Recently the groundswell of conservative voices demanding property tax elimination has reached all-time highs. The last two special sessions have not delivered the results for property tax relief that taxpayers have demanded. Property taxes have risen more than 181% in the last 20 years for Texas homeowners, and it seems like they will continue to rise if nothing is done about it. Abbott added property taxes to his agenda items for the 2nd called special legislative session and seemed to hear the demand from Texans that something needs to be done.

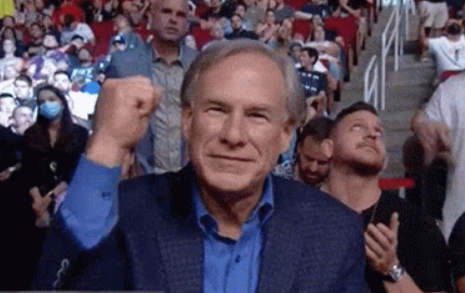

TFR and other fiscal organizations have been advocating to use the $7.85 billion surplus as well as dedicating future surpluses to paying down M&O compression rates until they are eliminated. This was made possible by the recent passage of a spending limit bill passed during the 87th legislative session. There was a bill filed in the 2nd called special session by Tom Oliverson (R-Cypress) that would have done just this. HB 122 dedicated 90% of reoccurring surplus revenues to pay down M&O compression rates until they reached zero. This was a bill with a true path to elimination. However, the House decided to ignore that bill in favor of tax carve-outs (SB 12) and a minor homestead exemption extension (SB 8). After signing these two bills into law Governor Abbott declared that he had given property tax relief to Texans and celebrated.

The problem is that we didn’t get property tax relief. Texans are still demanding the elimination of property taxes, or at minimum, significant tax relief. Knowing this, it was a surprise to TFR when Abbott called the 3rd special session and left property tax relief off of his agenda items list. He instead put leashing restrictions for dog owners as an agenda item. With this move, the Governor made it clear that he prioritizes criminalizing dog owners above helping homeowners drowning in property tax burdens.

Speaker Phelan and Lt Gov Dan Patrick have acknowledged that property tax relief needs to be dealt with and both have added it to their priorities for the 3rd special session. Sadly, both have put their influence behind SB 1 with is identical to SB 91 from the second called special session. SB 91 was passed by the Senate during the 2nd called special session but never made it to the House. SB 1 provides temporary relief by using a one-time payment of $2 billion dollars to buy down M&O compression rates. According to the bill analysis, this would result in a 6.6 penny decrease in M&O compression rates for taxpayers. In plain English, this would mean roughly $200 off your tax bill if you own a $300k house according to Paul Bettencourt’s (R-Houston) statement of intent.

Not exactly the significant relief you were hoping for is it? It feels as though property tax relief is getting the usual “minimum effective dose” again in hopes it will appease voters enough to get politicians through a crowded primary season. It is up to taxpayers to demand that more is done. Patching the leak with a one-time payment and no plan for elimination in the future is not an acceptable solution to our property tax problem. Taxpayers deserve a bill that would put into statute a path toward property tax elimination, a plan that TFR has been advocating for months.

A bill like HB 122 would be a good start, Tom Oliverson has filed an identical bill in the 3rd called special session (HB 90). TFR again will be supporting this bill as the only one with a real path to elimination. Will Abbott add property tax relief to his agenda items? Will HB 90 be ignored again in favor of weaker legislation? There is not much time to get this done, taxpayers who are concerned about rising property taxes should call and let their legislators know they demand a permanent solution, not a quick patch.