Understanding Texas’ property taxes, or more specifically understanding the means by which property taxes are levied, collected, distributed, and ultimately who bears responsibility for the increasing property tax burden in the state is admittedly a confusing endeavor; potentially intentionally so.

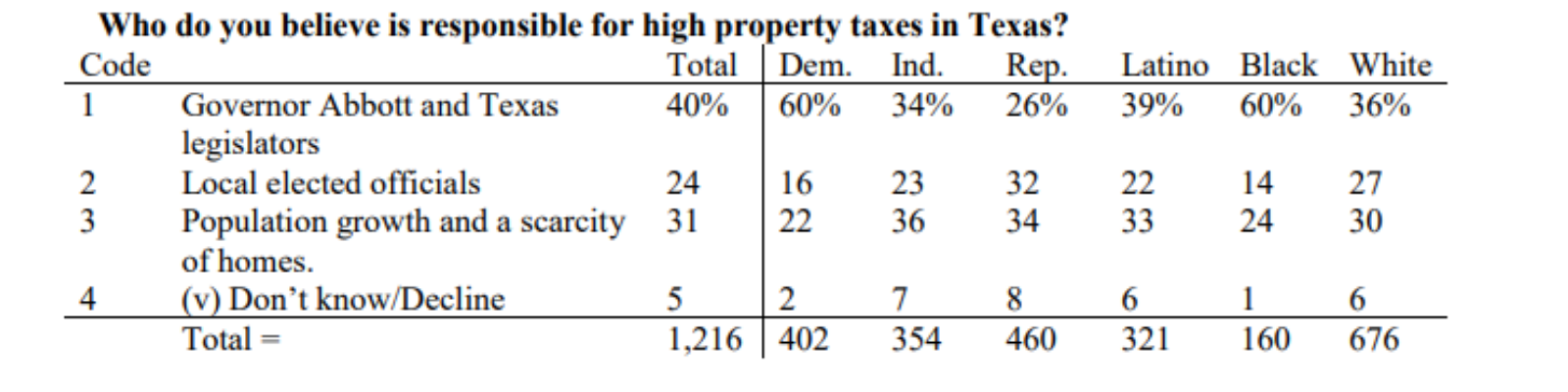

In a recent poll conducted by the UT Tyler and Dallas Morning News, Texans were asked

“Who do you believe is responsible for high property taxes in Texas?”

The responses were enlightening to say the least because they show that a significant portion (40%) of Texans place the blame on Texas Gov. Greg Abbott and the Texas State Legislature. This breaks down to 60% of Democrats and 26% of Republicans polled.

Though they certainly bear some of the blame when it comes to property taxes and the results, or lack thereof, of the promises they make on the campaign trail with regard to providing relief from growing tax burdens, the rates themselves are actually administered on the local level, by local elected officials, who notably, were only blamed by 24% of those polled.

So Who is to Blame?

In plain language, local elected officials. They ultimately set the rates.

School districts, municipalities, counties, and special purpose districts all levy property taxes. When a property owner receives their appraisals, they do not inherently raise their property taxes. A decision made by local elected officials when they set the tax rate the following Summer determines whether an increase in taxes will actually take place.

They determine whether to adopt what is called the ‘No New Revenue Tax Rate’ or to raise the rate, confined by statute set by state lawmakers and the approval of voters over a certain threshold.

