In a year where most property owners find themselves getting overwhelmed with inflation driving up the costs of basic goods and services as well as major increases in property tax burdens, it has not been surprising to see millions of Texas taxpayers call for the complete elimination of property taxes this year.

This is something that Texans for Fiscal Responsibility (TFR) has advocated in favor of for more than a year and we have stated our plan to use surplus dollars to accomplish this multiple times. Specifically, we have advocated for the elimination of the school Maintenance & Operations (M&O) portion of the property tax, using surplus tax dollars created by the spending cap passed by State Sen.Kelly Hancock (R-North Richland Hills) during the last regular legislative session.

It is expected that the State Comptroller will give an updated BRE (Biennial Revenue Estimate) sometime this Summer that would show roughly a $15 billion budgetary surplus that lawmakers will have the ability to allocate in the coming legislative session, slated to begin in January 2023.

In recent weeks, many people have asked TFR, “What are you advocating we replace the property tax with… a sales tax? a VAT tax? an income tax?” The simple answer is ABSOLUTELY NOTHING. There is no good reason to have to replace the tax with anything, and here are a few thoughts as to why:

An income tax is a near impossibility for Texas because, in 2019, Texas voters passed a constitutional amendment that prevents the creation of such a tax. It would be incredibly difficult to reverse this and see its implementation. Both the sales tax increase and the creation of a Value Added Tax (VAT) are feasible and have been suggested by many separate organizations to free us from the shackles of paying perpetual rent to the government to live in our homes, but we believe that they simply are not necessary.

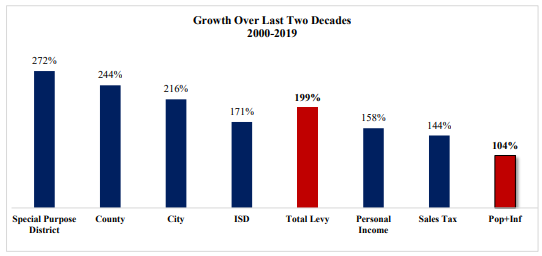

The chart above from the Texas Public Policy Foundation (TPPF) shows the rate of growth for property taxes in Texas over the last 20 years. You can see that Population + Inflation, which has long been a metric of conservatives to limit the size of the government, has grown 104%, yet the school portion of property taxes has grown 171% in that same time period. Texas also has the 6th highest property taxes in the United States. With such high growth of tax burdens in Texas, how would it be possible to eliminate the school M&O property tax without creating new taxes or increasing other burdens?

The answer is simple, our state lawmakers actually have to start legislating like fiscal conservatives. You know… the thing all Republicans label themselves as to get elected? At the heart of the conservative worldview is that the government should be extremely small in scope. TFR has yet to meet a self-proclaimed conservative that does not think our government is already too big, yet, despite Republicans controlling every statewide elected office and maintaining majorities in both chambers of the state legislature for nearly two decades, our state budget is on track to have tripled since 2000 in the next biennium (Fiscal Years 2024-25)! Does that sound like we are governing as conservatives? The fact that we passed a constitutional spending limit last legislative session is a huge victory for conservatives, but all these limits actually do is slow the growth of government. This is the same tactic that “conservatives” have used to convince you that they fixed the property tax system in 2019. They passed caps on rate growth, which of course does not lower taxes but merely slows their growth.

The only way we can end the property tax without shifting the burden elsewhere is for the Texas government to live within our means. This would mean that we need to actually cut the size of the government, not merely slow its growth. Right now Texas’ surplus is expected to be around $15 billion dollars and our savings account, the Economic Stabilization Fund (ESF), or ‘Rainy Day Fund’ is sitting at around $13 billion. Between the two we should have roughly $28 billion in expendable income (if not more). This total is not even counting the billions in COVID dollars that have yet to be allocated as a part of the ARPA funding passed by U.S. Congress, or the mountains of corporate welfare and abatements Texas pays out to companies like Facebook who actively silence conservatives while receiving our tax dollars.

Bridging the budgetary gap to eliminate school property taxes in Texas is possible. The only thing preventing this from happening are state lawmakers that campaign as conservatives but legislate like progressives. With budgetary surpluses expected to continue indefinitely and lawmakers actively shrinking the size of state government, organizations like TPPF believe that it would be possible within 10 years to completely phase out the tax. This could be accomplished even sooner if lawmakers made it a priority.

Texas does not have a revenue problem, we have a spending problem. The solution to property taxes is not increasing revenue, the key is cutting spending. If we hold lawmakers accountable to cut spending and reduce the size of government, our property tax problems would be over without creating any new taxes.