax structure:

- Corporate income tax

- Individual income tax

- Sales tax

- Property tax

- Unemployment insurance tax

The key isn’t just how much a state collects — it’s how it collects it. A competitive tax code should be neutral, simple, and predictable, encouraging investment and innovation rather than penalizing growth or distorting decisions.

The top-ranked states tend to either lack one or more major taxes or maintain flat, broad-based, low-rate systems. The bottom-ranked states suffer from complexity, narrow bases, and punitive rates that erode opportunity and fiscal health.

Texas and the Path Forward

Texas earns high marks for having no personal income tax, but its property tax burden — ranking 38th nationwide — reveals a major policy challenge. The problem isn’t valuation; it’s spending. Local government growth has outpaced population growth plus inflation for decades, fueling tax hikes even amid record state surpluses.

As I’ve emphasized across my writings and policy work with multiple states, sustainable reform requires spending restraint first. By limiting spending growth to less than population plus inflation and using surplus funds to buy down school district property tax rates, Texas can move toward phasing out property taxes altogether — responsibly and permanently.

This isn’t a radical idea. It’s the next frontier of fiscal reform — one that would strengthen property rights, make homeownership attainable, and ensure long-term prosperity.

The National Picture

These rankings are more than bragging rights; they map the economic migration of the 21st century.

- Florida and Tennessee continue to attract families and businesses with growth-friendly tax climates.

- California, New York, and New Jersey are losing hundreds of thousands of residents each year.

- The gap between top and bottom states is widening, and not because of weather — it’s because of policy.

People vote with their feet, and the data prove they’re moving toward economic freedom, not away from it.

The Bottom Line

Tax competition works because it’s rooted in human nature. When people are free to choose, governments must compete for them — not exploit them.

The states embracing that truth are building durable prosperity. Those ignoring it are doubling down on failure.

If policymakers want a blueprint for growth, it’s simple: limit spending, simplify taxes, and trust people — not politicians — with their money.

That’s how to let people prosper.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!