Saturday marked election day across the state for a whole host of ballot propositions, including over 200 bond proposals from various local governmental jurisdictions.

A total of $18.5 billion of proposed spending was considered by Texas voters and after reviewing the results, it appears that many Texas taxpayers might find themselves confused over what many of the bond proposals actually do.

Despite overwhelmingly supporting two statewide ballot propositions that would provide purported property tax relief to Texas taxpayers in the same election, many of those same taxpayers voted in favor of bond proposals that are funded primarily by their own property taxes, including some that will undoubtedly work to increase that same tax burden.

It’s absurd but perhaps lends credence to arguments in favor of things like the need for uniform election dates, a review of how the bond elections themselves are administered, and a review of the language used on the ballot which can oftentimes be found confusing to voters themselves.

Property Tax-Backed Bonds

Bonds are ultimately certificates of debt issued by a governmental entity to finance projects with the promise to repay the borrowed money at a fixed rate of interest in the future. Put another way, it is debt, financed on the backs of future taxpayers and their own future prosperity.

In this election, a dozen Texas cities proposed a combined $2.3 billion in bonds and over 100 Texas school districts proposed a combined $16 billion in bonds.

The largest municipal bond proposal package was from the City of San Antonio, totaling $1.2 billion ($1.8 billion when interest is factored in). It included 6 proposals, all of which were approved by San Antonio voters. The city maintained that it had no ‘planned’ increase in the property tax rate. San Antonio boasted about $1,237 of debt per capita as of 2020.

Similarly, the City of Fort Worth included 5 bond propositions in its package totaling $560 million ($845 million when interest is factored in). Propositions A through E all passed with nearly 60% support. Fort Worth Mayor Mattie Parker maintained that the bonds would not impact the tax rate. Fort Worth had about $824 of debt per capita as of 2020.

The largest school district bond package, promoted by Forney ISD, amounted to nearly $1.3 billion and passed with nearly 65% support. In 2020, Forney ISD had an enrollment of slightly less than 12,000 students and a debt per capita of about $7,748.

Some bond packages were in fact defeated, but en masse, most passed with solid majorities.

Bond Transparency and Rules

In 2019, the Texas Legislature passed House Bill 3, a school finance overhaul, and Senate Bill 2, property tax reform. Among the provisions included in the legislation was one that required school bond propositions to clearly state on the ballot the words “THIS IS A PROPERTY TAX INCREASE” for bond propositions that qualify. Similarly, if local jurisdictions must now seek the approval of voters if they intend to raise the tax rate above 2.5% for school districts and 3.5% for cities and counties.

The problem? Some local officials claimed that the proposed bonds would not raise taxes because there was no ‘current’ plan for the school district to actually increase its property tax rate, a rate that is reset annually. It is misleading, likely intentionally. School districts for instance can always raise future tax rates.

There is a litany of other issues with this as well. Local jurisdictions are almost assuredly relying on continued trends of growing populations in their jurisdictions. For instance, relying on growing property appraisals in larger urban areas, amounting to higher collections.

A few weeks ago, the Texas Senate Committee on Local Government convened an interim hearing to discuss bond elections and ballot language, items listed as interim charges by Texas Lt. Gov. Dan Patrick for the committee to study in preparation for the next legislative session, slated for January 2023. The Texas House of Representatives, by comparison, has no such interim charge.

This election was full of several examples of confusing messaging used by proponents of such bond proposals.

