The Federal Reserve holds interest rates at current levels, but the future outlook is more uncertain.

At their September meeting held last week, The Federal Reserve’s “Federal Open Markets Committee” (FOMC) declined to increase Federal Funds Interest Rates further and held the interest rates at their current 5.25-5.50% level.

While many economists expected the Federal Reserve to keep rates steady for the time being, there was an unanticipated shift in the Fed’s future outlook.

The Federal Reserve hinted at the possibility of one additional rate hike before the end of 2023, with meeting participants pointing towards a median 5.6% interest rate, which would bring us to a total of twelve rate hikes since hikes began back in March of 2022.

Data released by the Federal Reserve, after the conclusion of its two-day meeting, also points to more restrictive economic and interest rate policies for longer than was previously anticipated. While expectations after their meeting in June had forecasted four total interest rate reductions in 2024, the revised forecasts point to no more than two reductions.

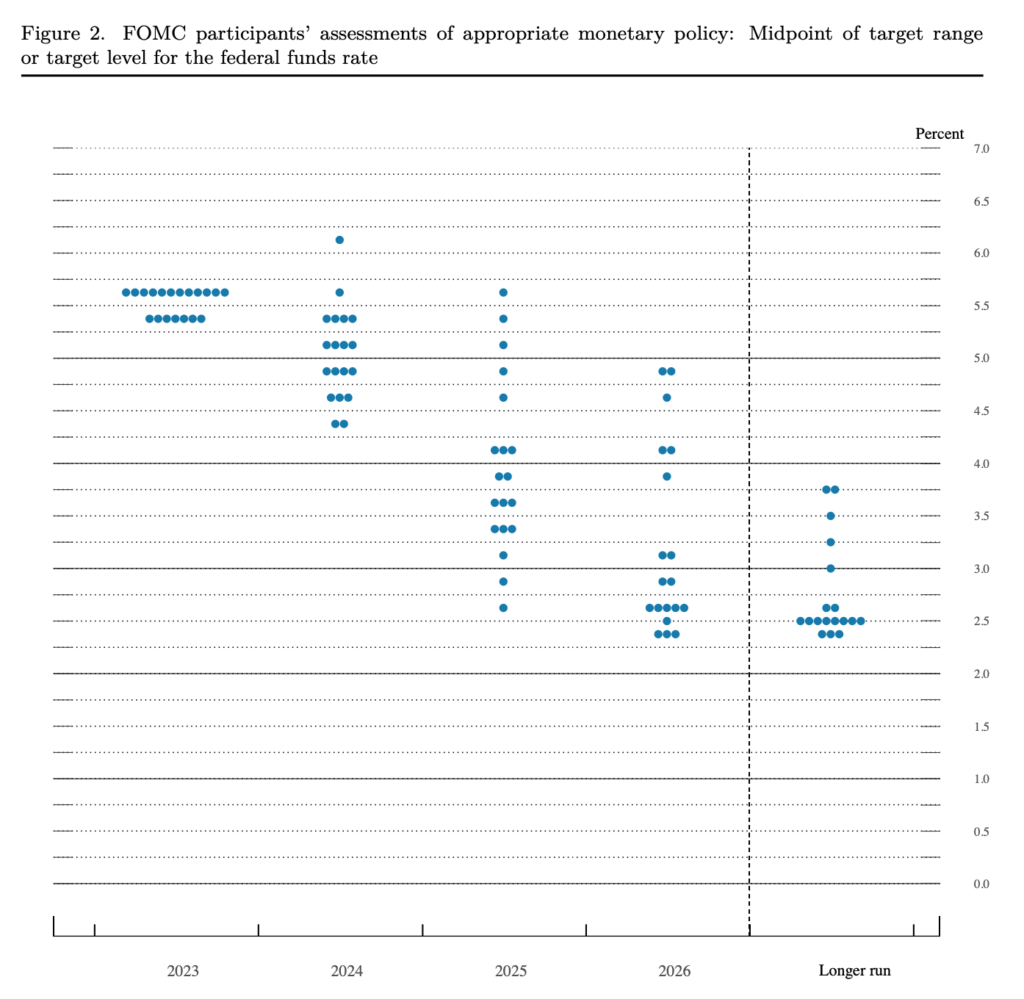

Median interest rates for both 2024 and 2025 were forecasted in the Fed’s “Dot Plot” (see below), which point to median interest rates of 5.1% for 2024, 3.9% for 2025, and 2.9% for 2026, all much higher than the near-zero rates that were seen just eighteen months ago.

Much of this is due to the ongoing concern of inflation, as stated by Federal Reserve Chair Jerome Powell, “We want to see convincing evidence really that we have reached the appropriate level [of inflation], and we’re seeing progress and we welcome that. But, you know, we need to see more progress.”

Inflation continues to remain high and is a major contributor to the continued pain that Americans are feeling in their pocketbooks. July data showed core inflation at 4.2% (excluding food and energy prices) with the all-items index at 3.7 percent for the period ending in August. Both numbers are better than the record highs of 9% just one year ago, but the threat has yet to truly abate.

Additional factors are weighing heavily on the economy, including record deficit spending, $33 trillion in national debt, nationwide bank failures, credit downgrades, over $1 trillion in private credit card debt, and businesses shutting their doors. All of this compounded makes the goal of achieving a “soft landing” (the idea of cooling the economy and bringing down high inflation without a recession) far from assured.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!