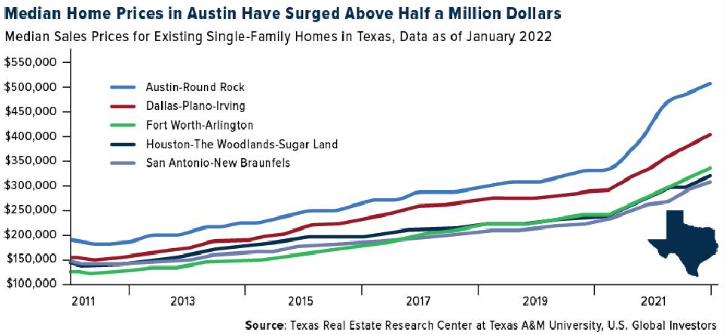

2022 has been an unprecedented year on a number of fronts. Texas, like the rest of the nation, has experienced record inflation, record gas prices, and sky-high home appraisals. Why have home prices been so high? Is it just a result of inflation or are there other factors at play? According to a recent Forbes article, “In Bexar County, where U.S. Global Investors is headquartered, home values have risen 23.2% from last year. Austin homeowners recently got notice that their residences skyrocketed a jaw-dropping 56% in value.”

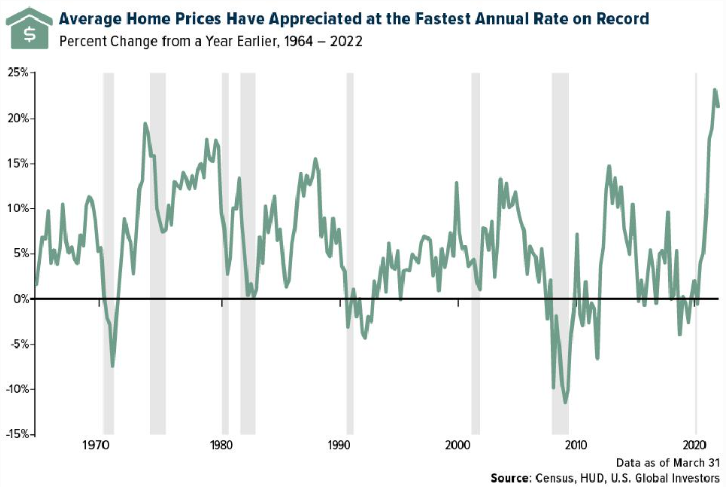

What is happening in Texas is not different from what is happening nationwide, average home prices have appreciated at the fastest annual rate on record. The fastest previous increase in annual appreciation was 19% set back in 1973. This record was broken in December of 2021 when we saw a 23% increase in average home prices year over year. We can see that many areas of Texas have far exceeded this metric, especially in populated desirable areas like Austin, San Antonio, Houston, and Dallas-Fort Worth.

The difference in Texas from that of the rest of the nation is our growing property tax burden. As Texans for Fiscal Responsibility (TFR) has reported numerous times before, Texas has the 6th highest property tax burden in the nation. The Texas appraisal system had long been a subject of criticism prior to run-away inflation and it was very common for appraisals to go far above market value when local jurisdictions needed more capital. This system places the burden on the taxpayer to protest their appraisal and prove that their home value has been inflated by the state. Historically, in many cases, homeowners who protested were able to lower tax bills, but this might not be the case this year. Home values have legitimately risen due to a number of reasons which include general inflation and a very hot housing market.

What does this mean for homeowners? If you asked the Texas State Senators who participated in a recent Senate Finance Committee hearing, things are going to be just fine. They believe that we need to give cities enough time to adopt the “No New Revenue Rate” which they will be able to do after the appraisal process is complete. These lawmakers want us to believe that all of our tax bills will go down because local governments are going to do “the right thing” and lower rates to make sure the amount of revenue is the same as last year.

Excuse us if we don’t hold our breath on that one.

So taxpayers’ hope according to the “historic reform” of 2019, is that local political subdivisions do the right thing and lower rates to help with tax burdens? This does not seem like “historic reform” at all. It seems like someone needs to tell these lawmakers that property taxes have continued to increase almost universally for Texans. This is why it is important that we focus on eliminating the corrupt system altogether. TFR recently unveiled our Texas Prosperity Plan that includes as one of the planks the Elimination of Property Taxes, specifically starting with the Maintenance & Operations (M&O) school property tax, which is the portion that is the easiest to ax.

TFR encourages taxpayers to protest their appraisals in hopes of lowering their bills, but we also encourage homeowners to not be content with what they have been given. We have been playing defense for too long on fiscal policy and it is time to go on offense. We encourage you to take a look at our Texas Prosperity Plan and show your support for the plan to help persuade lawmakers to begin the process of eliminating property taxes completely.