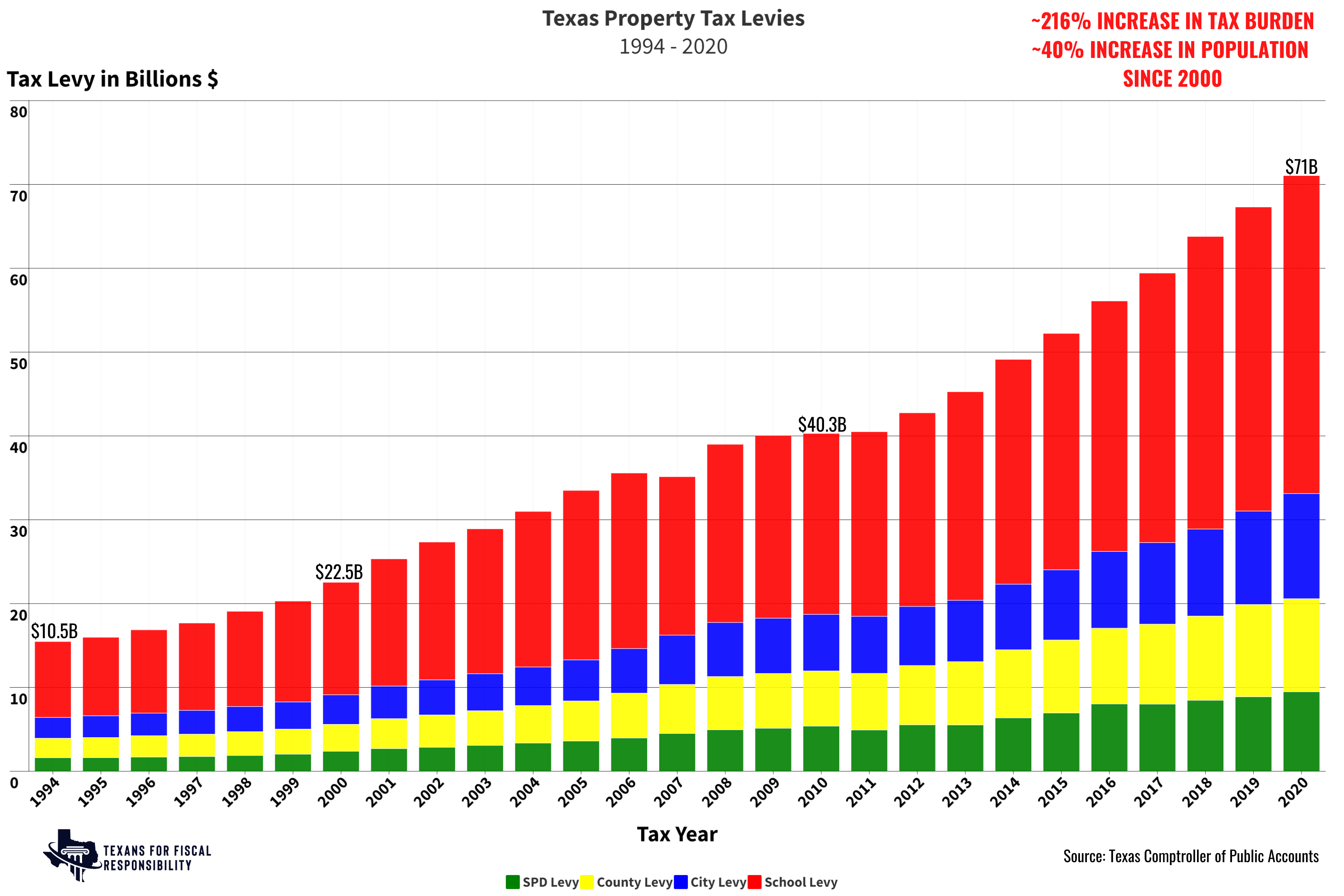

All of that being said, state lawmakers and the Governor absolutely do bear some of the blame when it comes to the structure of the property tax formula, and frankly allowing local governments to run roughshod over taxpayers in recent decades. The increase in tax burden has far out-paced the growth in Texas population, i.e. whom the taxes are supposed to serve; see below:

What Can Be Done?

Texans for Fiscal Responsibility (TFR) has long supported the elimination of the property tax in Texas. TFR believes the collection of such a tax is immoral and no property owner should have to pay perpetual rent to the government.

We do not have to replace the property tax with anything either; we just need our elected officials to actually cut the size and scope of government, instead of just merely subscribing to the current ‘slow-the-growth’ strategy.

Texas does not have a revenue problem, it has a spending problem and the solution to property taxes is not to increase revenue but instead to cut spending. If we hold lawmakers and local elected officials accountable to cut spending and reduce the size and scope of government, our property tax burdens would subside, without creating any new tax burdens.