In response to our article defining the correlation between inflation and interest rates, TFR has been asked by many subscribers to explain the system that makes this possible.

What is fractional reserve banking?

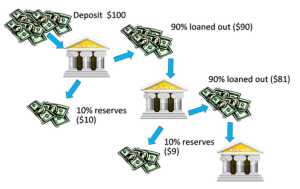

Fractional reserve banking is a system of banking that requires banking institutions to keep a portion of deposits as reserves. Banks then use these deposits to make new loans, making the banks intermediaries between borrowers and savers. This process allows them to create new money through loans and interest using savers deposits and it provides liquidity to savers that want to withdraw their money. This system was implemented around the time of the Great Depression in response to bank runs caused by depositors making withdrawals all at the same time. The Federal Reserve sets the reserve requirement which has traditionally been 10%. So if you make a $1000 deposit, the bank can lend out $900 but has to keep $100 in reserve.

The original concept of fractional reserve currency was invented in the gold trading era. Consumers would deposit gold or silver coins with goldsmiths and they would, in turn, receive a promissory note. These notes eventually became currency and were used in corporate transactions. The goldsmiths soon realized that not all depositors would withdraw their funds simultaneously due to the notes being used in trade, and in response, they started using the gold deposits to create loans.

This led to the goldsmiths becoming interest-earning banks. When consumers lost faith in these banks they would run on their deposits causing the bank to become insolvent. This led to the first governments creating laws to regulate banks, Sweeden establishing the first central bank in 1668 with the power to set reserves, regulate commercial banks, and be a fail-safe for consumers that fell victims to insolvent banks.

Banks in the modern-day US must keep their reserves in their vault or at the nearest Federal Reserve Bank. As said previously, the reserve requirement has been 10%, however, something remarkable happened in March 2020 when the Federal Reserve announced it had changed the reserve requirement to ZERO. This has allowed banks to lend as much money as they want with no reserve, and as of January 2022, this reserve requirement is still in effect.