It is that time of year again! When Texas taxpayers are reminded that they, in fact, do NOT own their homes, but rather pay perpetual rent to the government via the property tax.

That’s right, soon property tax bills will be hitting mailboxes all across Texas.

The Texas Tax Code, Section 31.01, requires “the assessor to prepare and mail a tax bill to each property owner listed on the tax roll or to that person’s agent by Oct. 1 or as soon thereafter as practicable each year.”Depending on where you reside in Texas, you could see your tax bills go up, when compared to last year, regardless of what property tax relief was provided by the Texas Legislature. Many local governments have sought fit to raise their tax rates and inflation remains high, eating away at potential savings.

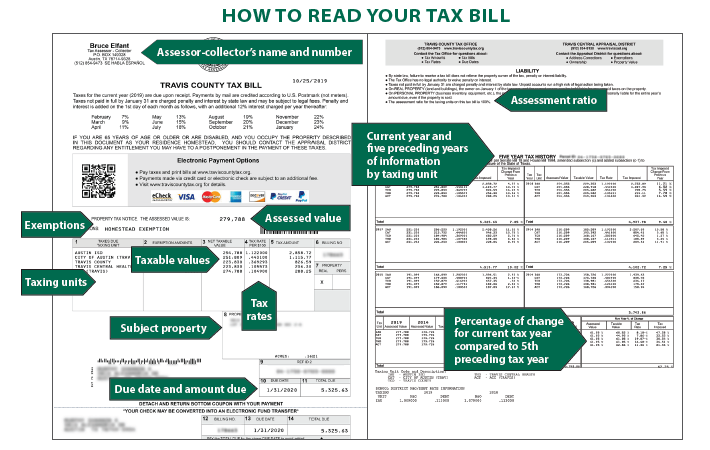

How to Read Your Tax Bill

Texas taxpayers have until January 31 to pay whatever property tax is owed. Starting on February 1, if taxes go unpaid, the tax collector adds a 6 percent penalty and 1 percent interest. That penalty will continue to accrue at 1 percent per month until July 1 and then it becomes 12 percent thereafter. Interest will be charged at a rate of one 1 percent per month, with no maximum.

According to the Texas Comptroller’s office,

“An assessor calculates your taxes owed by multiplying your property’s taxable value by the tax rate for each taxing unit. Your taxable value is your appraised value minus any exemptions on file with the appraisal district. Property that is appraised under a special valuation will also be noted on the tax bill. This includes appraisals for land designated for agricultural use, timberland and restricted-use timberland.”

Property tax bills will look very similar to the image below:

The property tax is ultimately levied by various local government jurisdictions and calculated as a result of the assessed value minus any qualified exemptions multiplied by the tax rate and then divided by 100.

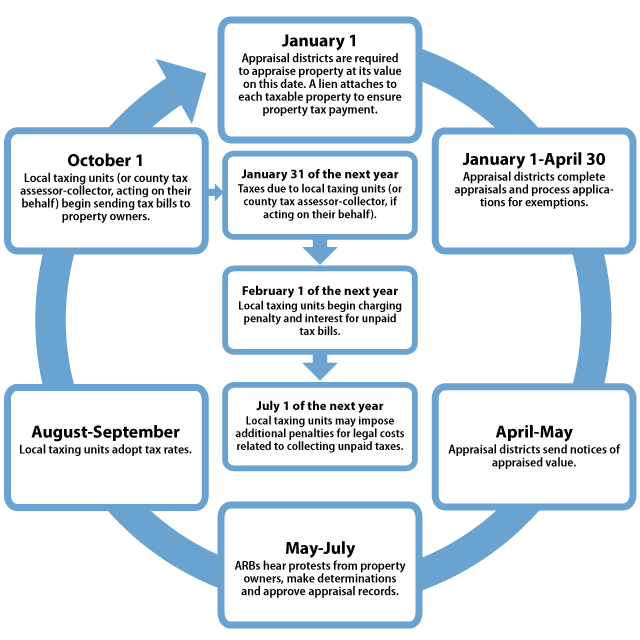

Property Tax Levy Timeline

The property tax levy process begins via the appraisal districts as they complete the overall appraisal process between January and April 30 every year. Appraisal districts then send appraisal notices to property owners between April and May giving them through July to protest those appraisals in front of Appraisal Review Boards (ARBs). Between August and September, local taxing units (i.e. cities, counties, school boards, and special purpose districts) adopt tax rates for the next year. Beginning October 1, local taxing units send property tax bills to property owners.

Property Tax Relief

Before the 88th Legislative Session got underway earlier this year, the Texas Comptroller gave a Biennial Revenue Estimate which included a projected $33 billion budget surplus (i.e. over-collected taxpayer money). This budget surplus represented a historic opportunity for the legislature to not only provide tangible and lasting property tax relief but also to provide for a realistic path to the elimination of the property tax altogether. Sadly, it seems they provided neither.

The legislative session came and went and lawmakers could not come to an agreement on how best to provide tax relief until the second-called special legislative session, which took place in July. Ultimately, the legislature agreed upon a compromise that, assuming Texas voters approve of the accompanying ballot propositions in November, will provide:

- Approximately $7 billion in school Maintenance and Operation (M&O) tax compression (the largest portion of the overall property tax)

- An increase in the homestead exemption from $40,000 to $100,000

- Roughly $600 million in increases to franchise tax exceptions

- A three-year pilot program of 20% property tax “circuit breakers” on non-homesteaded properties worth less than $5 million (essentially like an appraisal cap)

- The creation of three elected positions on appraisal review boards in counties with a population of 75,000 or more

Despite some claims to the contrary, the total amount of new property tax relief in the package equates to roughly $12.7 billion. While most property owners will see at least some tax relief, this number, unfortunately, falls short of actually being the largest property tax cut in Texas history.

It also falls short of what was originally promised by Texas Governor Greg Abbott (R) who on multiple occasions, including last year on the campaign trail at the lone gubernatorial debate, called for using surplus funds for maximum property tax relief and a path to the elimination of the school M&O portion of the property tax. Neither got done.

Relief Will Be Fleeting

To be clear, many Texas taxpayers will see some property tax relief. Sadly, it will not be near what could have been possible if state lawmakers prioritized such things, instead of spending more than they ever have in Texas history or revitalizing the largest corporate welfare program in Texas history.

It is also worth reiterating that what property tax relief is seen by some Texans will ultimately be short-lived as inflation and rising appraisals will eat away at the increased homestead exemption and local governments are still able to spend without any limits.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!