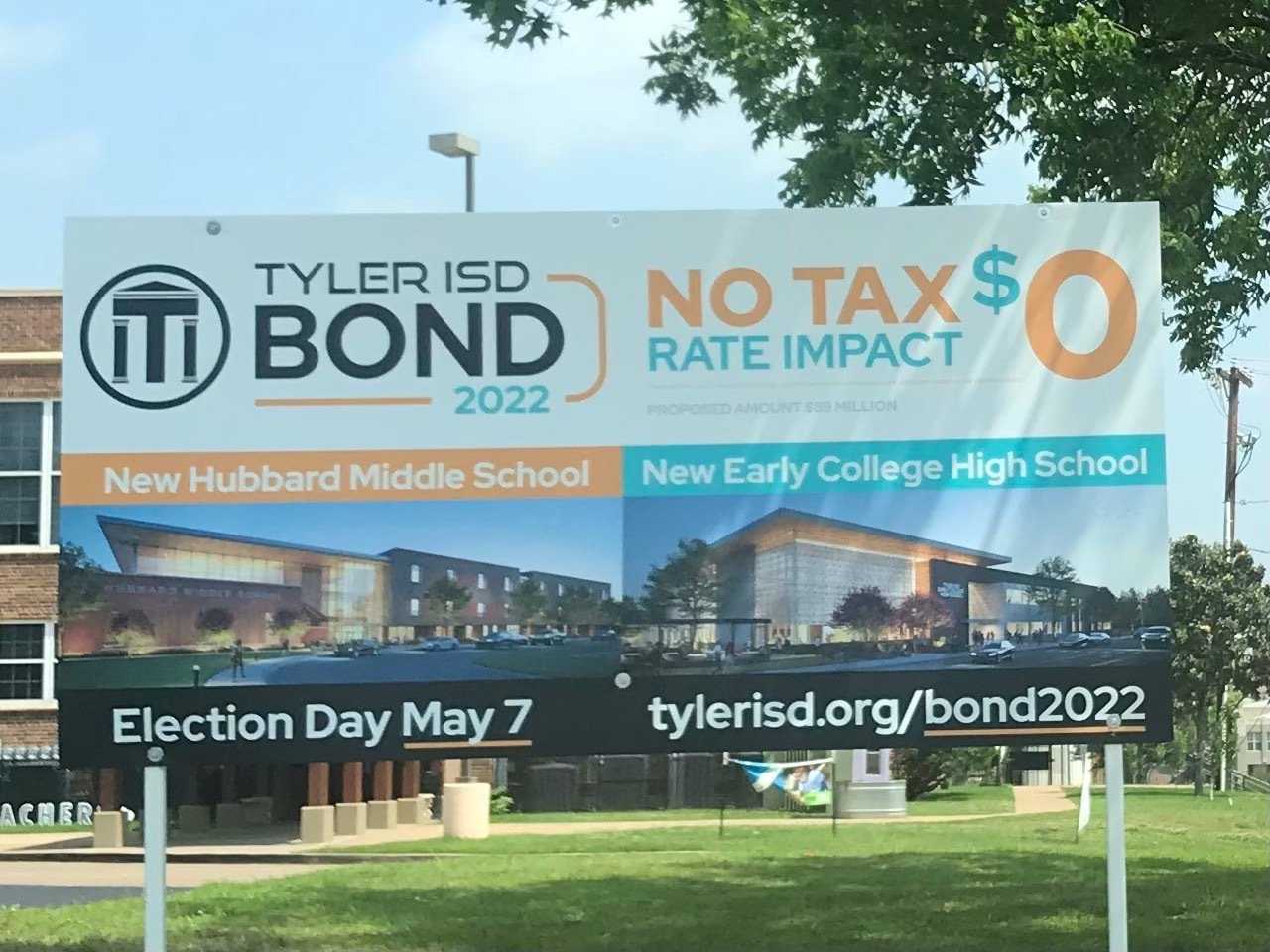

Take this one from the Tyler ISD for instance, which used a large sign including in large letters the words “NO TAX RATE IMPACT” while also including a large ‘$0’ next to the wording, both being easily readable by passersby. Perhaps intentional, however, the sign also included the words, “PROPOSED AMOUNT $89 MILLION” in much smaller text in a shade of grey, much less obvious to the eye.

The Background of Inflation, Increased Costs of Living, and Existing Debt Burdens

As debt continues to get approved, it is important to understand that it piles onto the already existing and troublesome debt burdens seen in jurisdictions all across the state.

All of this is also happening against the backdrop of 40-year high record inflation, increasing the costs of almost all goods and services. This of course does not even take into consideration the over $30 trillion of debt accumulated by the federal government with recent record spending under both Republican and Democratic administrations.

Eventually, someone has to pay those bills. Shamefully, it looks more and more like it will be future generations of Texans.

Election Results

The final election results as well as their final disposition of all bonds that were considered on the May 7 ballot have not yet been compiled by the Texas Bond Review Board.