State

The Ginn Economic Brief: Texas Economic Situation – March 2024

Overview The U.S. Bureau of Labor Statistics provides Texas’ labor market data to examine how people are doing across the state. Figure 1. Texas Labor Market by Industry Source: U.S. Bureau of Labor Statistics Figure 2: Real Gross Domestic Product…

Voters Give Taxpayer Foes the Boot in Historic Primary Election

TLDR: Taxpayers made their voices heard: “no more backstabbing.” The time has come for many incumbent politicians to pack their bags… Yesterday, the Texas Primary Elections were held, with taxpayer foes across the State being defeated or forced into runoffs,…

New Property Tax Numbers Prove Relief Was Not the Largest in Texas History

Texans are upset that their property tax relief is less than the Texas Legislature promised last year. While Texans for Fiscal Responsibility wrote about how we should expect this outcome, the reporting and claims about this relief were that it…

Impeachment Price Tag: Texas House Spends Millions of Tax Dollars on Impeachment

After months of delay following Lt. Gov. Dan Patrick’s call for a financial audit of the effort to impeach and remove Attorney General (AG) Ken Paxton this year, new revelations about the actual cost to taxpayers surfaced last week. These…

The Surge in Texas Local Debt and Property Tax Implications

Texas’ Local Debt Crisis: Unpacking the $461.3 Billion Burden In a startling revelation, the Texas Public Policy Foundation reported a significant surge in Texas’ local debt, now towering at an unprecedented $461.3 billion as of the fiscal year 2023. This…

The Ginn Economic Brief: Texas Economic Situation – November 2023

Texas lost jobs in October and faces major headwinds with a weak U.S. economy and a poor performance by this year’s 88th Legislature. There is a better way. Free-market capitalism is the best path to let people prosper, as it…

Texas Candidate Filing Begins

Filing to be on the primary ballot in March is open for a thirty-day window. As anticipation for the March primary elections rise, candidate filing to be on the ballot in either party officially began on Saturday, November 11th. Candidates…

Election Results: The Good, the Bad, and the Ugly

Tuesday was election day, and Texans across the State went to the polls to cast their votes on fourteen constitutional amendments, various local propositions, and a scattering of elections for office. Let’s briefly look at the election day results and…

Quick Reference Guide – 2023 Ballot Propositions

Early voting for the 2023 November election is officially underway, and voters across Texas are headed to the polls. This election held on November 7th is focused on fourteen constitutional amendment propositions, many of which will have a significant impact…

The Ginn Economic Brief: Texas Economic Situation – October 2023

Texas has been a leader in job creation. But Texas faces major headwinds as this year’s 88th Legislature has looked more like California than what Texans expect. There is a better way. Free-market capitalism is the best path to let…

Understanding Texas’ Financial Health: Takeaways from a 2023 State Report

Recently, Truth in Accounting (TIA), a fiscal watchdog organization, published a report titled “Financial State of the States 2023” shedding light on the perceived fiscal health of all 50 states in the United States based on key factors. According to…

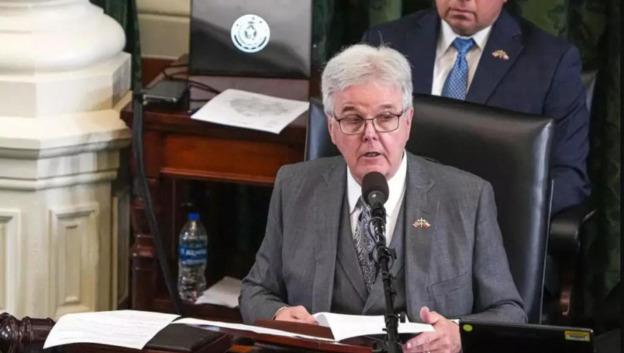

Comptroller Says Texas is Taking Too Much of Your Money

The State’s metaphorical piggy bank continues to fill up with surplus dollars from your wallet, says the Texas Comptroller. Last Friday, Texas Comptroller Glenn Hegar released the Certification Revenue Estimate(CRE) for the fiscal 2024-25 biennium. The CRE revises estimates from…

EXPLAINER: The Basics of How to Engage with the Legislature

The Texas State Legislature meets for its Constitutionally-required regular session once every odd-numbered year for 140 days from roughly mid-January to the end of May. The Governor can call additional special sessions of thirty days at any point outside of…

Property Tax Bills About to Hit Mailboxes

It is that time of year again! When Texas taxpayers are reminded that they, in fact, do NOT own their homes, but rather pay perpetual rent to the government via the property tax. That’s right, soon property tax bills will…

Dan Patrick Demands Audit on Failed House Impeachment Attempt

After this exciting weekend, there is no doubt that you have heard that the Texas House Board of Managers’ attempt to impeach Texas Attorney General Ken Paxton has failed. On Saturday Paxton was acquitted on all charges and able to…