We hear it over and over anytime a conversation about property taxes comes up. “If we have to pay property taxes, do we really own our property?” The assumption is correct, if you are bound to pay the government property taxes perpetually as a homeowner then isn’t it like paying the government rent for your own property?

What would actually happen if you were to stop paying your rent (property taxes)? According to the Comptroller of Texas Website:

If taxes go delinquent, the tax collector adds a six percent penalty and one percent interest on Feb. 1. Penalty continues to accrue at one percent per month until July 1. On July 1, the penalty becomes 12 percent. Interest will be charged at the rate of one percent per month, with no maximum. Private attorneys hired by taxing units to collect delinquent accounts can charge an additional penalty of up to 20 percent to cover their fees. If the delinquency date is postponed, penalties and interest begin accruing on the postponed delinquency date.

If you don’t pay can they foreclose on your property? Actually, yes they can.

In Texas, there is no time limit after you are delinquent in which a taxing entity can start the foreclosure process according to the Texas tax code (Tex. Tax Code § 33.41). So if you do not pay your taxes, technically the government can levy heavy fines against you and foreclose on your property immediately after delinquency. Does it sound like you own your home in Texas?

What can be done then? Is TFR advocating that there should not be penalties for people who evade taxes? No, we certainly are not. We are saying that Texas should give no one any reason to evade property taxes by completely eliminating them altogether.

When someone suggests the elimination of property taxes, it is usually followed by some typical questions:

How would it be possible to eliminate it?

How would we fund schools?

But you have to raise taxes somewhere else right?

What if you were told there is a plan which could begin the path of property tax elimination that would both: 1) fund schools, and 2) not raise taxes anywhere else (no consumption-based “tax swap”)? Not only is that possible, but the time to eliminate property taxes has never been better.

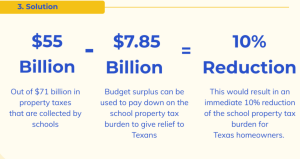

Recently TFR posted an article outlining our plan to eliminate the school property tax portion by using the recently announced $7.85 billion surplus announced by the Texas Comptroller of Public Accounts. This surplus was made possible in part by a bill that was passed this session that limits Texas spending to population-plus-inflation. This new limit will ultimately result in reoccurring budget surpluses in the coming years.

This is our path to property tax elimination.

The legislature must simply act and apply the entire surplus to the school portion of property taxes. This must occur before legislators do what they always do: waste more money on unnecessary bureaucracies and corporate subsidies. By dedicating the current and future state surplus to cutting property taxes, and cutting away wasteful spending, Texas could virtually eliminate the “school M&O” property tax within the decade – and possibly the rest not long after.

There is a clear path to elimination, but will our lawmakers commit to prioritizing property tax elimination and relief? Abbott has placed property tax relief on the special session agenda. There are already a few bills pending before the Texas Legislature that would apply the surplus to relief, but the strongest one is HB 122. That measure applies 90% of future surpluses to property tax relief.

If the legislature doesn’t provide meaningful and substantive property tax relief for taxpayers, there will be no one to blame but themselves.